As the U.S. slowly reopens, each one of us must step up and do our part to bring the pandemic-battered economy back to life. Just as 85 million Americans purchased war bonds during World War II to support an Allied victory, now is the time to focus our purchasing and investment power on community renewal. With so much at stake, we have neither the time nor luxury to dither. This is, in the words of Martin Luther King Jr., “the fierce urgency of now.”

So here’s my plea: Adopt your favorite local business, today.

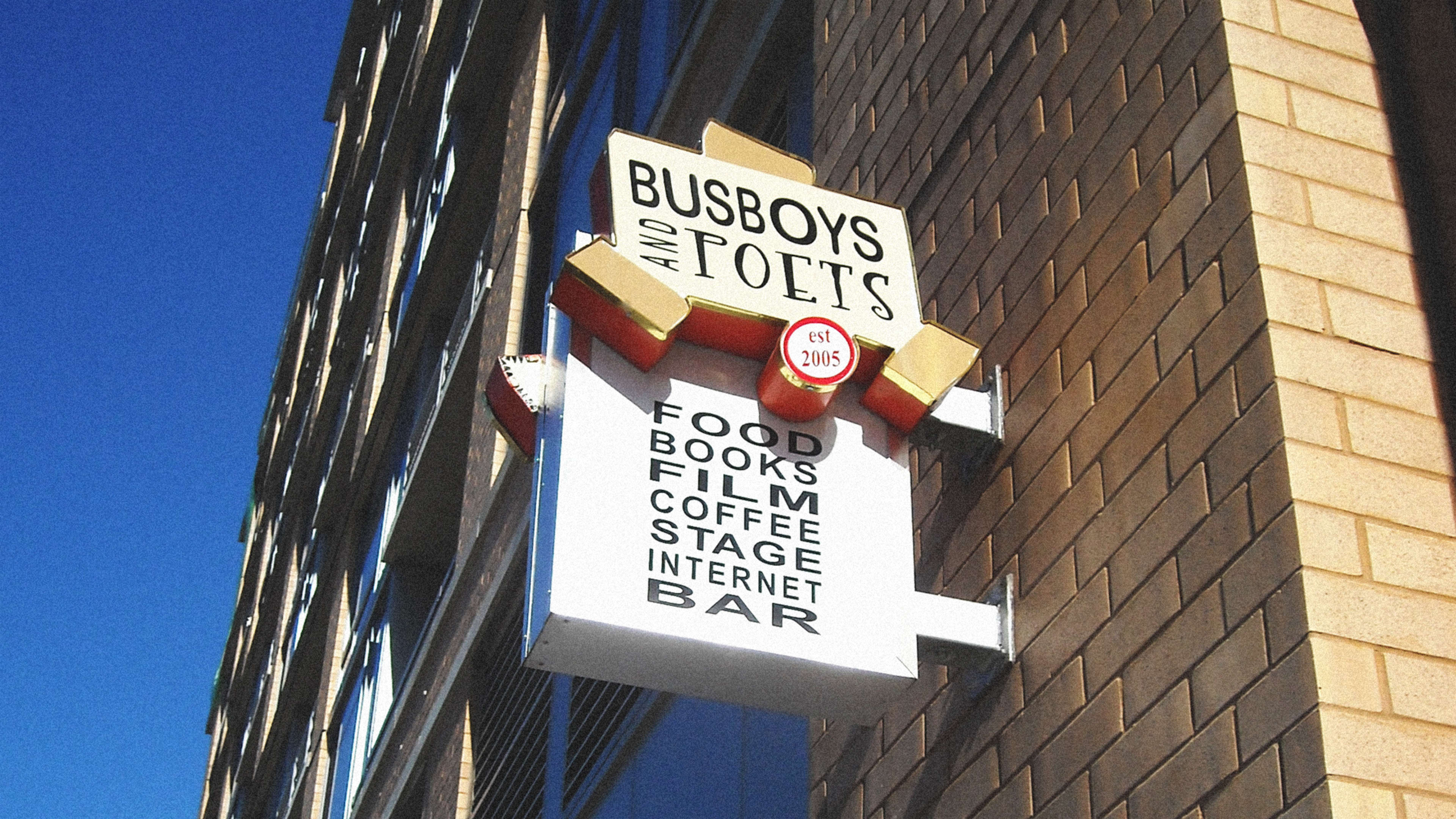

Living in the Washington, D.C., area, my partner, Audrey, and I just adopted Busboys and Poets, a community gathering place created by artist, activist, and restaurateur Andy Shallal.

In 2005, Andy opened the first Busboys and Poets—there are now seven locations in all—in D.C.’s U Street Corridor, where I once lived. With a bar, bookstore, restaurant, and event space, it was a huge hit—quickly becoming a cultural hub and one of the most consequential “third places” in the area. Not to mention that, over the years, Andy has provided jobs to some 1,500 employees, many of whom are young and lack previous experience, that receive great pay and work-life benefits.

Over a typical year, Audrey and I have 10–20 meals at Busboys and Poets, spending about $1,000 overall. So we emailed Andy, proposing that we prepay $1,000—plus encourage our friends to do the same—to help boost his cash flow for reopening. Deliriously happy, he sent us, in appreciation, $1,200 in gift cards. (Though we weren’t considering this an investment per se, you can’t beat a 20% rate of return.)

It’s not a cliché, or overstatement, to say that local businesses are the lifeblood of our communities. First, they’re our economic engines—providing, depending on how you define “local,” 60% to 80% of our output, including jobs. Moreover, as our social anchors, they play a vital role in our safety and well-being, and even our democracy. In fact, there’s compelling evidence that communities with thriving local businesses have lower rates of crime and poverty, and conversely, higher rates of giving, volunteering, and voting.

At this moment—amid this fierce urgency of now—we’re on the verge of losing literally millions of these businesses. And while federal, state, and local governments, among other institutions, have stepped up with some financial resources, not all businesses will benefit—not even close—especially if they lack the right political or banking connections. So what about the countless others? They’re failing—fast.

I wish I could agree with our national leaders who claim that COVID-19 is effectively behind us. Yet, like so many Americans, I’m admittedly anxious about returning to my local businesses. For now, Audrey and I are comfortable dining outside at Busboy and Poets. But we can’t ignore the elephant in the room: What happens if, after “flattening the curve” on COVID-19, a second, potentially even more severe wave hits in the autumn?

Over the past 25 years, shopping malls, big-box stores, and most recently, online behemoths like Amazon, have decimated Main Street in America. Many local businesses have clawed their way back through “buy local” movements, placemaking initiatives, and smart city planning. But the brutal truth is that, today, all that progress is in real danger of being undone. And, soon, in communities across America, boarded-up businesses could beset every streetscape, many of them for years, if not decades.

And that’s precisely why we must act. Now.

For inspiration, look no further than the Circle of Aunts & Uncles in Philadelphia. Since 2014, they’ve been providing low-interest loans and social capital to under-resourced entrepreneurs, most of them poor and nonwhite business owners, who don’t have access to money from “family and friends.” When the COVID-19 pandemic fully hit in March, Judy Wick, the brainchild behind the “Circle,” wasted no time. She immediately reached out to the thousands of people in her vast network, asking them to buy electronic gift certificates from the Circle’s adopted businesses, which they could use later or immediately convert into gifts to others.

If you want to cast a wider net, you can also set up a simple website to facilitate adoptions for businesses across your community. Protegra, a Winnipeg, Manitoba-based software company, is providing communities with a quick and easy platform for an adopt-a-business campaign. They call it “Local Futures.”

Another idea is to move some of your pension savings into a local business. Today, those who’ve been adversely affected by COVID-19 may take out a one-time loan, of up to $100,000, from their pension fund and invest it locally. In fact, in my book Put Your Money Where Your Life Is, I show how thousands of Americans have been doing this for years using self-directed IRAs and solo 401ks.

Also, with federal investment crowdfunding rules enacted in 2016, any local business can easily and inexpensively raise up to $1.1 million from grassroots investors. By the end of 2019, roughly 432,000 Americans had invested around $340 million this way through loans, stock purchases, and royalty agreements. And as the U.S. eventually moves to some sense of post-pandemic normalcy, this is a clarion call to all Americans to consider moving their pension savings from Wall Street to Main Street.

Prior to the COVID-19 crisis, U.S. households held $56 trillion in long-term investments in stocks, bonds, mutual funds, pension funds, and insurance funds. And even though local businesses account for at least 60% of America’s economy, just a pittance of that $56 trillion touched local businesses. So try this on for size: What if we were to move 60% of $56 trillion from Wall Street to Main Street? Every community in America would enjoy about $100,000 of additional capital per resident.

So whatever each one of us can possibly do, let’s do it today. At this moment, let’s you and I, and all the rest of us, adopt our favorite local business through pre-purchasing or investment. A little love can go a long way to saving our communities now, when they need our help most.

Michael H. Shuman is an author, speaker, economist, attorney, and entrepreneur, and a sought-after expert in economic localization. His new book is Put Your Money Where Your Life Is (Berrett-Koehler, 2020). He blogs at michaelhshuman.com.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the final deadline, June 7.

Sign up for Brands That Matter notifications here.