When Michelle Kennedy set out to secure funding for Peanut, a Bumble-like app she’d developed for connecting new moms, she had good reason to be optimistic. Kennedy was a five-year veteran of Badoo, where she was deputy CEO at the Tinder-like dating app, and had served as board advisor to Whitney Wolfe when Wolfe launched Bumble. But she quickly found that investors weren’t exactly lining up to write her checks.

Kennedy uncorks a merry laugh at the suggestion that she may have met some resistance, before launching into a string of anecdotes that would’ve thwarted a less determined founder. One venture capitalist dismissed her out of hand with an email that Kennedy says read curtly: “Nah, there’s a 15-year-old website already doing this.” Others’ comments about the potential market, she recalls, included, “Mommies just drink coffee all day and meet each other” and therefore don’t need an app, and, “My wife doesn’t need that–she does enough talking on her own.”

Related: The Tech Industry’s Missed Opportunity In Funding Black Women Founders

Seeing Opportunities Others Don’t

Women own more than 9.4 million firms in the U.S., according to the most recent data from the National Association of Women Business Owners. For perspective, that’s nearly a third (31%) of all privately-held companies. Those businesses employ nearly 7.9 million people and together generated $1.5 trillion in sales in 2015. Yet female founders like Michelle Kennedy struggle to raise the capital they need to get their ventures off the ground. With stories like hers, it’s no wonder that last year, VCs invested $58.2 billion in companies with a male founding team while women founders received just $1.46 billion, according to data from PitchBook.

Kennedy is quick to note that while she was inexperienced in pitching investors as an executive at a multimillion dollar company like Badoo, she did do her homework. And one thing was quite clear: Her research told her that mothers make 85% of household spending decisions, which in the U.S. accounts for $2.4 trillion, Kennedy says. So many of the dismissals she heard from investors were “a bit ludicrous and just a missed opportunity.”

“I’m quite a stubborn person,” she admits, so she kept her eye on the prize. Other matchmaking apps already existed for mothers, including Hello Mamas and MomCo, but as social networks have blown up, Kennedy was convinced that a offering users a more curated experience represented a rich market that she wanted to own. After running a fundraising gauntlet that she describes as sometimes “exhausting, frustrating, and disappointing,” Kennedy did secure investors–all of whom happen to be men. “You don’t have to be experiencing the problem in order to empathize with the market,” she observes. And as she saw it, those investors all had invaluable experience in product areas that would be crucial to her startup’s success.

Related: How I Successfully Pitched Investors As A 22-Year-Old Startup Founder

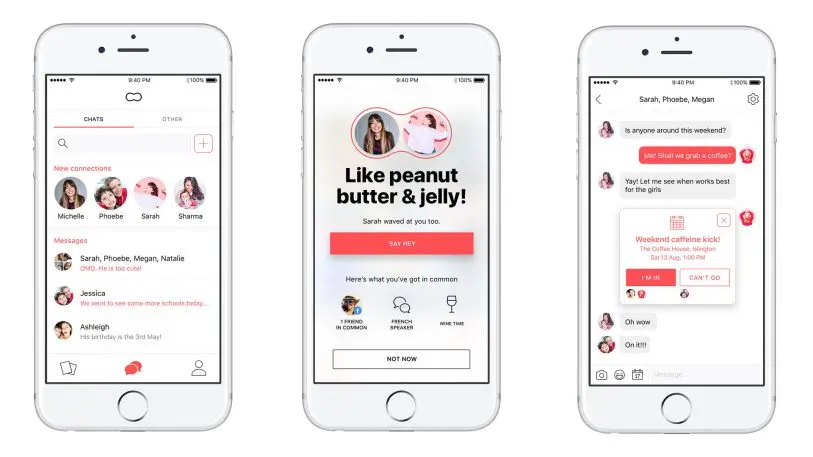

So far, Kennedy’s instincts are proving right. Since Peanut (the nickname of her now 3-and-a-half-year-old son) launched at the end of February 2017; its ranks of active users have swelled to just over 120,000. Collectively they’ve sent 700,000 messages and average about 100,000 swipes per day. The top three channels for “matchmaking” on the app–issues and interests Peanut users bond over–are “Wine Time,” “But First Food,” and “Powered by Caffeine.”

Perhaps these early wins were what prompted one investor who’d written off Kennedy’s idea to later send her an enthusiastic follow-up email, saying he “loved” what she was doing and hoped they could talk more about it. Investor double-takes like this have taught Kennedy a few crucial lessons in fundraising over the past 18 months, a time when she says she felt both “brave and naive” in her quest to fund Peanut’s launch. Here are here top four.

1. Don’t Forget What Funding Decisions Are Really About

“Not everyone is going to be polite. Not everyone is cordial. They are sometimes downright rude,” Kennedy underscores with a sigh. So it helps to remember the tired old chestnut: It’s not personal.

For her part, Kennedy has had to remind herself repeatedly that decisions about whether or not to fund a new venture ultimately aren’t personal. “When you don’t get the response you think you deserve, you have to have a thick skin,” she says, adding, “I must be like an elephant now.”

2. You Don’t Have To Share Every Detail

Kennedy recalls a meeting with VC who’d asked her to change the flight she’d already booked (on her dime)–annoying enough, but in this case the added expense wasn’t the most costly part, as she soon discovered. “I was asked for a marketing plan,” Kennedy explains, even though she’d already been through her pitch deck with him before. So she walked the investor through the marketing plan anyway, and–as they say in the dating world–he ghosted her for the next two months.

Before long Kennedy found out that he’d funded a similar product, aimed at Peanut’s market. The app folded quickly, she says, which just proves that “you can take someone’s ideas, but you can’t always execute them.” For Kennedy, the bigger lesson was about how much to share. She’s thought a lot since then about how to demonstrate the concept without giving too much away–at least, she says, until there’s a firmer indication of interest.

3. Don’t Be Afraid To Be Selective

Although Kennedy did plenty of research on investors before she decided which ones to reach out to, she admits she didn’t quite understand some of the nuance in VCs’ portfolios. As she now sees it, it’s important to find investors who aren’t “rule followers,” especially when you’re fundraising for a product aimed at a relatively new market.

Kennedy also warns against working with VCs who say they only occasionally fund seed rounds. In many cases, Kennedy points out, it may be that they already have a relationship with a particular founder who’s starting something new–but not that they’re experts in seed funding. “You have to be selfish with your time,” she maintains, “because fundraising can be a full-time job.”

4. Wait Until You’re Ready To Pitch

“Sometimes you meet people who are very helpful and lovely,” Kennedy says, who offer to connect you with an investor. At first, these struck her like golden opportunities to make a pitch, so Kennedy accepted each and every one. But she soon discovered that she wasn’t always prepared to answer all the questions some investors posed right away, causing some investors to back out when faced with those early unknowns. Now she says she’s smarter about saying, “Thanks, but I am going to come back when I am ready.”

“One thing I’ve come to note,” Kennedy says looking back, “[is that] if the investor is right for you, you will connect, and they will understand [your] vision.” Not only does she feel “really lucky” to have Peanut’s current investors, but Kennedy says she knew from the start that they’d be great partners. “They have the questions you want to answer, and they are anticipating questions you’re already working on,” she explains.

Finally, Kennedy adds, it’s important never to be squeamish about asking for what you need. “There is no shame in what you are doing–raising money for a business you believe is worth it.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.