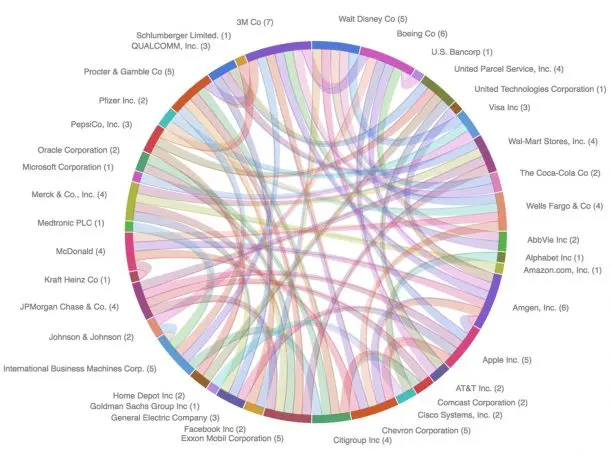

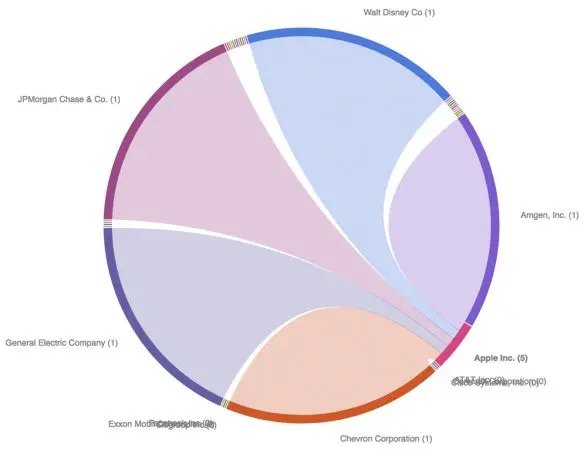

America’s corporate landscape is interwoven by a dense network of shared board members–for instance, Apple has board members that are also board members at Disney, Chevron, Amgen, GE, and JP Morgan Chase. The data analysis expert Erik Rood used publicly available information from the S&P 500 top 50 to create an unusual map of these connections, resulting in this interactive graphic that lets you explore the network in unprecedented detail.

Rood, who is also the founder of Data Interview Questions, a site focused on helping data scientists and analysts prepare for interviews at top companies, sorted the top 50 companies in the S&P 500 by market capitalization using public information from Reuters. In the visualization, each colorful tentacle indicates one shared board member between companies. 78% of the top 50 companies in the S&P 500 are directly connected through one or more board members, Rood concludes. “The number of connections gets much larger when you expand the scope beyond 50 companies or expand to second and third-degree connections,” he says, “but it becomes pretty difficult to fit into any sort of visualization.”

This connectivity can be positive for companies, since board members can bring good practices from one to another or facilitate deals that may benefit both. For instance, Steve Jobs being on the board of both companies likely played a major role in Disney becoming the first company to bring movies to iTunes. The Harvard Business Review also suggests that interlocking can help companies respond to economic crises.

However, as Paul Hodgson explained in 2012, this interweaving of board members can have very negative consequences. According to GMI Ratings–which publishes research on environmental, social and governance practices at corporations–there’s a clear link between corporate board interlocks and bad practices, including “egregious retirement/consultancy agreements for CEOs,” along with “excessive pay for failure” and option backdating. “What is needed here is awareness, transparency, knowing about the interlocks,” Hodgson concluded.

Another issue? People with hands in different pots have a tendency to mix things that shouldn’t be mixed. Google’s Eric Schmidt had access to privileged information about the iPhone when he was a member of Apple’s board of directors–which, according to Steve Jobs, gave Google’s Android an unfair boost, negatively impacting Apple’s smartphone market share and bottom line. Needless to say, it can have serious adverse effects on employees, too. In 2011, 64,000 employees accused Adobe, Apple Inc., Google, Intel, Intuit, and Disney subsidiaries Pixar and Lucasfilm of using “no poaching” agreements that squashed competition and drove down wages. The complaint zeroed on companies controlled by Steve Jobs and “companies that shared at least one member of Apple’s board of directors.”

Eventually, Apple, Google, Intel, and Adobe agreed to pay $415 million to settle the case in 2015.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.