When you use this new debit card from Aspiration, a bank that calls itself a “financial firm with a conscience,” you’ll get extra cash-back rewards when you shop at businesses that have been found to have the best sustainability practices and most employee-friendly policies.

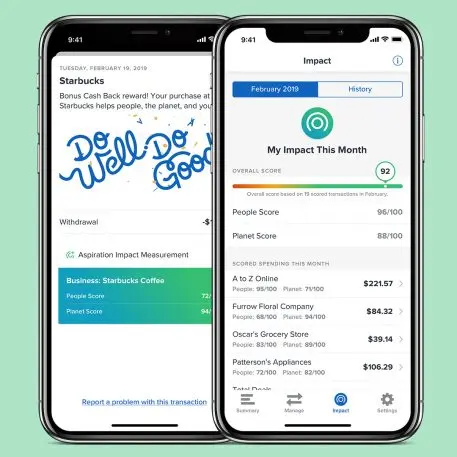

The bank already offered its customers a personal sustainability score, using tens of thousands of data points to rank businesses on issues like whether they’ve invested in renewable energy, or whether employees have access to healthcare–so as you shop, it’s possible to see how much of your money is flowing to companies in alignment with your values. But it wanted to go further. The result is the new Spend & Save account.

On any transaction, the account offers a half percent back–an unusual offering at a time when typically only credit card customers get cash-back rewards. But shopping at more sustainable businesses offers a 1% reward. In a year, the bank calculates, an average consumer will make $545.

The bank’s own investments also avoid fossil fuels. Big banks, according to a 2018 report from one nonprofit, invested more than $115 billion in coal mining, tar sands development, and other fossil fuels in 2017. (Here’s some tips on how to ditch your big bank.) Many customers come to Aspiration, Cherny says, because they’ve realized that “their own deposits are being used to fund hundreds of billions of dollars of extreme fossil-fuel projects that are destroying our planet.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.