A year ago, under Senate questioning, Mark Zuckerberg dodged, denied, and deflected criticisms of the company he cofounded. A year later, with major fines looming, and Facebook’s stock price having risen again by 11%, the CEO’s strategy has evolved: the company is now hailing the virtues of privacy and openly courting reform in what seems like an effort to set favorable boundaries for any data privacy legislation. But criticism of Zuckerberg continues to grow. On Wednesday, digital rights group Fight for the Future joined a growing chorus of activists and investors calling for a change to Facebook’s leadership.

“In this gilded age of Big Tech, Silicon Valley’s royal families have sat in their castles, amassing treasure mined from a mountain of our data, seemingly untouchable as they weather scandal after scandal while they offer empty apologies and their power grows,” writes Evan Greer, deputy director of Fight for the Future, in an op-ed in The Guardian.

“It’s time we prove that these kings are not gods,” he wrote. “It’s time we dethrone Mark Zuckerberg.”

Fight for the Future’s call for resignation comes days after digital civil rights group Color of Change and corporate accountability organization Majority Action sent a letter to the Securities and Exchange Commission (SEC), informing the agency that they will urge Facebook shareholders to vote against nominating Zuckerberg to lead Facebook’s board of directors at the company’s investor meeting on May 30.

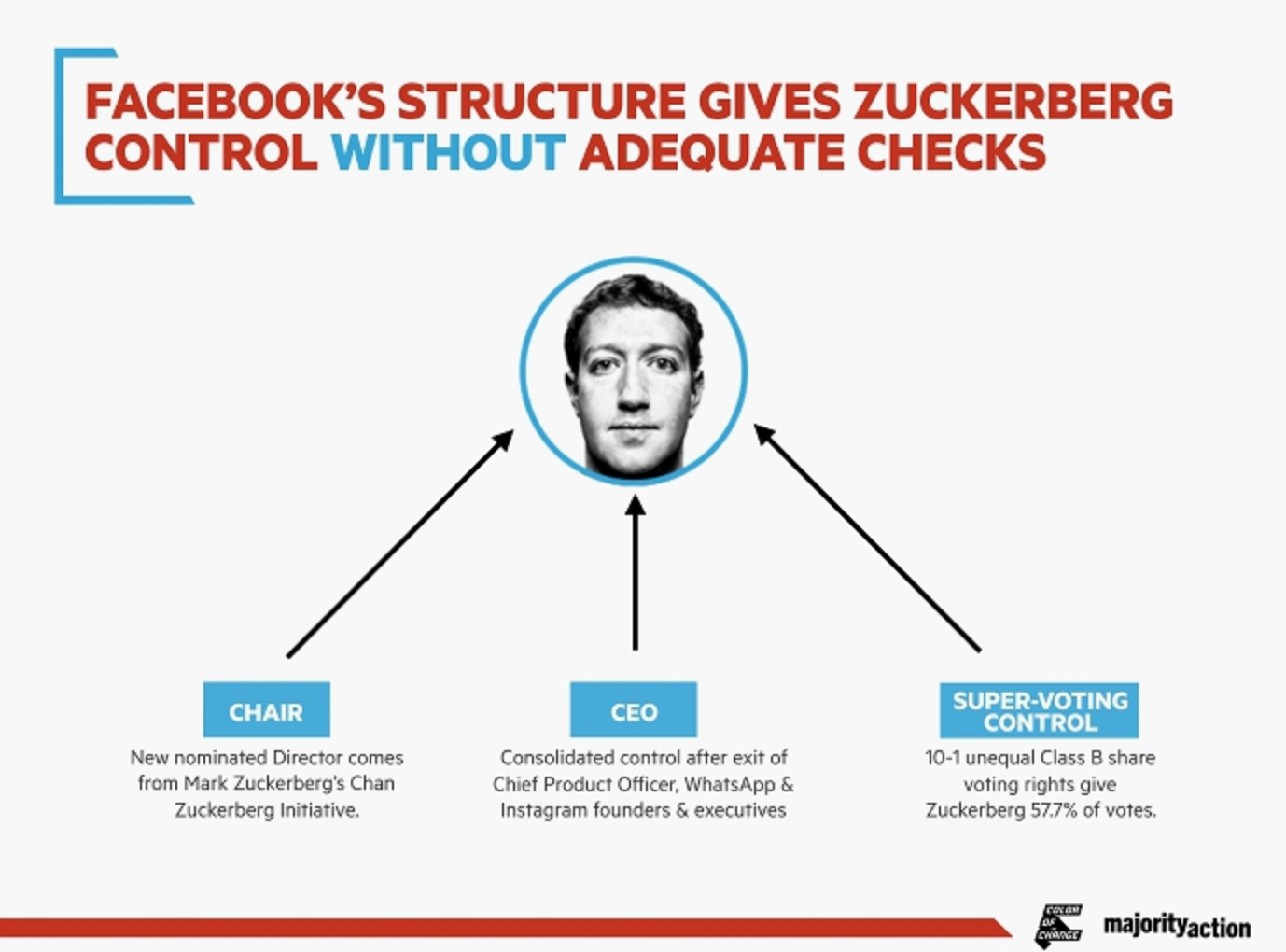

Zuckerberg’s dual role is considered unusual in Big Tech: at Google, Microsoft, Apple, and Twitter, separate people serve as chief executive and board chair.

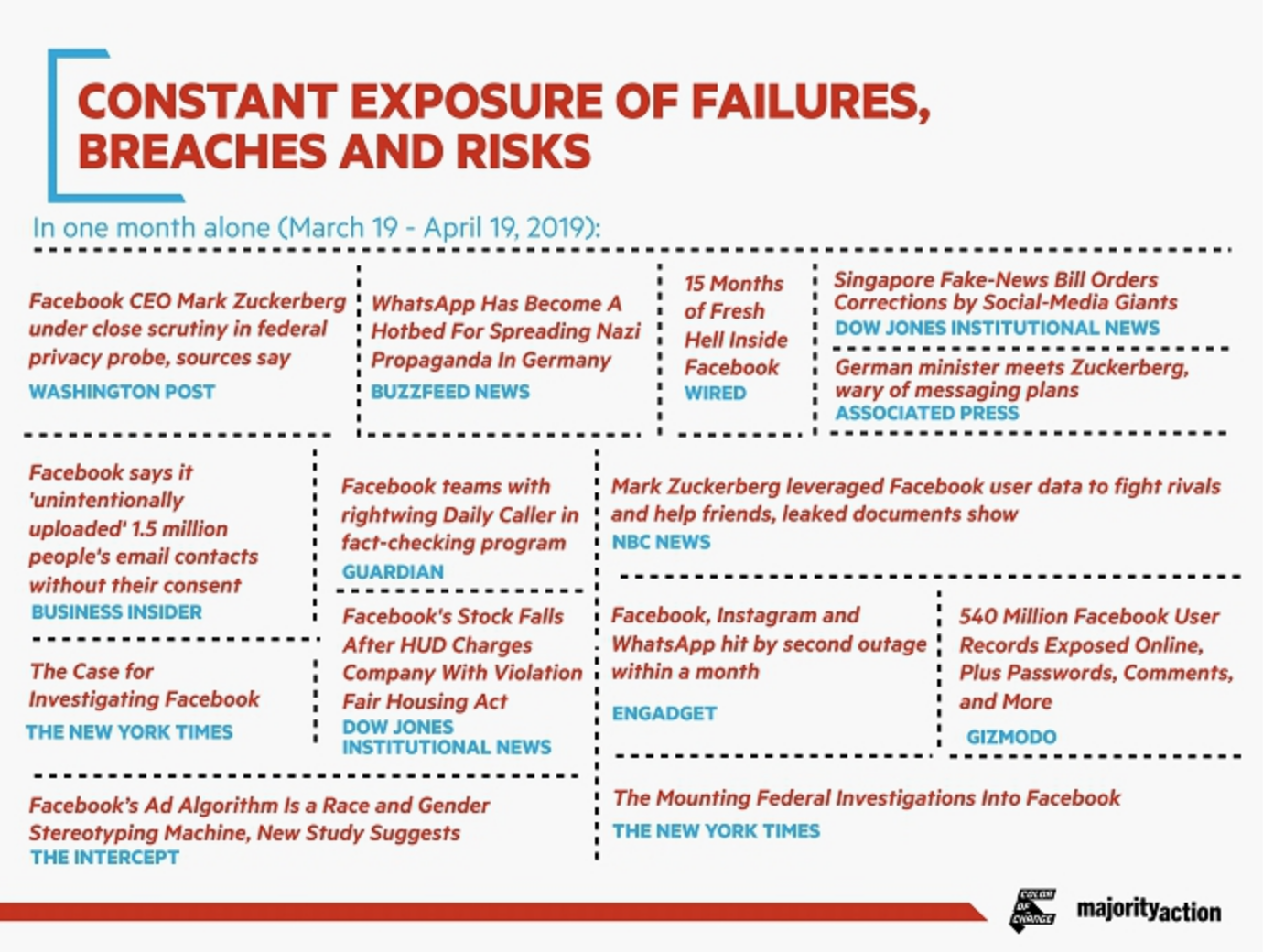

The groups pointed to a number of issues as worthy of a leadership change, including data violations, like the the 1.5 million users’ email contacts uploaded without consent, and an April report that 540 million Facebook user records had been exposed. The groups also cited Facebook’s ad algorithms and systems, which researchers have shown contribute to racial and ethnic discrimination and which are the subject of a recent complaint by the Department of Housing and Urban Development.

“As long as Mark Zuckerberg stands for election as Chair of a Board with insufficient power and independence, and retains majority voting control through unequal voting rights, Facebook shareholders cannot have trust in Facebook’s oversight and accountability,” write the groups.

Majority Action and Color of Change say they are concerned with Zuckerberg’s near total control of Facebook, and not just his 57.7% of voting shares. For instance, the company’s newest nomination to its 9-person board, Peggy Alford, comes from an executive position at his own Chan Zuckerberg Initiative, a for-profit limited liability corporation that can lobby politicians and make political donations.

Zuckerberg’s control over Facebook has only grown stronger after departures by the company’s chief product officer and the executives of WhatsApp and Instagram. In November, Zuckerberg told CNN that while he doesn’t plan on leading Facebook forever, stepping down now doesn’t “makes sense.”

Efforts to fire him or even remove his chairman position face an uphill battle, but the calls for change at the top have never been stronger. Zuckerberg is also a potential target of new federal regulations: commissioners at the Federal Trade Commission (FTC) are considering holding Zuckerberg personally liable for future privacy violations.

Facebook has indicated it expects a fine as large as $5 billion as part of a settlement with the FTC, but company lawyers have insisted that any liability for Zuckerberg—just like any demand for him to step down—would be unacceptable.

An unusual level of power

Color of Change and Majority Action are calling for investors to withhold votes on a nomination of Zuckerberg to the company’s board at the May 30 meeting and asking investors to support proposals calling for an independent board chair, expanded transparency, equal voting power among shareholders, and a requirement that directors in uncontested elections be chosen by holders of a majority of votes cast.

Two of the proposals call for annual reports on risks of content governance and gender pay inequity. As is customary for corporate boards of directors facing shareholder proposals regarding internal governance, Facebook’s board responded to each of the proposals by recommending that stockholders vote no.

The Facebook board has sought to assure investors that its current leadership and internal reviews are sufficient. In addition to expected changes mandated by an FTC settlement, including the possible addition of a chief privacy officer, the company is now undertaking an internal civil rights audit after years of campaigning by civil rights groups, including Color of Change.

Last month, a group representing some of the biggest public pension funds invested in Facebook—including treasurers in Illinois, Rhode Island, Connecticut, Oregon, and New York City—also asked the board to shift to an independent chair at the upcoming meeting.

Another group of Facebook shareholders called on Zuckerberg to step down as CEO last November after reports surfaced that Facebook had hired a PR firm, Definers Public Affairs, to smear Muslim Advocates and other groups by connecting them to George Soros. In December, Muslim Advocates and over 30 other groups sent another letter to Zuckerberg calling for his resignation. The coalition cited Facebook’s lack of action—despite ample time, opportunity, and the benefit of input from experts and advocacy groups—in outlining Facebook’s issues, including how easily users can be manipulated to stir racial division.

Fight for the Future has echoed this argument, noting in a statement that Facebook has had a decade’s worth of second chances, yet has still failed to address underlying issues around data use and civil rights. Greer, the group’s deputy director, says that in discussions with other digital rights and free expression groups, it quickly became clear that no single “silver bullet policy solution” would fix Facebook. She says a wide variety of changes are necessary, including federal privacy legislation, antitrust action, and the more symbolic move of deposing Zuckerberg to demonstrate that Silicon Valley companies aren’t invincible.

“Hefty fines, civil rights audits, antitrust, data privacy legislation, shareholder activism and employee organizing can all play a role,” she writes in The Guardian. “But we don’t just need regulation, we need a revolution—a massive cultural shift in how we think about our personal information and the companies that profit by collecting it.”

A Facebook spokesperson did not respond to a request for comment on the efforts to remove Zuckerberg as CEO or board chairman.

Related: Amazon can’t block a shareholder proposal on face recognition, says SEC

Roger McNamee, an early investor in Facebook who has become one of the company’s most prominent critics, is not certain removing Zuckerberg is the right focus for activists. For him, the emphasis should be on changing the business model. “If you change the incentives, it doesn’t matter who’s running it. If you don’t change the incentives, it also doesn’t matter who’s running it,” McNamee said in an interview with New York magazine.

Fight for the Future’s Greer is in agreement with McNamee when it comes to changing the business model. But she says such a move goes hand in hand with Zuckerberg being removed as CEO, among other legislative and corporate reform.

“When we want to see a change in direction of a country, we have an election and we demand new leadership, not because that single person changes everything but because it’s a way of showing that we want something different,” Greer says. “Facebook practically thinks of itself as a country at this point, so Zuckerberg is essentially a king right now, and I think we need to bring down the king if we’re going to have a different type of kingdom.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.