The startup community is still reeling after the collapse of Silicon Valley Bank. The California-based lender was taken over by the Federal Deposit Insurance Corp. late last week after several VC firms advised companies they invest in to pull funds from the bank, leading to a bank run.

On Monday, the bank resumed business with a new CEO as Silicon Valley Bridge Bank, as it continues to look for a buyer. In addition to providing banking services for many tech startups, SVB was also the largest issuer of venture debt. According to a report by The Information, SVB had about $6.7 billion in loans to early- and mid-stage private companies in 2022. For startups, several big questions still loom: What will happen to SVB’s clients with venture debt? And what will its collapse mean for this important source of funding? Here’s what you need to know.

What is venture debt?

Venture debt is a type of loan typically offered to early-stage, high-growth companies from specialized banks or lenders. It’s a common funding method for startup companies that are fast-growing but not yet profitable.

What’s the difference between venture capital and venture debt?

With venture capital, companies raise money from investors, commonly in exchange for a sizable portion of equity in the company.

Venture debt on the other hand is a loan with a bank or financial institution. It’s often raised around the same time as equity funding to extend the company’s runway or can be used as a bridge to provide needed cash between equity funding rounds. Unlike traditional business loans, venture debt usually includes an “equity kicker” that gives the lender the ability to obtain shares in the company later if it gets sold or goes public.

What are the pros and cons of venture debt?

One upside to using venture debt is that it gives companies working capital to grow without having to give away much equity. Taking on venture debt also allows companies to raise money without setting a new valuation. That’s particularly handy if the potential value of the company may have dropped, allowing companies to avoid a down round that would dilute the equity of founders and existing shareholders.

One big downside to venture debt is that, unlike equity financing, it needs to be repaid—with interest. Investment is also typically tied to specific business plan milestones, which can be more restrictive than with equity financing.

What will happen to venture debt loans from SVB?

Silicon Valley Bridge Bank’s new CEO, Tim Mayopoulos, says the bank has resumed its deposit and lending services, even as it continues to seek a buyer. Until then, VCs and founders are in limbo over what will happen with venture debt. Private-equity firms such as Blackstone, Apollo Global Management, Carlyle Group, and KKR are reportedly looking to buy pieces of Silicon Valley Bank’s $75 billion loan portfolio.

What does this mean for the future of venture debt?

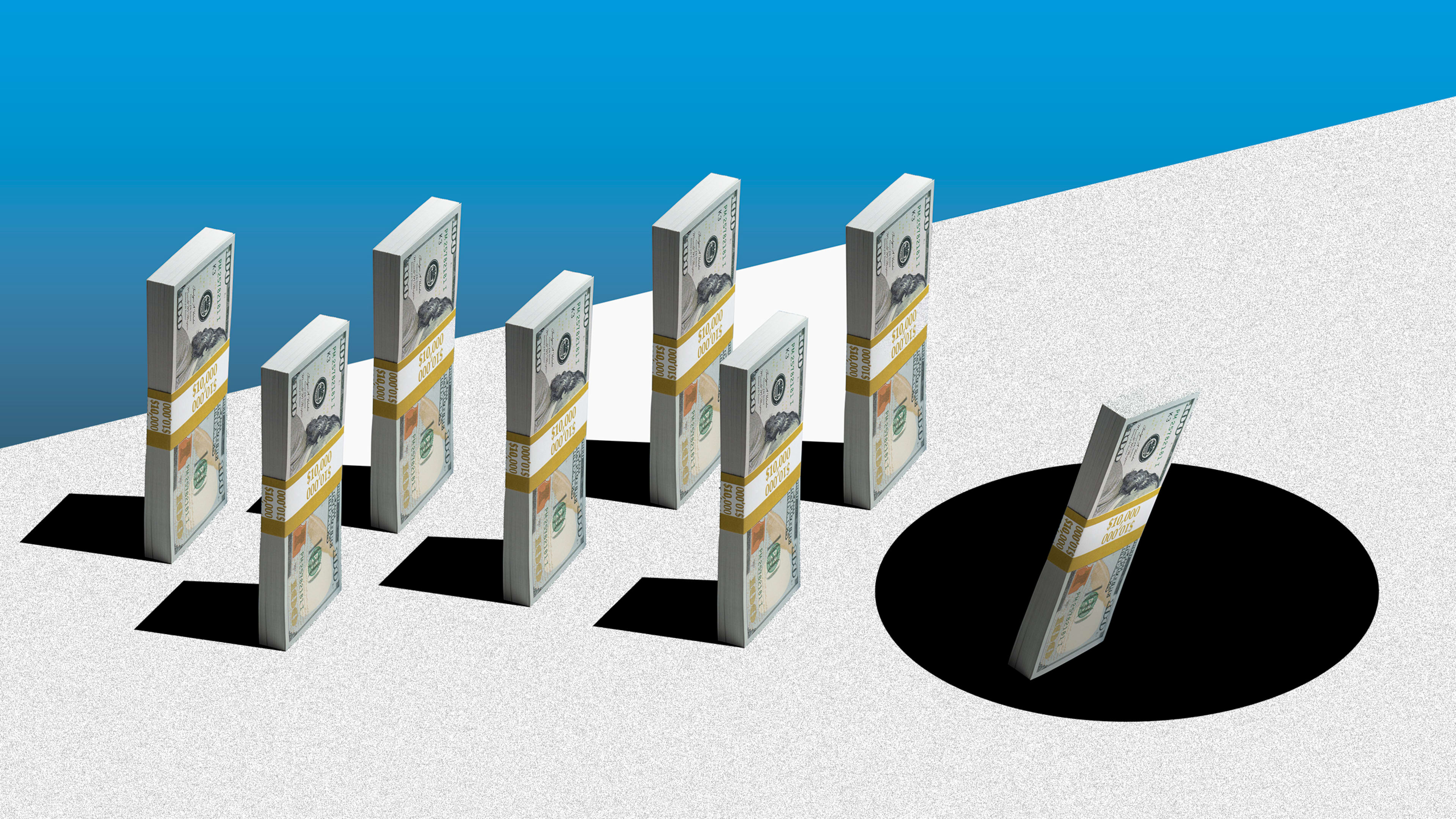

The use of venture debt has increased over time, recently reaching $26.5 billion in value over 2,419 deals at the end of November 2022, according to PitchBook. And SVB’s collapse could have long-lasting effects on the future of venture debt. Not only was SVB the largest venture debt lender, but it also offered attractive rates to risky startups. With SVB likely to be sold to another bank, many predict it will be harder—and more expensive—for startups to gain access to capital.

Valuations could also be affected, notes Spencer Ante, the former head of insights at Meta and author of Creative Capital: Georges Doriot and the Birth of Venture Capital, in an article for Fast Company. Already companies like Stripe are reportedly seeing lower valuations when raising new rounds of VC funding. “The declining access to capital brought about by the demise of SVB and the chill it’s brought to the venture debt space,” he writes, “will mean VCs have more leverage to drive down valuations.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.