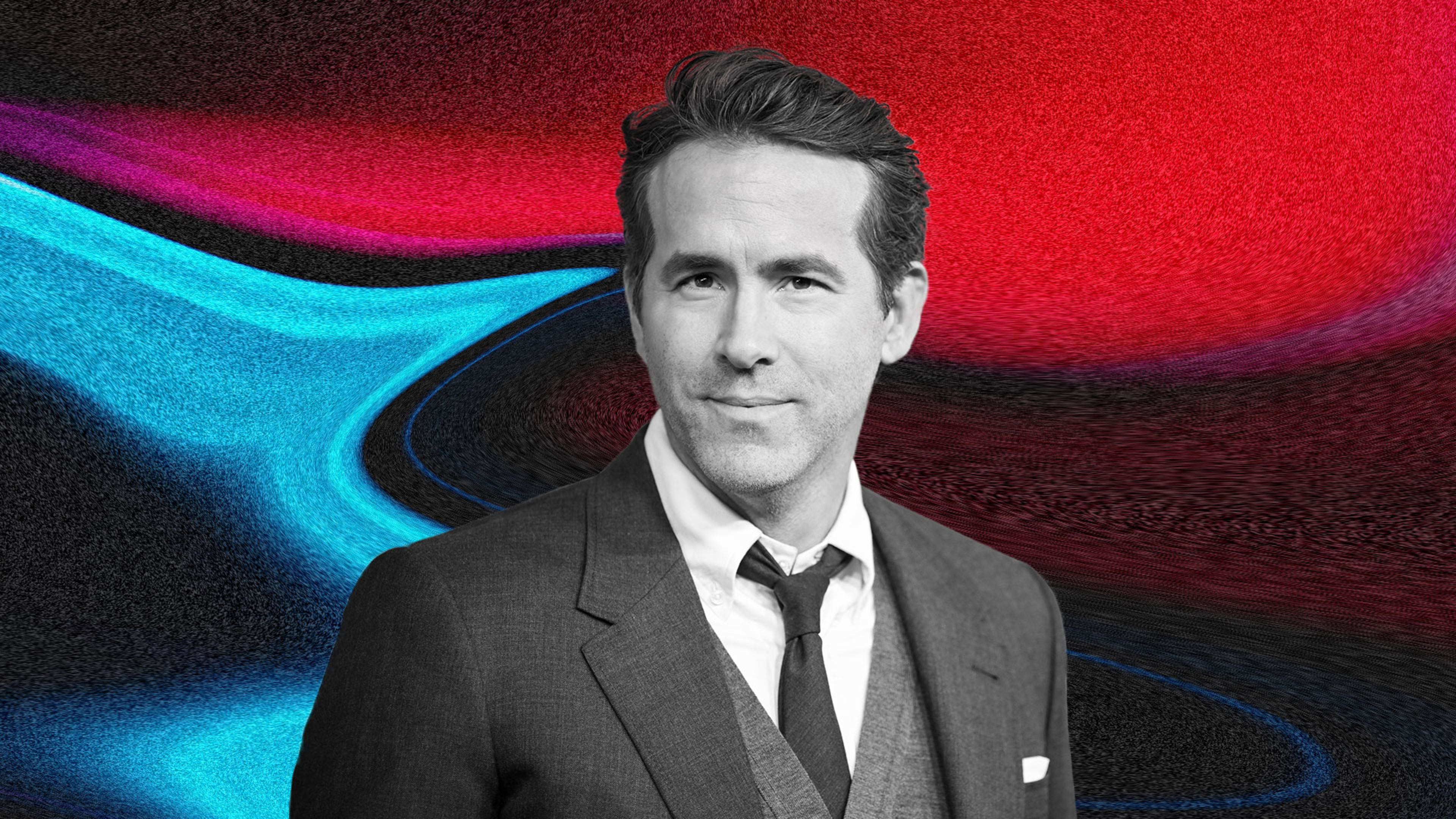

Less than a month after making a mint on the $1.35 billion sale of Mint Mobile to wireless giant T-Mobile, Hollywood heavyweight Ryan Reynolds is announcing his next move as an entrepreneur: an investment in Nuvei, a Canadian fintech company.

Reynolds’s total investment in Nuvei wasn’t disclosed, but his trademark humor was evident in the company’s announcement: “I know about as much about fintech as I did about gin or mobile a few years ago,” Reynolds said, per the release. “But Nuvei is impressive. The leadership team is exceedingly intelligent and hard-working and it’s about time a Canadian company got the type of attention American tech companies do.”

Well known for his roles in such movies as the Deadpool franchise, Free Guy, Pokemon: Detective Pikachu, and dozens more, Reynolds has also emerged as a prolific investor in recent years. In addition to Nuvei, he’s invested in Wealthsimple, 1Password, and Aviation American Gin. Additionally, Reynolds recently became the co-owner of the Welsh soccer team Wrexham Football Club—a purchase he made with friend Rob McElhenney (of It’s Always Sunny in Philadelphia fame), and which is documented in the FX series, Welcome to Wrexham.

Even with all that on his plate, he’s evidently not done yet: Reynolds is also part of a group that’s bidding on the National Hockey League’s Ottawa Senators, gearing up to shoot Deadpool 3 later this year, and running Maximum Effort, a film production and digital marketing company.

The only thing he’s seemingly not doing is building a rocket—something he joked about in a video he shared on Twitter today, along with Nuvei CEO Phil Fayer, in an apparent shot at Elon Musk.

Nuvei is a global-payments company that’s headquartered in Montreal and offers services such as card-issuing, banking, and risk and fraud management. The company’s been around for decades, having first been founded in 2003 as Pivotal Payments. It went public in the United States in 2021 and trades on Nasdaq under the ticker NVEI. While the Reynolds announcement didn’t send the company’s stock into the stratosphere, its share prices are up more than 66% year to date.

Both Reynolds and Fayer made a joint appearance on CNBC Monday morning to talk about Reynolds’s investment, during which Reynolds said that it was two years in the making. And as for why he’s investing? At least a little bit of the decision had to do with Canadian pride.

“America gets a lot of credit for innovation, and I think there’s something quite funny and interesting and a fun story to tell about Canada flexing a little bit. This is already a multibillion dollar global company with an amazing story to tell, and I look at these guys who are running it, and that’s a huge part of it for me,” the Vancouver-born Reynolds explained.

“I think while a lot of people are running away from fintech, this is one company worth running toward.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.