In the past 40 years, regular working Americans have barely seen their salaries grow, while around them, the cost of housing and basic needs have skyrocketed, as has pay for business executives. What’s behind this decline? Economists and political scientists often point to the decline of labor unions in those same years as a major contributing factor to the current environment of soaring business profits and meager worker salaries.

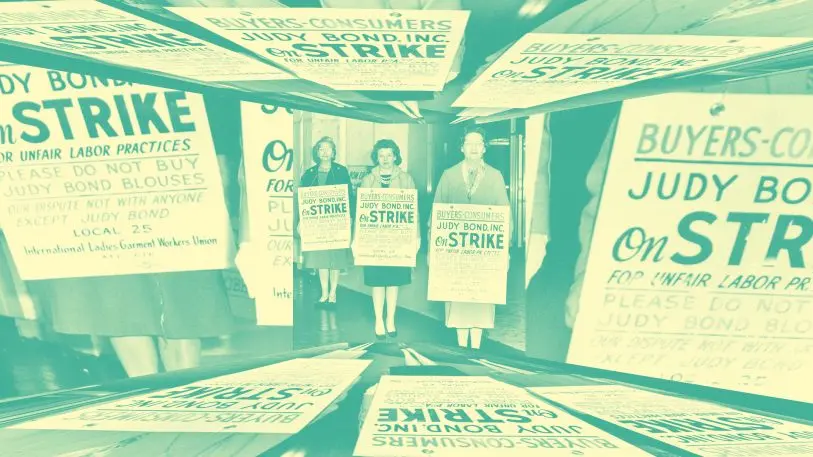

When unions were at their strongest before the 1960s, they helped narrow the gulf between worker and executive pay (which currently stands at 312 to 1), and lobbied for higher minimum wages and better access to health care. Researchers have also speculated that unions created positive spillover effects at nonunionized workplaces, where managers may have introduced higher salaries and better benefits in an effort to head off organizing efforts among workers.

Findings like these, however, tend to rely on cross-sectional population snapshots, rather than assessments of individuals over time. In other words: There was not sufficient evidence to prove that unions substantially improved individual people’s outcomes over the course of their careers. Absent that evidence, it became almost too easy to blame people’s current economic struggles on their failure to work hard enough, or pull themselves up by their bootstraps.

But in a new study, University of Illinois sociology professor Tom VanHeuvelen finds that unions created benefits for individual workers, and that their decline is directly responsible for the lack of cash in workers’ bank accounts.

“Unions are important for establishing and amplifying norms and values of egalitarianism; unions provide a dialogue about things like worker rights; unions fight for social policies that are broadly beneficial to everyday workers and normal people,” VanHeuvelen says. These are all macro benefits that have unraveled as unions have declined; that much is indisputable. But what VanHeuvelen wanted to find out was to what extent these benefits affected individual outcomes, and in his paper, he found what he calls “remarkably robust” evidence that the presence of unions created benefits over the course of an individual’s career, and conversely, the absence of unions creates barriers to success on a highly personal level.

To arrive at this conclusion, VanHeuvelen pulled data from the Panel Study of Income Dynamics, longitudinal study of over 18,000 individuals in over 5,000 families that began in 1968, which is currently the longest-running household panel survey. By working with data from individuals over time, VanHeuvelen was able to account for demographic factors like educational attainment, race, gender, geographic location, and industry-switching, which some economists argue have more bearing than the presence of unions.

“Typically, you hear people say that these benefits like higher wages are not the result of unions–it’s people’s inherent abilities or demographics, and if you could measure for those, you would find that union effects are smaller, or not there at all,” VanHeuvelen says. That assumption, he says, did not play out in his research.

To illustrate, VanHeuvelen zeroes in on the transportation manufacturing industry, which has seen membership rates decline from around 80% in the early 1950s to less than 20% today. “For folks working in that segment of the labor market, my studies suggest that the wage growth in their career would have been more reliable, and their wages less volatile, had the broader decline of unionization in transportation manufacturing not been so severe,” he says. “I found that to be true both for folks who are members of labor unions, folks who transition out of union jobs, and folks who were never in unions to begin with.”

He did find that the strength of the association between unionization and wage inequality diminishes somewhat–by around 50%–when individual worker characteristics are taken into account, “To suggest that the association between union decline and inequality would be not only robust, but immune, to such a bundle of factors is an unreasonable null hypothesis,” he writes in the report. Factors like race, gender, and educational attainment have an undeniable effect on people’s economic outcomes over time that unions do not necessarily flatten, but certainly helped to mitigate. For instance, macro-level data show that unionized workers, in general, see a wage boost of around 20%. When VanHeuvelen controlled for various demographic factors like race and geographic location, he tracked wage increases between 3% and 12.5% for union members. While union wage benefits tend to be overstated without diving into demographic particularities, he says, unions still associate with higher wages for workers across the demographic spectrum.

This diminished association at the individual level “should not be mistaken as an argument that union decline is unimportant for wage attainment and dispersion,” VanHeuvelen writes. Instead, these slight variances reflect broader, entrenched socioeconomic trends, and labor unions “do what they’re intended to do–raising wages, reducing inequality, and making wages across a person’s career”–within this greater context, VanHeuvelen says.

Despite the positive benefits for workers, the union decline is being cemented across all levels of government: The Supreme Court ruled in June, for instance, that public-sector unions cannot collect dues from nonunion employees (whom they also represent), in a case that will continue to diminish their power. And the fact that the teacher strikes earlier this year largely occurred in right-to-work states, where unions have been weakened, demonstrates the untenable conditions that often arise for workers when organized labor loses its grip.

His research, ultimately, brings these high-level trends down to the personal level. “If you look at typical working families now, there’s much greater attention paid to things like economic insecurity, not being able to plan for the future, not having enough money in bank accounts to smooth over negative life events,” VanHeuvelen says. “With the decline of unions and lack of institutional protections for workers, it makes sense that you would see these markers of economic instability and anxiety crop up.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.