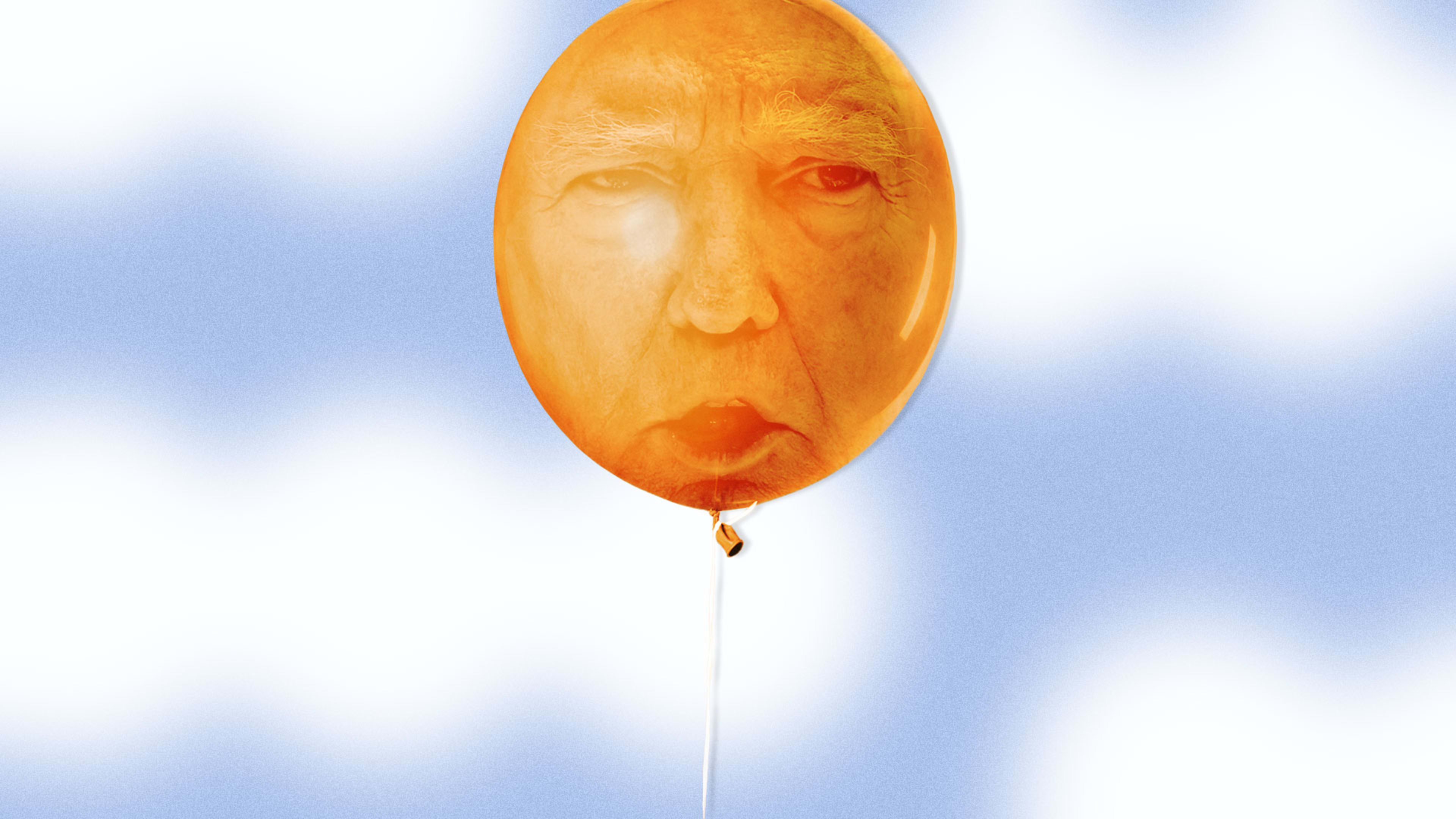

As Donald Trump might put it, a lot of people are saying, why is Trump Media & Technology Group (TMTG) trading for such a huge amount of money?

The company that runs alt-tech platform Truth Social had its IPO on Tuesday (under the ticker symbol DJT). It traded above $70 most of the day, soaring by as much as 50%, for an estimated market cap above $8 billion, and that values the former president’s cut at somewhere around $5 billion. These may sound like logic-defying numbers, but the context gets truly staggering once you open TMTG’s hood and inspect what’s inside.

TMTG emerged in 2021, via a SPAC merger with a Miami, Florida-based company called Digital World Acquisition Corp. Its singular product—the Truth Social app—is toxic to many progressives, thanks to the deep, un-excisable Trump ties. As a result, it’s never attracted that many more users than rivals like Gab, Parler, Gettr, and Rumble. It boasted just 5 million active users in February, according to research firm Similarweb. That’s several billion shy of Facebook (3 billion) and TikTok (2 billion), and fewer than even the anonymous messaging app Yik Yak had during its brief heyday, before it started getting banned by colleges for incidents involving sexual harassment and racist threats.

DWAC’s proxy statement to shareholders, ostensibly filed as a way of convincing people on the fence why they ought to invest their hard-earned dollars into TMTG, barely goes through the motions of sketching out a business model. In fact, in the section outlining risk factors, the corporate leadership says they can’t predict when, or if, Truth Social will bring in more money than it loses:

TMTG expects to incur significant losses into the foreseeable future. . . . There is limited operating history upon which to base any assumption as to the likelihood that TMTG will prove successful, and TMTG may never generate sufficient operating revenues to achieve profitable operations. If TMTG is unsuccessful in addressing these risks, its business will most likely fail.

Topping that off, revenue between January and September 2023 clocked in at a paltry $3.3 million (the most recent quarterly figures haven’t been released). Annual revenue of low- to mid-seven figures is a tad bit higher than sales for the average McDonald’s franchise. TMTG’s revenue came from sponsored ads on Truth Social, placed by an equally uninspired group of businesses—Mike Lindell’s My Pillow; Proud Patriots, hawker of a China-made “Trumpinator” bobblehead; a frightening number of companies paying their own money to promote items like a “free $100 Trump gold bar,” “free 2024 Trump $1,000 bills,” or a “$2 Trump bill” for “85% off!”

The revenue was also earned against companywide losses of $49 million. But with the $8 billion valuation, TMTG’s current value is nearly 2,000 times the annual revenue disclosed in its own SEC filings. Of course, investors plow cash into as-of-yet-unproven or even money-losing ventures; if they get in early and others keep bidding up the shares, the company will post exponential growth figures, and they’ll be rich. But on Nasdaq, a price-to-sales ratio in the thousands is basically unheard of.

During its successful IPO last week, Reddit debuted with a price-to-sales ratio of about 8. WeWork went public through a SPAC merger in 2021; at the time, its price-to-sales ratio was around 3. According to FactSet, the same math for publicly traded companies, based on their past year’s revenue, yields ratios of almost 10 for Meta, a 6 for Google parent Alphabet, and a 4 for Snap. Chipmaker Nvidia—currently Earth’s third most valuable company—boasts a 25.

For additional context, University of Florida business professor Jay Ritter—called “Mr. IPO” for his work on initial public offerings—keeps a running tab of IPO price-to-sales ratios for every year since 1970. His data shows two standout periods. One was 1999 to 2000, the tail end of the dot-com era when Microsoft, IBM, and Intel were swimming in money. The average price-to-sales ratio back then? Ritter says it peaked at 49.5. The second was 2018 to 2021, tech IPOs’ last high-octane run before the bubble burst in the pandemic, when the peak ratio was 21.8 in 2020.

It isn’t necessarily fair to compare Trump Media’s opening-day trading performance to meme stocks. When WallStreetBets retail traders sunk their claws into GameStop, AMC, and Bed Bath & Beyond, these companies were well(ish)-oiled machines with billion-dollar year after billion-dollar year. GameStop was founded 40 years ago; it went public in 1988 and operates 4,413 stores in nine countries. Truth Social isn’t even three years old by comparison. For grins though: During January 2021’s notorious short squeeze, GameStop closed at a record high of $86.88, valuing it at $22.6 billion. Revenue projections back then were between $5 billion and $6 billion, which is a price-to-sales ratio of about 4.

Meanwhile, TMTG’s financial backers sound psyched to be along for the ride. Many may have reasons beyond investing in an app with a shady business prospectus. The New York Times reported earlier this week that a top shareholder (after Trump, who owns 60%) was the billionaire Jeff Yass, the top GOP donor for 2024 and a big-time investor in TikTok, which both leading Republicans and Democrats are trying to ban—with the exception of Donald Trump, who just did a 180 and now appreciates the app.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.