Google “how to raise funding for my startup” and you will find hundreds of articles telling you how to craft your pitch, how important storytelling is, and how you should order the slides in your pitch deck.

Let me tell you something shocking.

I have seen a $5-million-seed-funding round come together from brand-name VC firms without a single slide . (And no, this founder wasn’t someone with a massive prior success.) I have also seen founders struggle to raise a much smaller amount, despite beautifully crafted decks, comprehensive materials, and superb narrative and storytelling.

Contrary to conventional wisdom (and Google searches), the pitch deck is not the most important element of a fundraising pitch.

So what is important, and how I should go about fundraising? Here’s my take:

Spend your energy on people, not the pitch

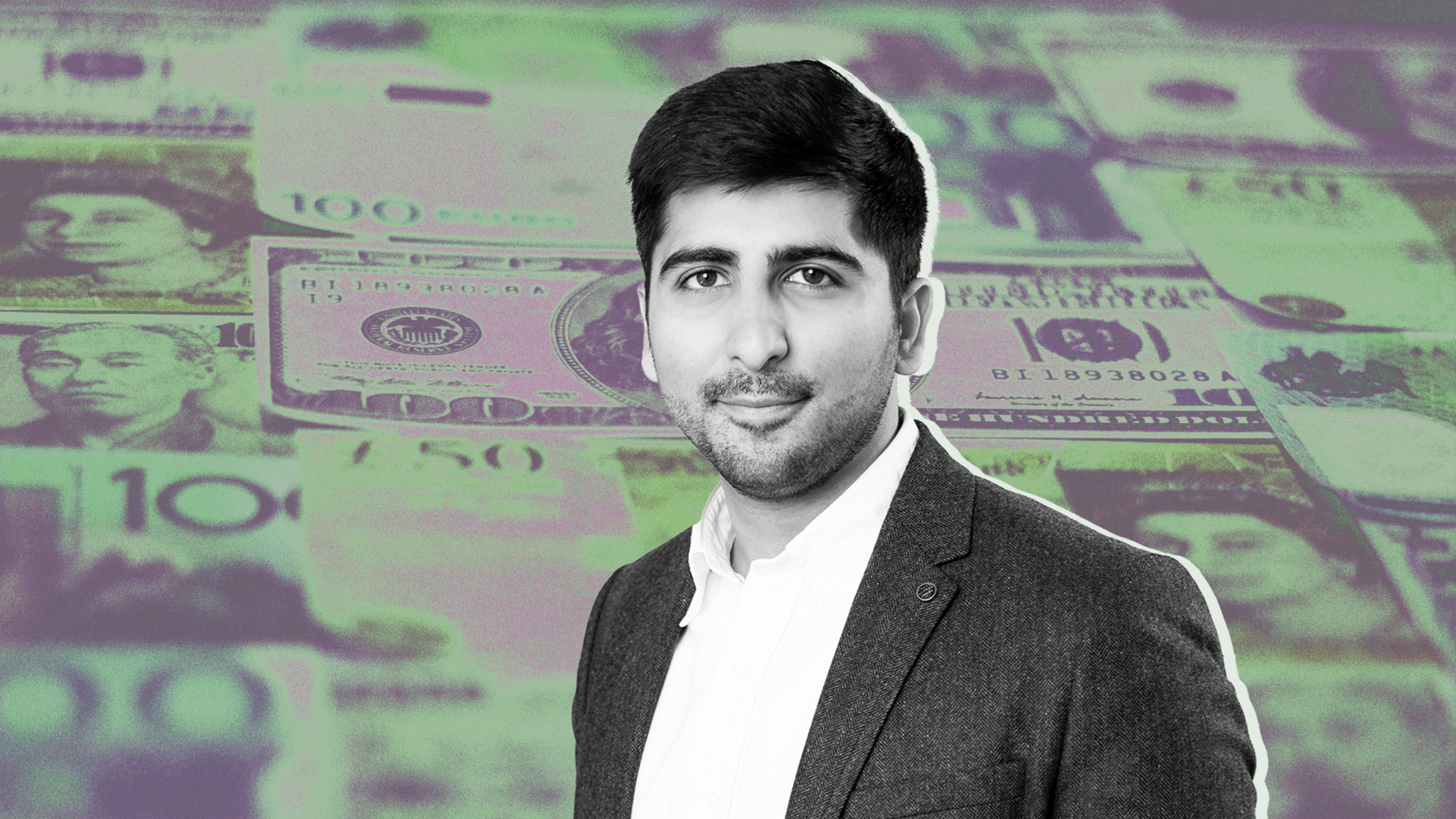

Investors care much more about who than what. They care about people in your company, people around your company, and people talking about your company. I spent the last four years collecting the world’s largest dataset on startups, trying to understand what differentiated companies that went on to become billion-dollar enterprises from those that didn’t. I wrote a book on the findings. According to the data, early-stage venture investors consider the team way more important than the idea, product, and the industry. Yet, most pitch decks have only one slide about the team and a dozen about everything else.

The best founders that I’ve seen get exceptional people to join them early on. Even if they haven’t raised money yet, they convince top-notch talent to join them. Take Katrina Lake of Stitch Fix. Eight months after graduating from business school, Lake was able to attract the then-chief operating officer of Walmart.com to join her startup. A couple of months later, she wooed Netflix’s then-vice president of data science as well. Those are two extraordinary recruits for an early-stage startup with a founder who didn’t have any industry experience or past startup success. Lake was able to attract them to join as executives by convincing them of the future scale of her vision. Before focusing on investors, spend your energy on selling the vision to get great people in your company.

First raise from individuals

Savvy founders start by raising a small amount from a strategic group of individual (angel) investors. These are the “people around your company” part. This is your opportunity to gain a great set of cheerleaders who have skin in the game. Some of these may be the people you tried to recruit to join you but couldn’t. Some may be executives in the industry you’re going after and your startup may very well be their first angel investment. Think about who would make the dream executive team for your company in five years and try to bring them on as individual investors now. Even if they don’t invest, you will have a network of individuals who may help and talk about your company. These are the “people talking about your company” part.

Run a fundraising process

Don’t scatter around investor meetings all year long. Line up all your first meetings within a short time frame, but allow enough time for everyone to do their diligence and for you to know them and for them to know you. Make sure to keep momentum. Use backchannel to your advantage; ask the person who made the introduction or other people who may know that VC firm to send a follow-up note after your initial meeting or directly follow up with thoughts on key questions that were asked.

Don’t spend too much time on history

The data in Super Founders: What Data Reveals About Billion-Dollar Startups suggest it is a myth that the ideas behind the most successful startups were born out of founders’ personal problems or frustrations. Stop trying to conform to the stereotype with length narratives about your origin story. You need to say what exactly your company does within the first couple of minutes. Start with a simple and straight-to-the-point statement of your unique insight into the market, the opportunity you’re pursuing, and the gap in the market you have identified.

Be thoughtful and clear

It is important that you have thought so deeply about your company that you can pinpoint exactly what problem you are solving and for whom. If you have to list five bullet points for the problems you are solving and five bullet points for your value propositions, and another five bullet points for why now is the best time, think harder. Get to the root. Find the one main reason.

Focus on attracting the finest people to join you early, and money will follow your success. It’s the ability to attract top-notch talent and selling the vision to early employees and backers that gives VCs the confidence to invest, even if the revenue or other metrics are still negligible. Spend your time, focus, and energy on things that matter to your business like its team and customer, rather than perfecting your pitch deck for investors.

Ali Tamaseb is a partner at DCVC, a venture capital firm with more than $2 billion under management, and author of Super Founders: What Data Reveals about Billion-Dollar Startups,

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.