Online giving platform Daffy.org is letting anyone start a fundraiser for their favorite charity.

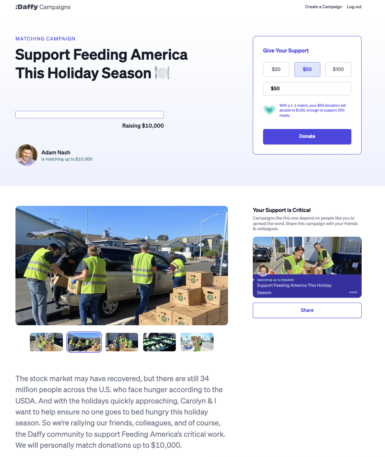

Daffy announced a new feature Friday called Daffy Campaigns, which lets users designate a nonprofit or a set of nonprofits and call upon others to contribute to them. The feature also lets people set up matching donations, where contributions up to a certain amount will be matched by funds from the campaign organizer, as well as particular “giving milestones” similar to what’s seen on other crowdfunding platforms. And Daffy won’t take a cut of the donations, except for certain credit card processing fees.

“I would love to see a future where everyone runs a campaign for something they care about,” says Daffy cofounder and CEO Adam Nash.

Nash envisions people could set up campaigns for school fundraisers, for community causes, for a memorial campaign with contributions going to a favorite charity of someone who passed away, even for wedding registries in lieu of gifts. The multi-charity feature can also help raise money for a variety of related nonprofits addressing a particular cause, such as relief after an emergency. And OpenAI’s ChatGPT will automatically help people set up a fundraiser by generating a first draft of the campaign description.

Campaigns won’t directly replace many uses of existing crowdfunding tools, like raising money for a project on Kickstarter or for personal emergency needs on GoFundMe, since the software is focused on gathering funds for registered nonprofits. But the basic mechanics will be familiar to those who’ve used such platforms, which is in line with Daffy’s basic philosophy to bring the power and ease of modern tech tools to charitable giving.

Daffy stands for Donor-Advised Fund For You, referring to a type of financial account where people can make tax-deductible contributions similar to a 401(k) or IRA, then effectively transfer the contributions and any investment growth to nonprofits of their choice. The accounts have historically been used by wealthy donors, and they’re supported by big banks and brokerages. But Daffy is trying to take a more internet-forward, user-friendly approach, reminiscent of how digitally forward banks and fintech companies have approached saving, borrowing, and investing.

Nash, a former executive at Dropbox and Wealthfront, sees charitable giving as generally underserved by the tech sector. “Giving is this incredible part of our lives—60 million or so American households give to charity every year,” he says. “It’s a really huge sector that surprisingly we haven’t invested a lot in as a technology industry.”

Daffy’s plans range from free, with under $100 invested, to $20 per month based on desired features, such as shared plans with family and the sizes of intended contributions. A basic individual plan with unlimited balance is $3 per month, and a similar family plan is $5 per month. Most other donor-advised fund managers charge based on a percentage of assets in the plan, says Nash. Earlier this year, the platform launched the feature, Daffy for Work, which lets employers offer automatic contributions to Daffy funds essentially as an employee benefit similar to a 401(k), with employer-configurable matching options.

Nash says he imagines the new Campaigns concept will bring Daffy to the attention of new audiences, as they see friends, relatives, colleagues, and local organizations promoting fundraisers on the platform. Campaigns will be readily shareable as URLs that can be sent through social networking platforms, email, and messaging tools, he says.

“We think, for a lot of people, participating in a campaign will be their first exposure to Daffy,” he says.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.