It’s been a pretty lackluster market for IPOs ever since Russia invaded Ukraine in February 2022. Since then, investors have been reluctant to put their cash into new listings for fears that worsening geopolitical maneuverings could tank global markets.

But that hesitance could change later this year, and in a big way. Reuters is reporting that superstar chipmaker Arm is expected to “confidentially submit paperwork” for its IPO in late April with a listing expected later in 2023. Here’s what you need to know:

- What’s happening? Arm, the Cambridge-based British semiconductor maker, is getting ready to file papers in April to go public later in 2023, according to Reuters. Arm’s current owner, the Japanese giant SoftBank Group, is reportedly in late-stage talks with several banks to lead the stock floatation.

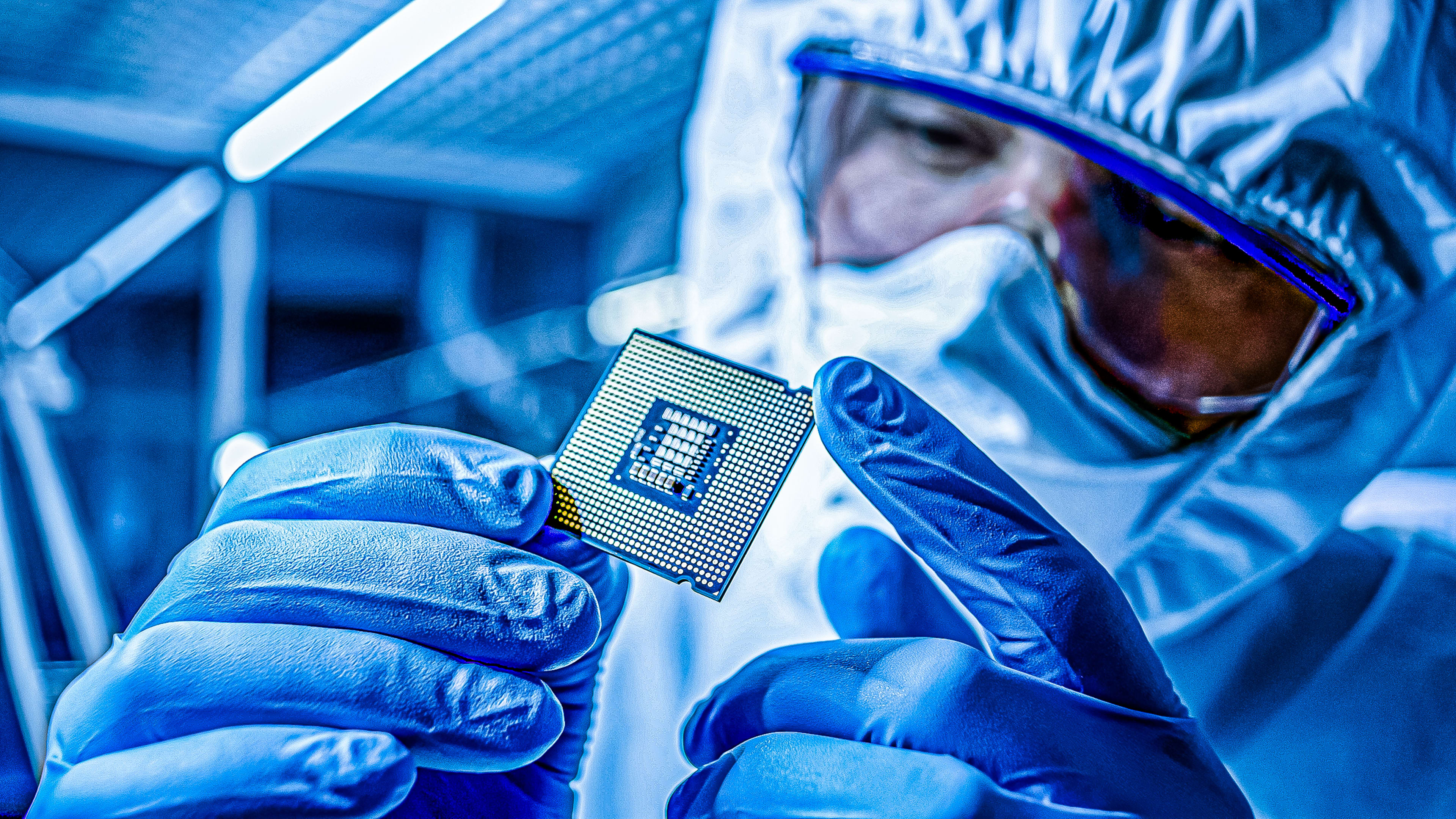

- What is Arm known for? The company is primarily a semiconductor company. It makes computer chips that go into a wide array of devices. If you have a smartphone or laptop, the chances are good that there is an Arm chip inside, or at least a chip based on Arm’s architecture. But Arm chips are found in numerous other electronic devices, too—from supercomputers to smartwatches. In other words, Arm chips and technology are critical for most of the devices we use in our work and personal lives.

- Didn’t Arm previously trade on a stock exchange? Yes. Arm was a publicly traded company until 2016 when it was purchased by SoftBank for about $32 billion in cash. At the time, SoftBank said, “We have long admired ARM as a world renowned and highly respected technology company that is by some distance the market-leader in its field.” It also said the company would be an “excellent strategic fit” for SoftBank’s ambitions in the IoT, or Internet of Things, space.

- But didn’t SoftBank try to sell Arm shortly after? Yes. In 2020, graphics giant Nvidia made an offer to buy Arm from SoftBank for $40 billion. (That value rose to about $80 billion at one point due to it being pegged to Nvidia’s share price.) Nvidia wanted to use Arm’s tech to bolster its AI position. But the Arm-Nvidia deal fell through after it drew the scrutiny of antitrust regulators in the U.S. and Europe.

- So that’s why SoftBank now wants to spin Arm out publicly? Yes. In a press release after the Nvidia deal collapsed, Arm confirmed it would “start preparations for a public offering of Arm within the fiscal year ending March 31, 2023.”

- How much will Arm shares cost? There’s no way to know at this point since SoftBank hasn’t publicly announced the details of the IPO. Reuters says Goldman Sachs, JPMorgan Chase, Barclays, and Mizuho Financial Group are set to underwrite the deal and that Arm is “hoping to be valued at more than $50 billion during its share sale, the sources said.”

- What market will Arm trade on? That’s unknown at this time but Reuters says it will be on a U.S. market despite the company being British and owned by a Japanese conglomerate. The most likely market it will trade on is the Nasdaq.

- When will Arm shares actually start trading? We don’t know yet, and SoftBank and Arm probably aren’t sure of an exact date yet either. Sources told Reuters the IPO is expected to happen later this year, but the exact timing will depend on market conditions.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.