Spotify moved forward on Wednesday with plans for its unusual IPO by filing for a direct listing on the NYSE. The Stockholm-based music-streaming service, last valued at $19 billion, will trade under the ticker symbol “SPOT.”

As part of the filing, Spotify reported financials that show it is growing, but still unprofitable. In 2017, the company earned €4.1 billion ($5.01 billion) in revenue, but posted a €1.24 billion loss. The year prior, it made nearly €3 billion, but lost €539 million.

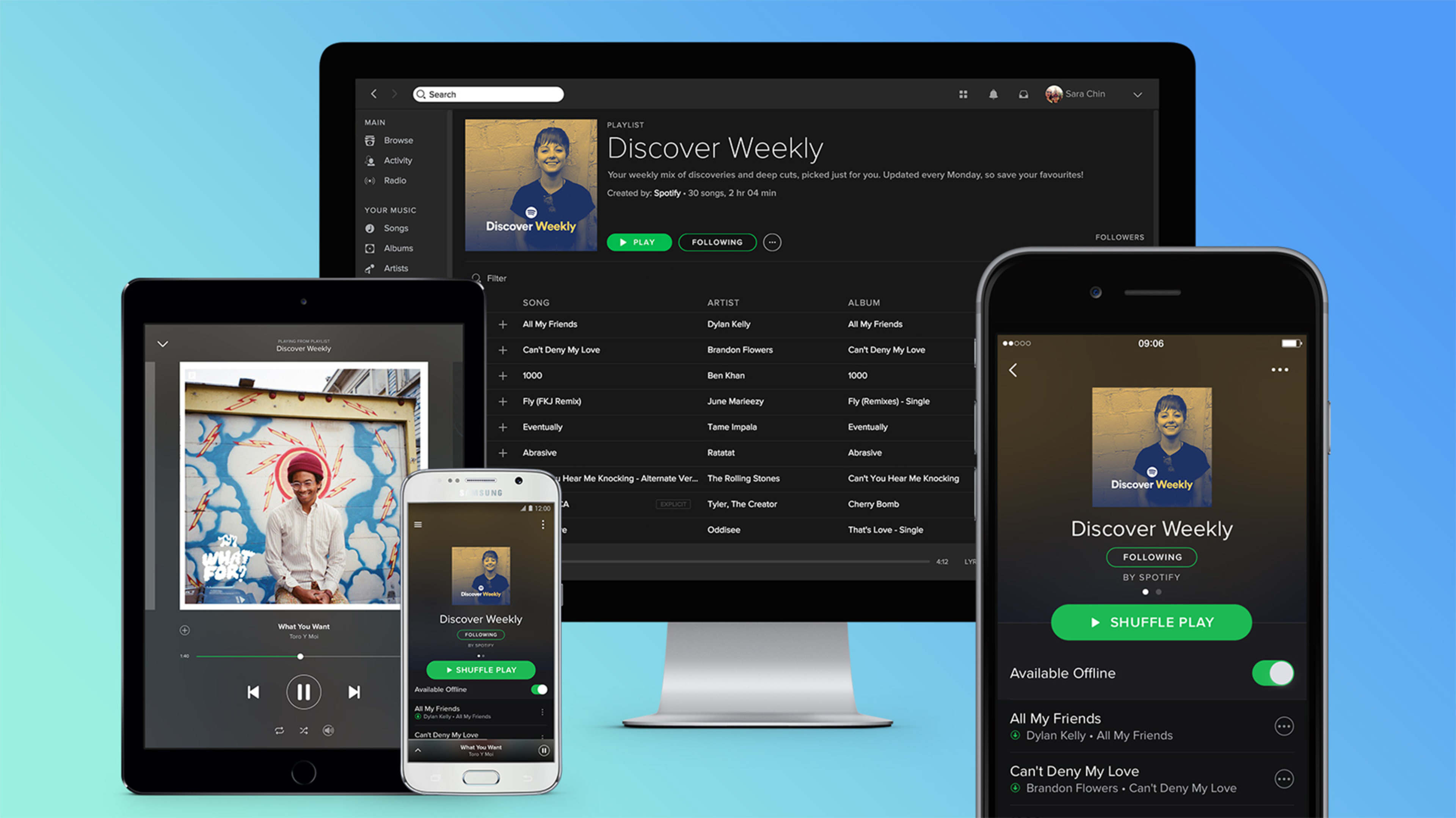

Spotify’s mission, the company writes, is to give “creative artists the opportunity to live off their art and billions of fans the opportunity to enjoy and be inspired by these creators.” But for now, its fans number in the tens of millions. As of December 2017, Spotify had 71 million paying subscribers, and 159 million monthly active users overall. Europe remains the company’s largest market, comprising 37% of its user base.

In choosing to IPO via direct listing, Spotify eschews the roadshow and pricing process that accompanies traditional public offerings. Spotify will save on banker fees, but will face potentially greater volatility during its initial trading window.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.