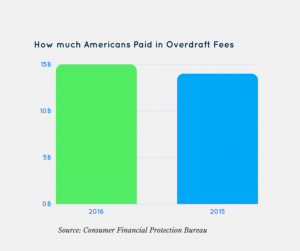

Overdraft fees have become big business for big banks. Last year, banks and other financial institutions charged Americans $15 billion in penalties for accounts with insufficient funds, according to a report published on Friday by the Consumer Financial Protection Bureau. In 2015, banks charged their customers $14.7 billion. Consumers who incur frequent overdraft fees—defined as more than 10 charges per year—tend to be financially vulnerable, with an average credit score of less than 600 and an average end-of-day balance of around $300. Over the span of a year, at a typical rate of $34 per zero-balance, they end up paying $450 or more in fees. Most overdraft fees are for low-value transactions. The median transaction size, the bureau says, is just $24.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.