We’re just a few days into 2022, but we already have what promises to be the biggest video game acquisition of all time.

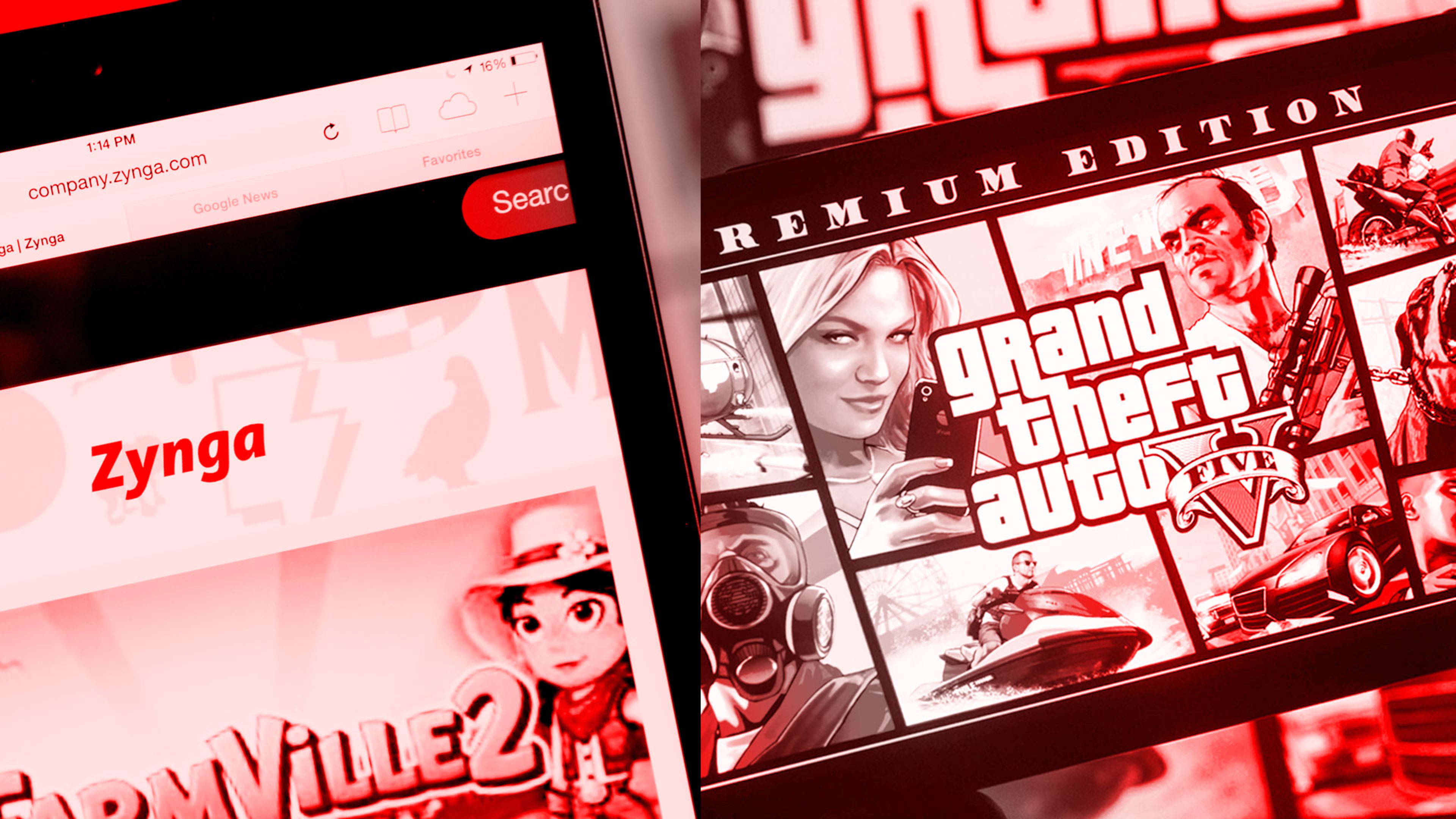

Take-Two says this morning that it’s struck a deal to acquire social-gaming developer Zynga for $12.7 billion. It’s the latest massive deal in an ever-growing string of massive video-game-industry deals. Owner of Rockstar and 2K Games and maker of Grand Theft Auto, Take-Two Interactive says it will buy all the outstanding shares of Zynga, creator of app games like FarmVille and Words with Friends, for $9.86 a share—64% more than their closing price on Friday.

Zynga’s shares were up nearly 50% Monday morning on the news, and Take-Two’s had dipped by about 10%.

While Zynga is best known for a game nobody plays anymore on a social-media platform that lost its cool factor a long time ago, the deal suggests Take-Two sees the future of gaming growth to be on smartphones, as opposed to traditional video-game consoles. In a press release by both companies, Take-Two CEO Strauss Zelnick said, “This strategic combination brings together our best-in-class console and PC franchises, with a market-leading, diversified mobile publishing platform that has a rich history of innovation and creativity.”

Meanwhile, Zynga CEO Frank Gibeau predicted the two will achieve “significant growth and synergies together,” and added he’s “incredibly excited” to “begin a new journey which will allow us to create even better games, reach larger audiences, and achieve significant growth as a leader in the next era of gaming.”

Take-Two says the deal will be partly funded through $2.7 billion in financing from JPMorgan. The total figure beats previous video-game-history deals by a pretty wide margin: The next-closest are Tencent’s 2016 deal for about 84% of Supercell ($8.6 billion) and Microsoft’s purchase of Bethesda Softworks parent company ZeniMax Media earlier this year ($7.5 billion).

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the final deadline, June 7.

Sign up for Brands That Matter notifications here.