If you’ve not yet bought your tickets for tonight’s historic $1.6 billion Mega Millions jackpot, you can be forgiven if your FOMO has reached fever pitch.

“Get to stores early today to get your #MegaMillions tickets! Long lines are expected until tonight. Don’t miss out on your chance at $1.6 BILLION because of one line!” the drawing’s Twitter feed screams.

And everywhere you turn, you’ve been told just how AMAZING winning all that money can be.

They’re dropping celeb and sport team names–even rocket ships!

Come the 11 p.m. ET drawing tonight, you could be, if you win and take the $904 million lump sum payment:

- As rich as Jay-Z

- Three times richer than Taylor Swift

- One-third as rich as Donald Trump

- Able to fund 10 Space X rocket launches

- Rich enough to buy the Mona Lisa ($800 million)

Sweet, right?

https://twitter.com/MegaMillionsUS/status/1054719178387701760

If you’re a cynic—and honest—you know that none of that is going to happen, but a skeptic can dream.

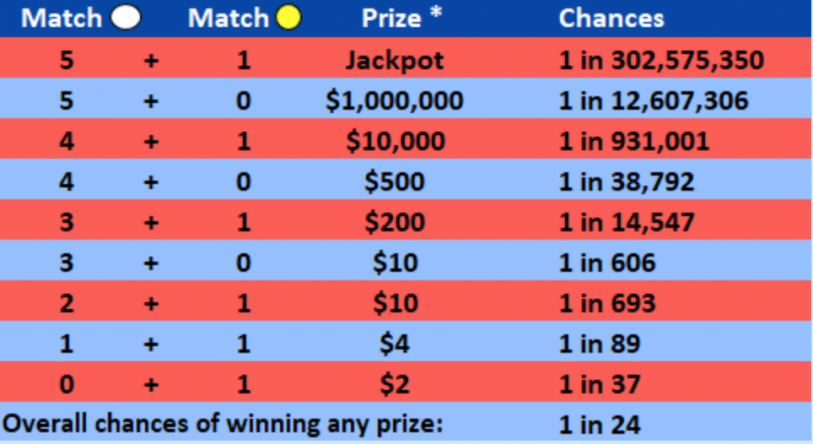

So, what are the odds of winning the whole thing? About 1 in 302 million. You have a far, far better chance of being struck by lightning this year (1 in 700,000).

From the folks at Slate:

You can do the math by multiplying the size of the winnings (very large) by the probability of you winning (very low) to get the value of your ticket. For this new $1.6 billion jackpot, ignoring tax implications, the value of a ticket comes out to be $5.53—a very good deal.

They lost me at multiplying.

But, seriously, the site’s Jordan Ellenberg actually lays out complicated formulas to argue why, mathematically, you win even if you lose. (“Suppose an object might be worth either V1 or V2 dollars, and suppose the probability is P1 that it is worth V1, and P2 that it is worth V2. Then the expected value is defined to be P1 x V1 + P2 x V2.”)

Alrighty, then.

The folks at Business Insider also did math and crunched numbers based on “expected value.”

The expected value of a randomly decided process is found by taking all the possible outcomes of the process, multiplying each outcome by its probability, and adding all those numbers. This gives us a long-run average value for our random process.

They conclude: “If we take the lump sum, we end up seeing that the expected value of a ticket drops all the way to $1.23.”

But let’s be practical, people. When you wake up tomorrow and head out the door to the rock pile, we’ll all know what we already know: That ticket is worth nothing.

https://twitter.com/MegaMillionsUS/status/1054340228402610176

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the final deadline, June 7.

Sign up for Brands That Matter notifications here.