In 1990, KRS-One rapped about combining knowledge and entertainment, saying “I’ll just name it Edutainment / People sit and look at my album / Like a problem, they try to solve ’em / They don’t know it only leads the way / To a bright more positive day.”

Now, three decades later, rapper, activist, and entrepreneur Killer Mike (Michael Render) is aiming for the same result with Greenwood, his digital banking company, which is launching a new studio to create financial education content.

“KRS-One talked about ‘edutaining’ people,” Render says. “People want to see content and are interested in being entertained, but people also want their education in a way that is easily absorbed. The people who don’t know get to know, the people who already know, know more, and the people who know-it-all realize how little they really do know and get a chance to be educated as well.”

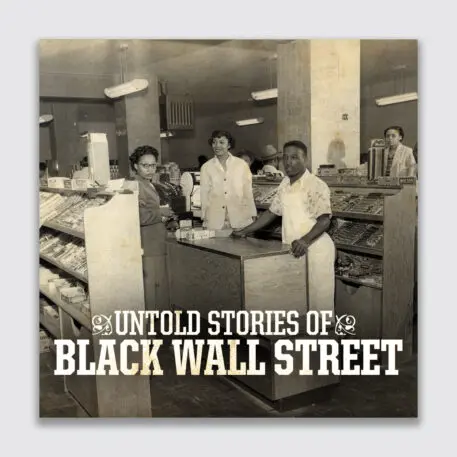

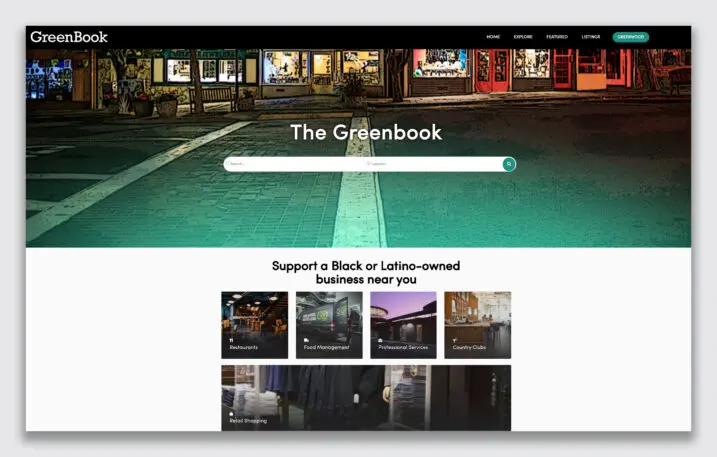

Other Greenwood programming includes a daily podcast called Money Moves hosted by Tanya Sam of The Real Housewives of Atlanta; a documentary of stories from Black Wall Street; and “Greenwood’s Greenbook,” an online directory of Black- and Latinx-owned businesses across the U.S.

Black loan applicants are denied at an 80% higher rate than white applicants, according to 2020 data from the Home Mortgage Disclosure Act. And, according to the Boston Consulting Group, Black and Latinx households make up 32% of the U.S. population but represent 64% of the country’s unbanked households and 47% of its underbanked households. Check cashers and payday lenders—which are often predatory—are more common than major bank branches in lower-income communities. Greenwood’s goal is to start changing those statistics.

“In order to thwart racial inequality, financial empowerment has to exist,” says Glover, a former record exec and founder of Bounce TV. “It starts with the recirculation of capital. We want to extinguish all predatory-lending practices in banking. Candidly, we want to put all check-cashing businesses out of business.”

Mixing pop culture and entertainment to promote financial education isn’t a new idea. NBA star LeBron James’s Uninterrupted partnered with Chase in 2018 for a video and eventual podcast series. But Greenwood is pitching itself as a different kind of messenger.

“Oftentimes working-class people, people who are newly immigrated, people who grew up poor, are intimidated by finance,” Render says. “They’re intimidated by the language, they’re intimidated by the environment. The addition of content wipes away a lot of that anxiety and fear because you’re engaging people that also look like you.”

The last few years have seen the rise of so-called neobanks, or financial tech firms offering digital banking services. According to PitchBook, investors put $44.4 billion into fintech startups last year alone. Some, like teen-focused debit card startup Step, endorsed by TikTok star Charli D’Amelio, target a specific audience, but most are more generally focused on simplifying and disrupting traditional banking for younger customers.

Render says that Greenwood is a response to how America’s systems have failed Black people. “Whether it’s finance, healthcare, education—the mistrust is not unwarranted. But we’re here to make some progress on it in my lifetime so it’s not as warranted as it once was,” he says. “We want to help people build the confidence it takes to participate in this system, so we’re living in it and not under it.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.