Broadcom’s dream of dominating the mobile chip business by taking over Qualcomm is apparently dead. The White House issued a statement late on Monday:

“The proposed takeover of Qualcomm by the Purchaser is prohibited, and any substantially equivalent merger, acquisition, or takeover, whether effected directly or indirectly, is also prohibited,” according to the order describing the findings of the Committee on Foreign Investment in the United States (CFIUS).”

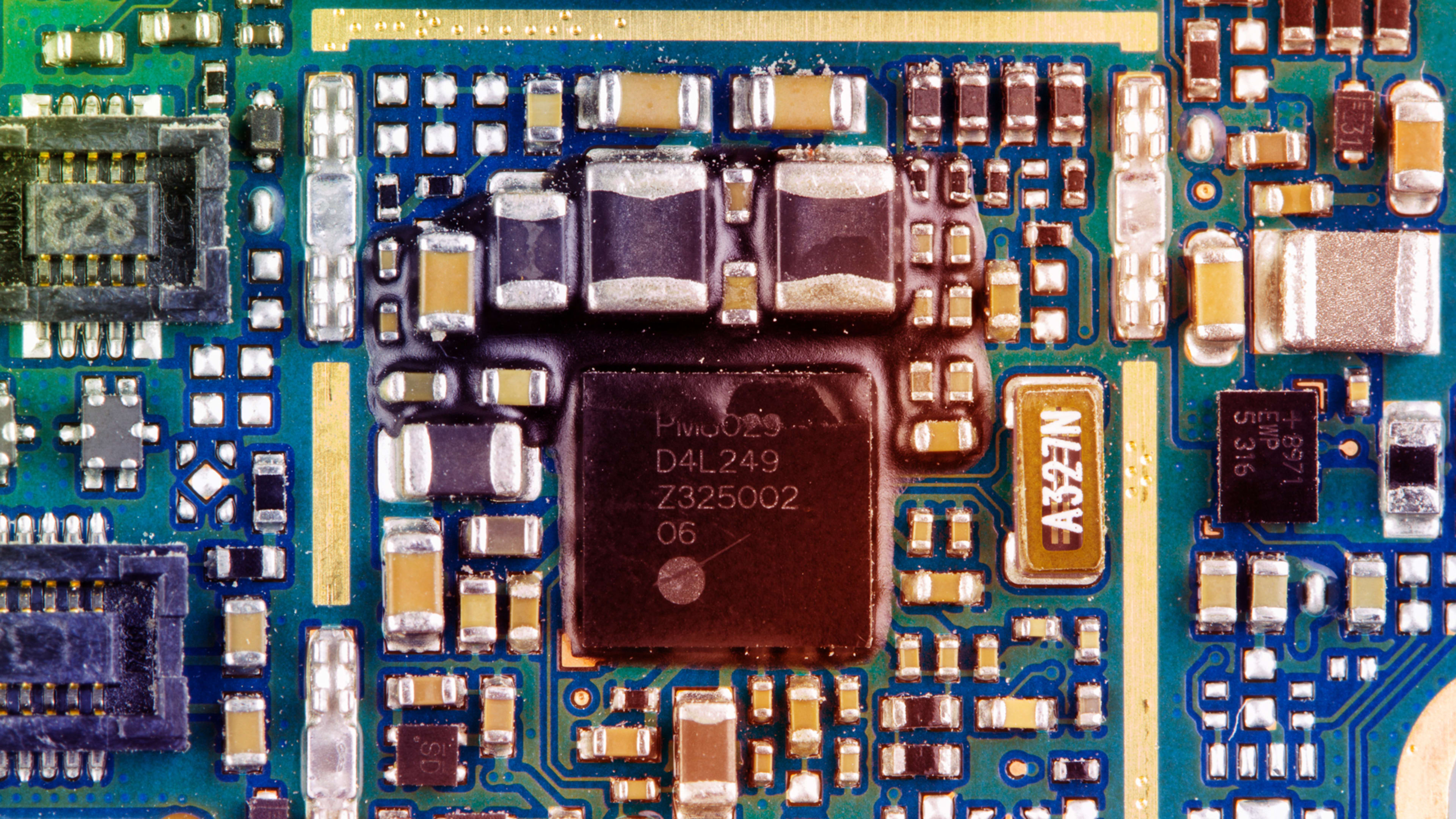

Broadcom’s quest involved bids of $103 billion, $121 billion, and $130 billion–all rejected by the Qualcomm board, which insisted Broadcom was undervaluing the San Diego-based company’s business. During early 2018 Broadcom began trying to persuade Qualcomm shareholders to support a hostile takeover.

Broadcom downplayed chances that the CFIUS investigation (which began last week) might disrupt a potential deal. But news came early Monday that the committee had already sent letters to both Broadcom and Qualcomm hinting that it was leaning toward recommending against the acquisition for national security reasons.

“It appears CFIUS either found some disturbing things in its investigation or the administration sees [Qualcomm’s] technology leadership in 5G and beyond as important to national security,” said Moor Insights & Strategy principal analyst Patrick Moorhead in an email to Fast Company. “Broadcom would have likely dismantled Qualcomm’s long-term investment in wireless, so the block is understandable.”

Broadcom–which was formerly known as Avago and adopted its new name after buying the original U.S.-based Broadcom in 2016–is based in Singapore. But it announced at a splashy White House event last November that it planned to move its headquarters to the U.S. At the time Donald Trump took credit for the planned move (and the jobs it might create). But Broadcom CEO Hock Tan’s real goal was apparently to smooth the road for its hoped-for acquisition of Qualcomm. Oh, well.

By 8 p.m. Eastern Time, Qualcomm’s stock price had dropped 4.47% in after-hours trading on the White House’s statement.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.