At COP26, the annual meeting where more than 200 nations convene to discuss their individual and collective responses to and progress toward achieving the stated goals of the 2015 Paris climate accord, controversy over the use of carbon offsets has been central. Tom Goldtooth, executive director of the Indigenous Environmental Network, stated in unequivocal terms his members’ viewpoint on offsets: “It lets governments and corporations pretend they are doing something about climate change when they are not.”

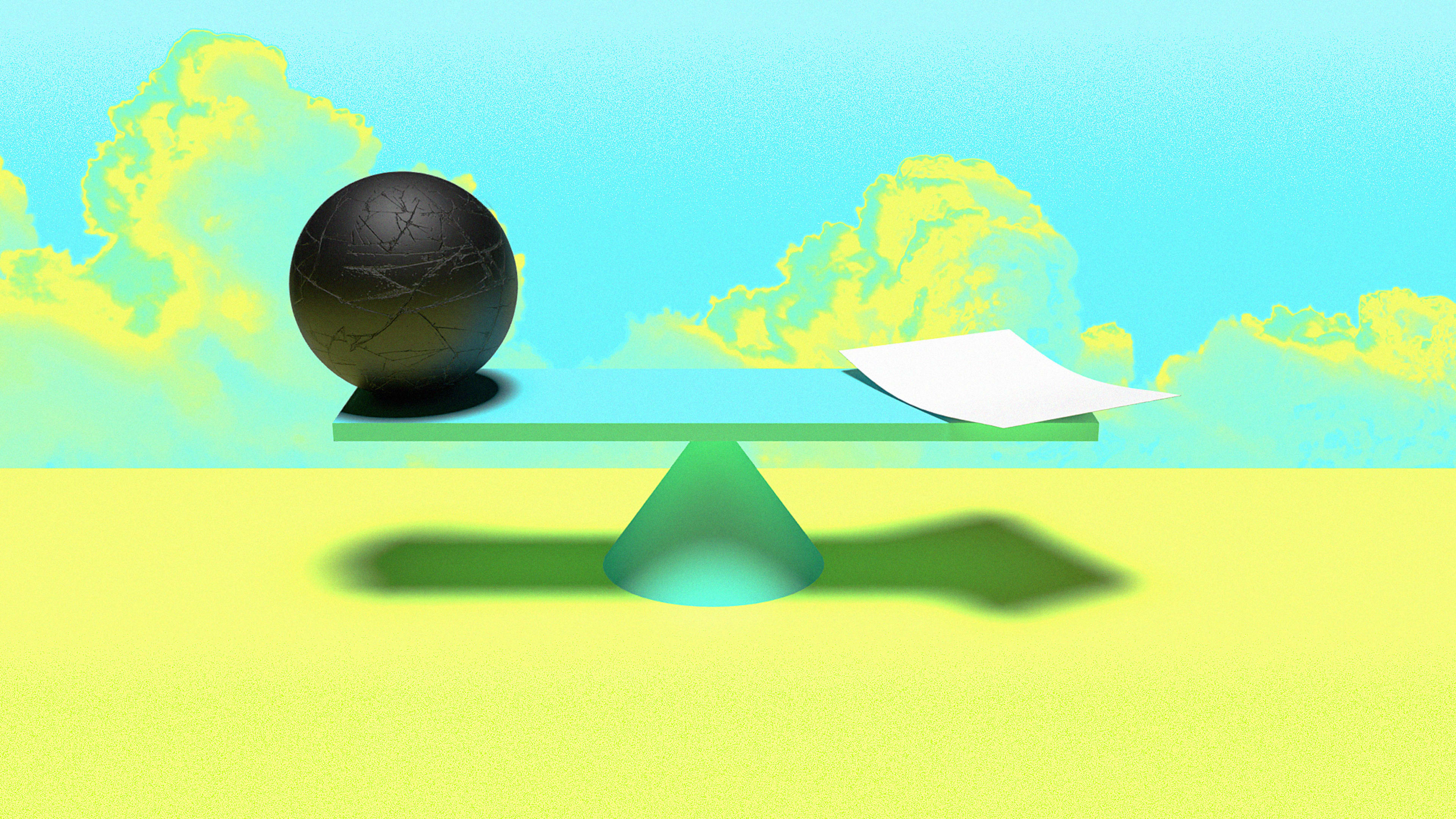

Carbon offsets are an accounting mechanism that allows nations, companies, and individuals to purchase a certificate that lets them lay claim to the reduction of one metric ton of carbon dioxide emissions per dollar amount associated with each metric ton. They are a market-driven economic instrument that are supposed to fund preservation and conservation projects and technology systems (e.g., solar and wind farms) to reduce carbon emissions in the atmosphere with the ultimate aim of mitigating the climate crisis.

Carbon offsets are used by nations and organizations to say that they are working toward eliminating their carbon footprint to the point of “net zero.” But carbon offsets are also increasingly viewed with wariness. Below are five points to understand about carbon offsets as companies join nations to meaningfully support the mitigation and reversal of our collective existential crisis: climate change.

1: Offsets are not a cure-all but a tool in a multifaceted tool kit

Carbon offsets are absolutely a part of the set of levers companies must use to propel them toward realizing their net-zero goals. Organizations such as the World Wildlife Federation, SBTi, the United Nations, and the Taskforce on Scaling Voluntary Carbon Markets all agree with this approach. But offsets are just one lever among a set of mitigation strategies companies need to pursue to reduce their carbon emissions, increase their energy-efficiency measures, and transition away from reliance on fossil fuels. Carbon offsets should be the last “pull” after the pursuit of mitigation efforts in-line with a company’s science-based targets toward reaching carbon-neutral goals.

2: Offsets are currently priced too low

Current carbon offsets don’t reflect the detrimental negative externalities (climate change) companies have driven, nor does their pricing structure effectively incentivize businesses to move away from their reliance on fossil fuels and energy-intensive business models. The University College of London calls current prices of carbon offsets unsustainably low. Coming out of COP26 and with the broader awareness of the need to take action to mitigate climate change within the next several decades, demand for carbon offsets is expected to increase five- to tenfold by 2030 as more companies pursue net-zero commitments. Carbon credit prices are expected to grow from $3 to $5 per metric ton today to $20 to $50 per metric ton by 2030. Carbon offsets will grow in demand and scarcity in the intervening years before 2050, driving their prices toward $100 per metric ton. Companies will come to realize that internal operational mitigations will be the most cost-effective carbon-reduction strategy for them.

3: Offsets are voluntary for U.S.-based companies (and for much of the world)

Because they are not required, they are not well regulated as a market instrument, which allows and invites bad actors to manipulate the system. Effective offsets are expected to meet four key principles that can be difficult to verify, including:

- Additionality: Do they add a carbon-reducing solution that didn’t already exist?

- Permanence: Do they deliver carbon reductions forever?

- Double counting: Are the offsets already “claimed” by others for meeting their declared climate targets?

- Leakage (aka, unintended consequences): By creating a carbon sink in one area of the world, does another area get developed that takes away its carbon-reducing benefits for the planet?

4: Offsets have become an easy tool for cash-rich companies to claim “good works” without doing the hard work of reducing emissions operationally

Carbon offsets let developed nations and cash-rich companies buy their way toward climate mitigation without grappling with the impacts the climate crisis is having on poorer people and nations that can least afford fast transitions away from fossil fuel use. Offsets are an easy instrument to access that allows companies to feel good about and publicly report on their carbon-neutral journeys without necessarily making hard choices or committing to direct financing instruments supporting decarbonization efforts in communities being hardest hit by climate change.

5: Offsets are focused on carbon reduction; Carbon capture and sequestration are equally important

There are not enough nature-based carbon offsets to meet demand by nations and corporations to solve the climate crisis. The U.N.’s Special Climate Report published this summer emphasized this point: The world’s efforts must include both carbon reduction and capture and sequestration to mitigate the effects of a warmer world. The range of carbon offsets in the future will likely need to include projects and technologies that “suck” greenhouse gases out of the air and either bury or sequester them in rock, oceans, or other man-made materials (e.g., cement and steel). Most of these carbon-capture concepts are noncommercial or have not yet scaled.

Kate Gaertner is the founder and managing director of TripleWin Advisory, a sustainability insight consultancy. She is the author of Planting a Seed: Three Simple Steps to Sustainable Living.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.