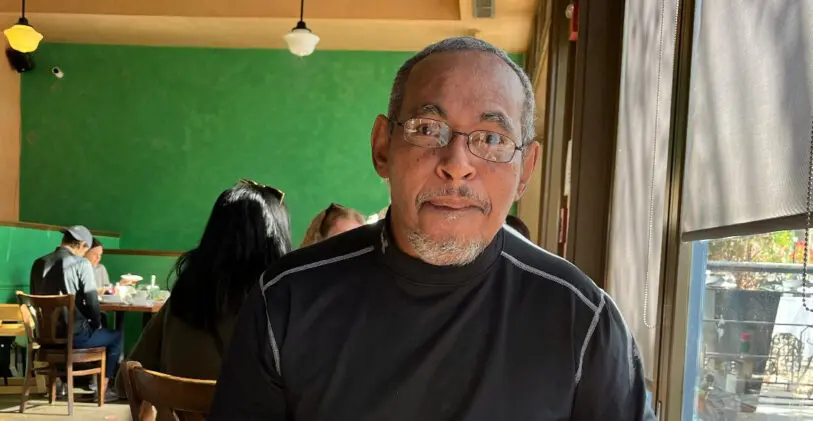

When he moved into a unit in a Kansas City apartment complex six years ago, Harvey Nash didn’t expect his rent to be raised annually. Now he struggles to pay the bills; over the last couple of months, Nash has been putting as much as he can toward rent, but he says “it wasn’t nearly what they were asking for.”

Earlier this year, his landlord tried to evict him, and though Nash won in court, he doesn’t know how long he’ll be able to stay. “I don’t even want to think about moving,” he says. “I didn’t move in here to get priced out.”

Nash’s story is far from unique: His landlord, a large company called Landmark Realty that owns thousands of apartments across the country, relies on rent hikes to make its business model work. The California-based realty company bought the building with a loan backed by Fannie Mae, the government-sponsored mortgage enterprise. Now housing advocates, including Nash, argue that landlords with federally backed loans should be forced to offer tenants more protections. And the Federal Housing Finance Agency is considering the idea.

“The nature of the rental market has changed significantly in the last decade,” says Tara Raghuveer, who leads a broader “Homes Guarantee” campaign at the community organization People’s Action. “In particular, the corporate buyer of housing has created near-monopolistic elements in the current rental market where a small set of landlords are price setting—and we would argue price gouging—based on the kind of desperation that they know tenants are facing in the market, and also based on the fact that they bought up rather huge shares of the market.”

That includes both larger apartment buildings and single-family homes, which institutional investors began buying in large numbers after the 2008 financial crisis. Some state lawmakers are considering action; in Minnesota, for example, where the number of homes bought by investors has surged, one proposed bill would ban corporate landlords from converting single-family homes to rentals. But People’s Action and other advocates (and some politicians, like Elizabeth Warren) argue that federal action is also necessary.

“When we talk to the Feds about housing policy, they often say the housing market should be regulated at the state level or the local level,” Raghuveer says. “Our response to that is that actually it’s been a long time since landlords functioned as local and state-based entities. Most of the biggest landlords in this country have operations that extend well beyond state boundaries. And so there is a role for the federal government to play in regulating this market much more practically than it has.”

The group previously pushed for the Biden administration to create a Renter’s Bill of Rights, a white paper that outlines the need for more affordable housing and eviction prevention, though People’s Action says that it doesn’t go far enough.

Now, as the group focuses on federally backed loans, it’s arguing that every dollar of federal financing should come with strings attached. Protections for renters could include regulations that address evictions, rent hikes, safety requirements, and bans on discrimination.

Fannie Mae and Freddie Mac purchase $150 billion in mortgages for multifamily buildings each year (they don’t offer mortgages directly, but buy them from other lenders, taking on the risk). If new regulations can be put in place as a condition of the financing, it could affect more than 12 million apartments and rental houses.

Making sure that everyone has access to housing should be a top priority for the government, Raghuveer says, noting, “The industry will say if you introduce all these regulations, it’ll fundamentally change the market, right? And our response to that is, that’s the point. The market today is really only benefiting a select few profiteers who have structured the market to benefit them. A story of [millions] of tenant households across the country unable to pay the rent every month is not a story of market success; it’s a story of market failure.”

This spring, the group brought tenants to Washington, D.C., to meet with the director of the Federal Housing Finance Agency and share their stories. Now it’s planning to organize thousands of tenants to offer comments on the agency’s request for information about what Fannie Mae and Freddie Mac should do. You can submit a comment through People’s Action here.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.