Yesterday, Apple briefly halted trading and delivered news to investors that holiday sales weren’t as good as previously thought. In these revised expectations, Apple blamed slowing iPhone sales–specifically in countries like China–which ultimately led to weakened growth. Because of this and other factors, wrote Tim Cook, the company now believes it’s going to hit $84 billion in revenue in Q4, compared to the originally expected range of $89 billion to $93 billion.

As soon as the news hit, onlookers prepared for a swift Wall Street response. Moor Insights & Strategy principal analyst Patrick Moorhead told Fast Company that until Apple is able to regain double-digit growth, the stock price will very likely be affected.

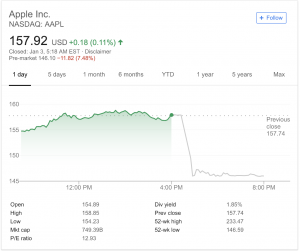

And though the markets haven’t opened yet, pre-market trading isn’t looking too good for Apple. The stock price is already down nearly 8% from what it closed yesterday–hovering at around $146. That drop alone caused the company to lose about $55 billion in its market capitalization.

It’s unlikely that Apple will suddenly announce good news today, so we should expect to see some poor stock performance. We’ll keep an eye out and see how low the price will go. Let’s just hope this isn’t an omen for 2019’s financial performance as a whole.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.