In the three years since its launch, micro-savings app Digit has helped its customers set aside over $1 billion for emergency funds, travel, and more, the company said today. The average Digit customer earns around $50,000 per year and is saving around $2,500 per year.

Founder and CEO Ethan Bloch attributes the company’s success to its reframing of savings as a tool for specific life events, rather than an abstract financial instrument. “I don’t need a ‘savings account,'” he says. “I need a thousand dollars when my car breaks down or someone in my family gets sick or I’m going on this trip.”

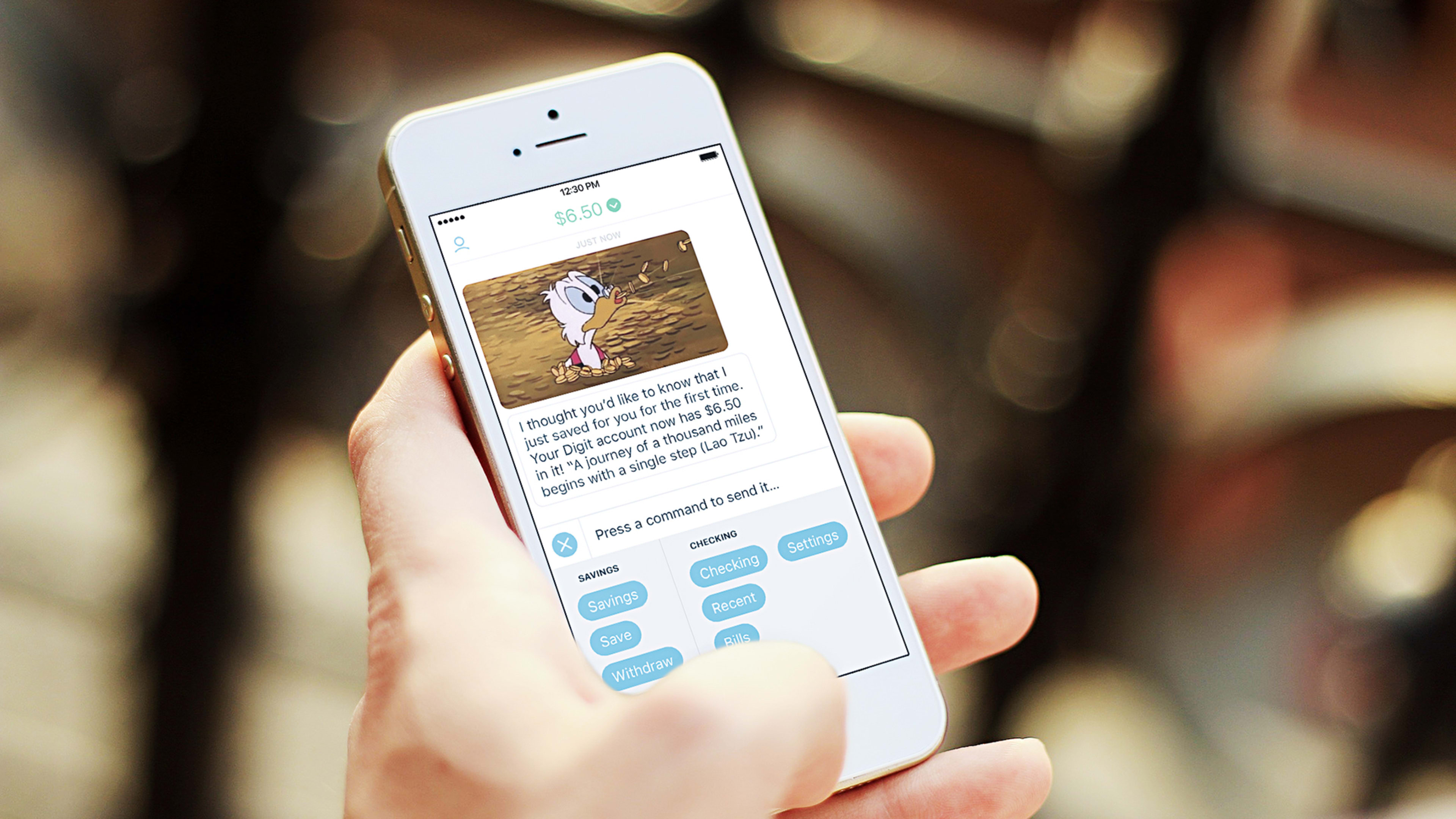

Like Acorns, its primary competitor, Digit orchestrates the creation of customer savings by operating in the background. The company plugs into customers’ checking accounts and analyzes their spending behavior; over time, it automatically transfers small-dollar amounts to a Digit-managed account on their behalf. (Customers are allowed to establish goals and access their Digit funds whenever they choose.) Last July, Digit started charging customers $2.99 per month for the service.

So far, that fee has not had an impact on Digit’s growth. But new entrants, like SoFi Money, are mimicking aspects of Digit’s offering and bundling automated saving into broader financial offerings. To survive as an independent company, Digit may have to follow suit.

Digit is already exploring products that would help customers manage their debt, Bloch says. Using what it knows about customers’ personal balance sheets, Digit hopes to help customers prioritize their debt payments, and make extra payments when possible. “Where we’ll start is just helping folks make progress against the debt that seems insurmountable,” Bloch says. Down the road, he may also explore refinancing products.

Digit, based in San Francisco, has raised $36.3 million in venture funding.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.