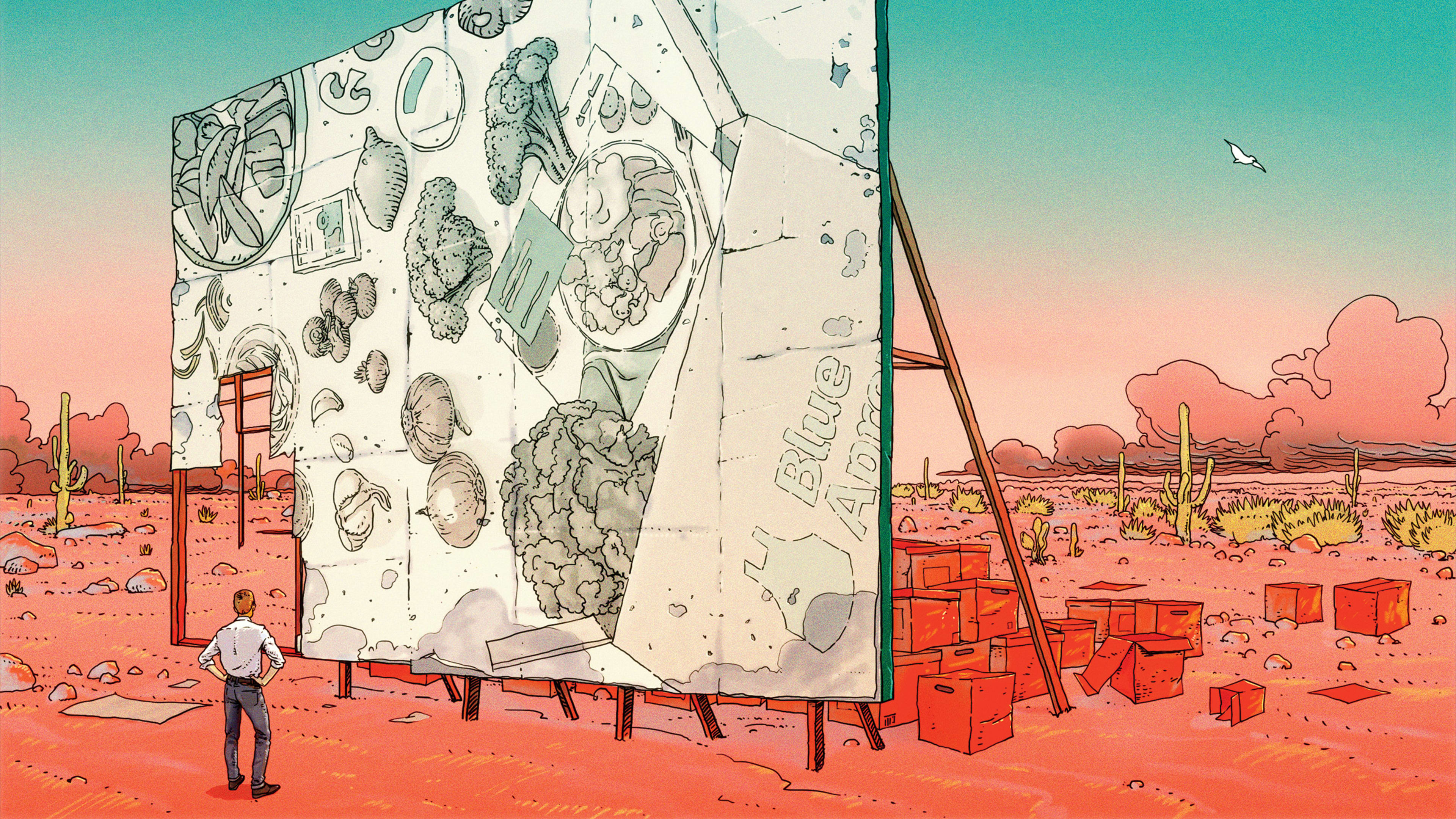

In 2017, Blue Apron bet the farm. With its valuation at $2 billion, its brand sizzling hot, and its IPO imminent, the meal-kit delivery startup snapped up BN Ranch, a network of sustainable meat producers founded by grass-fed-beef pioneer Bill Niman.

BN Ranch had been providing Blue Apron with pork, beef, and poultry for dishes like Seared Hanger Steak with Rosemary Fingerling Potatoes and Green Bean Salad since 2015. The acquisition cemented their relationship, with Niman staff joining Blue Apron’s fast-growing team. It also signaled Blue Apron’s ambitions to cut out the middlemen from its operations, working closely with ranchers and growers. “We are furthering our vision to build a better food system,” Blue Apron cofounder Matt Wadiak said at the time.

But Blue Apron’s dreams to reimagine the industry, bringing food from organic farms to the tables of its then 746,000 subscribers, soon withered. Three months after announcing the BN Ranch deal, Blue Apron went public, and it didn’t go well. The company lowered its target share range from $15 to $10, and raised just $300 million—a third less than its stated goal. Investors questioned Blue Apron’s decision to spend such a massive sum on marketing and its ability to fend off on-demand food-delivery entrants such as GrubHub. Net revenue dropped by half between 2017 and 2019, and the figure has been stuck below $500 million ever since. The company has struggled to turn a profit. This summer, its market cap hovered at around $50 million as it retreated from its once-expansive operational vision to focus on . . . recipe development.

If the plan was to make Blue Apron attractive to buyers, it worked. In October, serial entrepreneur Marc Lore’s Wonder Group, which is developing what it terms a “mealtime super-app,” recently agreed to buy Blue Apron, ending the company’s troubled public-market tenure. The deal values Blue Apron at around $103 million.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the final deadline, June 7.

Sign up for Brands That Matter notifications here.