Cryptocurrency exchange Coinbase went public this week, fetching an $85 billion valuation, and spurring bitcoin and ether to all-time highs. Did we lose you already? Read on.

What exactly does a cryptocurrency exchange do?

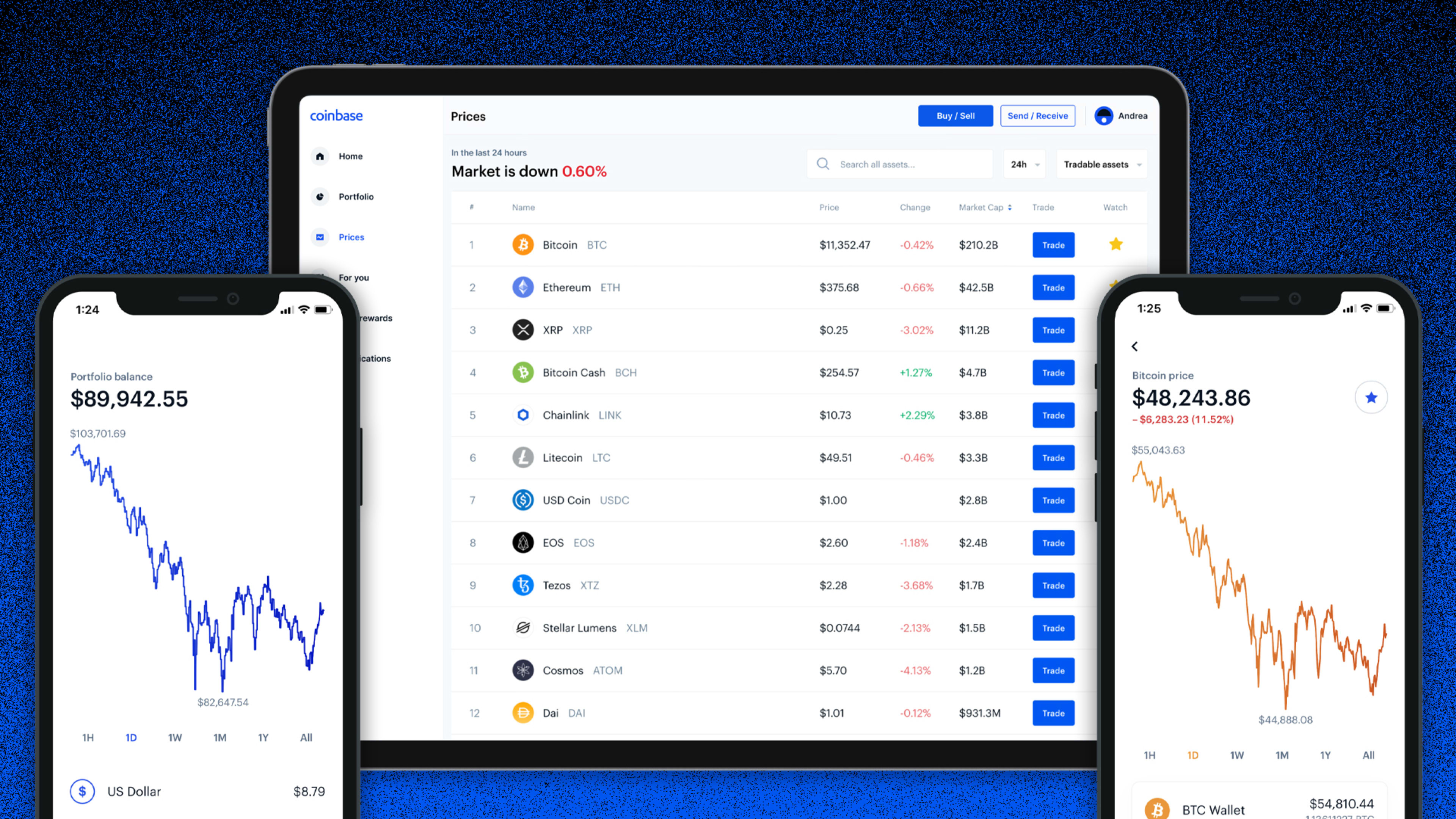

It’s where you go to buy, sell, or store cryptocurrencies. Coinbase trades bitcoin and 50 other cryptocurrencies that you’ve never heard of, and it also does a lot of explaining to customers about crypto markets and the ins and outs of what’s happening with them.

Why is it finally time to care about crypto markets?

Remember the 1990s when newfangled web companies such as Netscape went public, and everyone breathlessly watched for confirmation that a company with no physical product was worth greenbacks? Same concept here. Coinbase is the first major cryptocurrency company to go public and therefore a test of whether it’s real or not. Spoiler alert: It’s real.

So what happened?

On Wednesday, Coinbase began trading on Nasdaq under the COIN (cute!) ticker symbol. Its share price went on a roller coaster that peaked at $429 per share and ended the day at $328, surpassing expectations of $250. As of Friday morning, it’s trading at $339, up about 5% from the previous close. (Cryptocurrency values themselves are also often roller coasters.) Bitcoin and another cryptocurrency, ether, also hit record values.

What does this mean?

Cryptocurrency has gone mainstream. It’s for real.

What does this mean for me?

It’s time for you to become fluent in crypto-speak. As in, you should be able to name four cryptocurrencies and their approximate values.

Is Coinbase really worth $85 billion?

Unlike all the tech companies that go public without having turned a profit, Coinbase is definitely in the black, profiting over $730 million in the first quarter of this year, but its earnings are also somewhat unpredictable, because it is tied to wildly volatile cryptocurrencies. In Q1 2020, the company earned 22 times less ($32 million) in profits. Would you say that a company on track to profit $3 billion this year is worth $85 billion? Maybe not so much. This mostly means that investors are just enthusiastic—perhaps, um, because many of them own assets in cryptocurrency.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.