Renderings of Amazon’s new HQ2 headquarters in Arlington, Virginia, demonstrate innovation and creativity in the field of architecture. The proposed complex includes 2.8 million square feet spread across three 22-story buildings. The centerpiece of the project will be a swirl of building and greenery known as “The Helix,” which will be certified LEED Platinum, the highest seal of sustainability issued by the United States Green Building Council. According to Amazon the complex will “align with Amazon’s Climate Pledge to be net-zero carbon by 2040 and advance Arlington and Amazon’s shared commitment to be leaders in the fight against climate change.” But will it?

Commercial real estate bears an undeniable responsibility for the climate change fight. As of 2016, the built environment consumed 44.8% of all energy in the U.S. and contributed 38.7% of carbon dioxide emissions, of which three-fifths was produced by commercial real estate. A significant amount of carbon dioxide emissions produced by the built environment occur during the construction phase of a building’s life cycle. A term that is rapidly gaining fluency in the industry is embodied carbon. It represents the sum of all greenhouse gas emissions that have occurred in the construction of a building as opposed to those during the building’s operational phase once completed. This concept of embodied carbon deserves far greater scrutiny given its impact, but it is rarely part of the sustainability calculus that most industry participants contemplate.

Recent research shows that the ratio of carbon released during construction relative to that from building operation is moving beyond a one-to-one ratio when taking a very optimistic building life span of 50 years. In fact, more carbon is emitted during the construction of the asset than during its entire lifetime. The emission impact of this embodied carbon happens today, while post-construction energy savings occur over the ensuing 30 to 50 years, which is too late.

The commercial real estate industry has developed a number of environmental certifications to demonstrate the environmental sustainability of a real estate asset, such as LEED (in the U.S.) and BREAM (its European equivalent). The inherent flaw with these certifications is their near total focus on the operational phase of a building’s life cycle and near exclusion of the carbon-intensive construction phase. This reality has led to an industry that has an incomplete and potentially dangerous understanding of a given building’s true carbon footprint.

Unlike operational carbon emissions, which can more easily be addressed through usage of renewable energy sources, there is currently no easy way to reduce the carbon emission of construction. Interestingly, the bulk of embodied carbon is not related to the nature of the energy used in the construction process, but to the materials themselves. Cement, which is the most widely used material on the planet after water, emits substantial amounts of carbon through the chemical reaction that creates it.

The positive news is that reducing emissions attributed to the construction of commercial real estate does not require complex technology, nor substantial taxpayer investments. Our industry needs to think judiciously about new construction given the meaningful emission load that results from ground-up construction and adopt a mindset that looks first to the adaptive reuse of what has already been constructed. This would require better education of commercial real estate investors, lenders, architects, and occupiers. Investors should favor adaptive reuse and improvement of the efficiency of existing buildings.

The lender community must also understand their influence given the necessary role of debt capital in a real estate investment, and architects need to put forward new approaches that address issues of functional obsolescence that are common in older buildings. Finally, occupiers must also consider their leadership position in the built environment and see these refurbished assets as substantially as good, efficient, and inspiring as new construction and understand that these assets are fundamentally more sustainable and better aligned with climate transition.

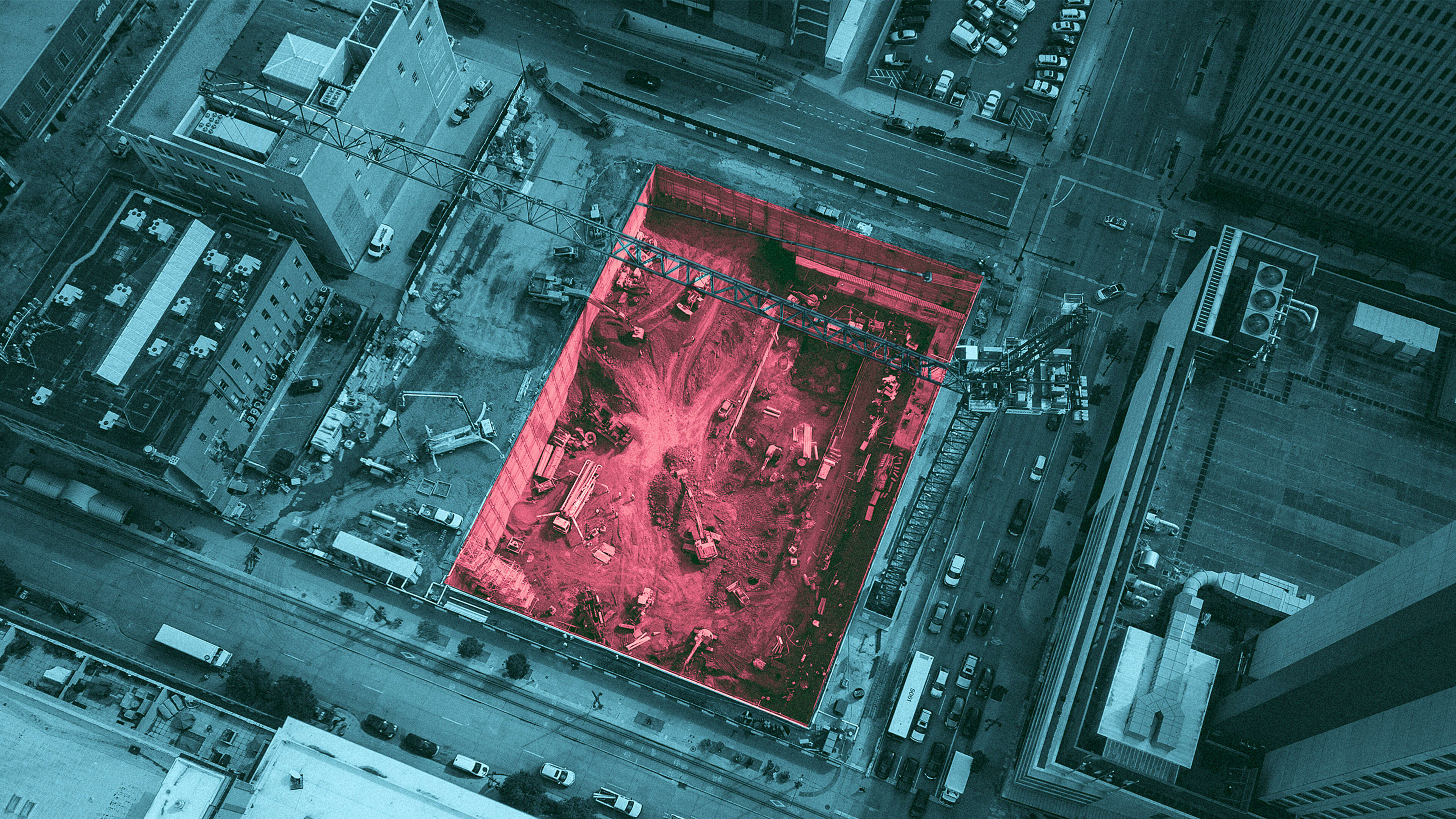

The average office vacancy rate in U.S. cities was 11.5% at the end of 2019, or equivalent to around 610 million square feet, which is enough to serve roughly 45 years of net absorption. The submarket of Arlington, Virginia, where Amazon is located had roughly 2.1 million square feet of total office availability as of Q4 2020. The effects of COVID-19 and working from home are likely to only increase space availability. Priority should be given to repurposing this vacancy and new construction should be used only when no viable retrofit is possible.

We cannot help but think of the impact that a company such as Amazon could have on the climate change conversation if it were to complement its approach with adaptive reuse and integration of existing building stock to HQ2. The real estate industry needs to think critically about our contribution to climate change and not be lulled into complacency by single-dimension sustainability certifications. The global pandemic has prompted us to question how we use space, and we would be well-served to use this time of reflection to consider the true environmental consequences of our investments.

Matthew L. Cypher is the Atara Kaufman Professor of the Practice and Director of the Steers Center for Global Real Estate at Georgetown University’s McDonough School of Business. Olivier Elamine is cofounder and CEO of alstria office REIT-AG.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.