Back in March, Apple unveiled the Apple Card, a new credit card—offered in partnership with Goldman Sachs—that’s as much an extension of the Apple Pay mobile payments system as it is a piece of plastic—or, to be exact in this case, titanium.

At the time, Apple said only that the card would arrive this summer. Last week, during the company’s earnings call, CEO Tim Cook gave a more specific time frame: August. And starting today, a “limited number” of consumers who signed up to be notified about the card will be selected to participate in a pre-release trial that Apple is calling the Apple Card Preview. They’ll only have a slight head start on everybody else who wants one: The card is on schedule for broad rollout later this month.

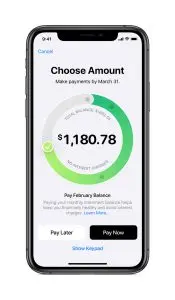

Participants in the preview won’t have to wait for their shiny titanium card to arrive in the mail; actually, receiving it at all is optional. Instead of living in your wallet, Apple Card’s principal place of residence will be in Apple’s wallet—the iPhone’s Wallet app, that is. Already the hub for Apple Pay and the Apple Cash person-to-person payment service, Wallet will be where you do everything from apply for the Apple Card to pay off your account. That makes owning an iPhone pretty much mandatory to use the card, although a subset of the card-management functionality Apple has built for the iPhone will also be available on the iPad and on Macs with Touch ID.

Instead of looking like an old-school credit card statement translated into digital form, the Apple Card’s transaction history aims to make it really clear what you’ve bought and from whom. Merchants are clearly identified and plotted on a map, and you can review all your purchases from a particular seller in one place. Bar graphs and category breakdowns let you track how much you’ve spent from month to month and on categories such as Entertainment and Food & Drink; that isn’t unique, but Apple’s interface looks a lot more approachable than the dreary norm for such features.

Apple being Apple, it’s quick to emphasize that all of this was designed with privacy in mind. The transaction views are generated on the iPhone, not in the cloud; in fact, Apple doesn’t have access to data about your spending at all. By necessity, Goldman Sachs does have that information, but pledges not to mine it, sell it, or otherwise use it for any purpose other than processing your payments. Apple also gave the Wallet app the ability to generate virtual credit card numbers for use when paying online merchants that don’t take Apple Pay, permitting you to complete such transactions without revealing your full credentials.

In March, after Apple announced the Apple Card, my colleague Mark Wilson pondered its features and policies, talked to some experts, and ended up with a cautious stance about whether the card will encourage its users to have a healthier relationship with credit. Swift cashback payments could incentivize people to spend more freely, as if it were a game! Or perhaps the beautifully rendered ring of payment options will leave some folks more tempted to make minimal payments, interest be damned. More generally, it’s not a given that all that many consumers actually use the tools that can help them manage their finances in the smartest possible manner.

All those concerns are reasonable things to consider. Still, I’m glad to see Apple try its hand at reimagining the credit card as a software-first experience. It’s about time someone put this much care into crafting a credit card app. It makes sense that the someone was Apple. And if the Apple Card takes off and other credit card issuers draw inspiration from it, we’ll all benefit.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.