“When I first started collecting cards, it was strictly to get the gum inside,” Derek Jeter tells Fast Company.

Over the years, the MLB hall-of-famer has had more than enough to chew on—evolving from novice collector to appearing on countless cards himself during his 20-year career as a Yankee shortstop.

“It’s surreal. Growing up, you always dream about having your own card one day,” he says. “When you actually see it, it’s hard to believe. Then you’re nitpicking on how you look, what you’re doing on the card, and what you would change.”

With Jeter’s latest venture, Arena Club, the baseball icon sets out to dive into the $13-billion-dollar sports trading card industry at a moment when this analog pastime is in flux.

“As with any market, the trajectory can’t only go up and the market will see some corrections, which this market is currently experiencing in some sectors,” says Chris Ivy, director of sports auctions at Heritage Auctions. “Some aspects of the market are seeing much sharper corrections than others, and some portions of the market are still seeing significant gains. For example, the modern card market is much more speculative and investment minded, and some of the key modern cards have seen auction results down as much as 70 percent from the record highs. However, key vintage cards are supported by longtime collectors and have only seen declines in the 10 percent range from the peaks, if at all.

“With that said, the market remains incredibly vibrant and resilient, and Heritage set many auction records for sports cards in our January catalog auction that closed last week,” Ivy says. “We have also seen rare memorabilia continue to show strong world record results as many collectors feel that the price gap had become too wide between sports cards and the memorabilia in the market.”

The industry was one of the first to embrace NFTs, which drove dramatic growth—at least, for a short while.

“I think we’re at a crossroads,” says Ty Wilson, a collector since 1997 and host of the web series Chasing Cardboard . “The heart of collecting sports cards really goes back to community… You don’t experience any of that community piece of it on the NFT side. And I think that’s where the heart and soul of it—that’s not connecting very well. How does the community piece stay relevant with NFTs? No one’s figured that out.”

Last year, Fanatics, the sports apparel company, acquired Topps and struck deals with the NBA, the NFL Players Association, and Major League Baseball—culminating in the release of a Lou Gehrig NFT that reportedly sold to Tyler Winklevoss for more than $70,000.

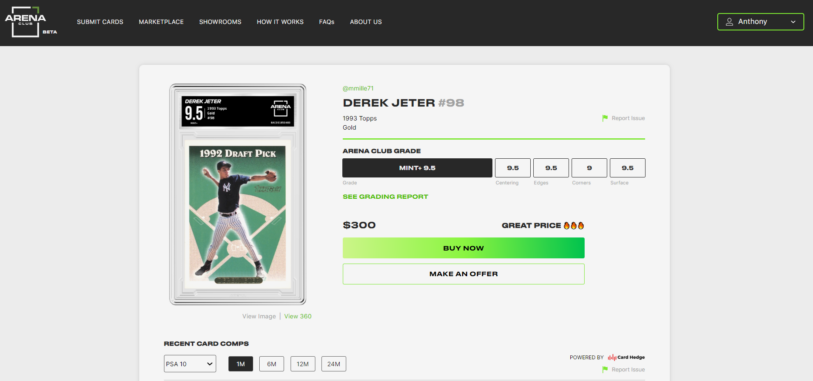

Though the market for NFTs has cooled since then, the team behind Arena Club—which includes cofounders CEO Brian Lee and CFO/COO Jesse Glass, along with Jeter—is betting that growth will resume. And their strategy is to bet on the sector, by launching a virtual marketplace that went live late last year. Offering card storage facilities and online showrooms for collectors to display and grade their collections, Arena Club is an open forum for instant buying, selling, trading, and window-shopping, with all transactions recorded using the blockchain.

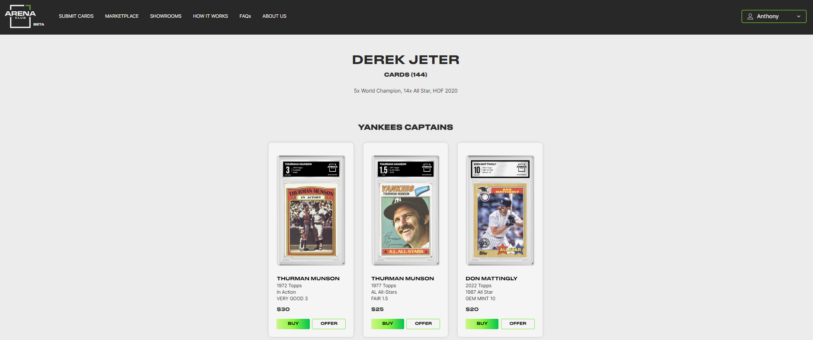

“As children, our friends came over to our homes, and we would bring our cards out of shoeboxes from our closet and spread them out on the table to show them off and trade,” says the five-time World Series Champion. “Arena Club is bringing that to life using today’s technology.”

Expected to grow $6.71 billion by 2026, the global sports trading cards market has boomed, with a recent string of high-profile sales spiking all-time auction highs.

“It almost seemed like the trading card space was a secret society where people were whispering that they traded cards,” says Jeter. “Now it’s just come to the forefront—they’re singing it from a mountaintop because the industry continues to grow.”

In what feels equally forward-thinking and nostalgic, Arena Club has procured around 20,000 cards into its system since September, which have an overall marketplace value of approximately $8 million. Arena Club has secured total funding so far of around $20 million with a recent $10 million round led by venture capital firm M13, with Defy.vc, Elysian Park Ventures, Lightspeed Venture Partners, and BAM Ventures also participating.

“The industry is ripe for a little bit of disruption. So what we’re doing is digitizing the physical and bringing the excitement of walking into a card show or even a card shop and having that experience of discovery and connection with other community members,” explains Lee, whose own virtual showroom features cards from iconic sports heroes like Normie Kwong, the first Asian Pro footballer from the 1950s, Michelle Kwan, and Yao Ming.

While the Arena Club concept has been percolating in Lee’s mind for many years, timing has been crucial.

“I don’t think Arena Club would’ve been possible before the blockchain came to fruition and how it exists today,” he says.

For Jeter, who first connected with Lee after retiring from his playing career in 2014, the Arena Club concept hit home on a personal level.

“I wish it had existed about 20 or 30 years ago. There was a flood at my parent’s house in Michigan, and I had many of these valuable cards in large doses that were ruined,” says Jeter. “We started having a conversation, and I could tell how passionate Brian was about the space—it was a perfect match.”

The pair hopes to create audience engagement driven by joy rather than the purely transactional. “We’ve had a lot of growing pains just making sure that the foundation is set and will last for generations,” says Lee, noting the popularity of the platform’s free card-for-card trading feature. “It has surprised us that there’ve been more trades than sales on the platform showing that the people are coming in and really engaging and interacting with each other and within the community.”

Gaining the trust of the trading world has always been top of mind. To counterbalance the fraud-related problems that have historically plagued the industry, Arena Club has created an intricate system that offers grading reports to show imperfections of any card, with all trades and sales rerecorded on the blockchain, providing the authenticity and provenance of the card.

“We are bringing as much transparency as we can to the industry. It gets very granular and has never existed in this hobby before we brought it to the forefront,” says Lee, whose own Steve Garvey rookie card was graded a 2.5 out of 10. “I guess I didn’t take care of it that well,” he quips.

Since hanging up his number 2 jersey, Jeter, who has amassed a net worth around $200 million, has swiftly dug his cleats into various business endeavors. Aside form a four-season stint as the CEO and shareholder of the Miami Marlins, his investments include Bespoken Spirits Whiskey, the cloud-based video conferencing startup Blue Jean Networks, the multi-channel video company Whistle Sports Network, and the sports-media platform, The Player’s Tribune (which he sold in 2019) and the athletic wear line Greatness Wins he launched last year with UNTUCKit Founder Chris Riccobono, dancer Misty Copeland, and Wayne Gretzky.

Jeter’s approach to victory off the field has always mirrored that of his playing days.

“I get asked a lot about the similarities between professional sports and business—it’s all about teamwork and having the right people with shared goals, work ethic, and passion. Anything you’re successful in all starts and ends with the people you surround yourself with,” says Jeter, who also sits on the board at Rockefeller Capital.

Lee echoes that sentiment. “Ideas are a dime a dozen. It’s the team that executes and performs them that ends up winning in the end,” he says. “Like sports, it’s the desire to work hard to build something fantastic together.”

Building a team with a like-minded passion for Arena Club’s mission is vital to its success. Warren Laufer, Vice President of Business Development, who joined the roster last year, started selling baseball memorabilia as a teen and has now sold more than $3 million. As a junior partner at Mint 10, a fund dedicated to investing in sports-collectibles-focused startups and collectibles themselves, he brings a keen eye as an experienced collector himself.

“I got into collecting because I wanted to be close to the games I loved and the players I idolized. That passion is contagious when I work with customers,” says Laufer. “When someone spends their hard-earned money on something, I want to do everything in my power to make that a good experience for them, so that they want to do it again,” the recent Forbes 30 Under 30 recipient elaborates further. “I’ve had plenty of product mistakes and customer service hiccups, but keeping focused on treating customers how I would want to be treated has helped me maintain long-term relationships with big spending customers.”

As Arena Club continues to write new rules for an industry that has yet to see extensive change over the past century, there is a careful and critical approach not to alienate the existing guard while harnessing a new one.

“What we are doing is brand-new and unknown and requires changing consumer behavior. However, as we push boundaries, we must always be grounded in what is best for collectors,” says Laufer. “Traditional collectors have an established way of doing things, but we have already seen so many of them fall in love with our platform, so we are confident in what we are building.”

Increased awareness of our belongings and their value during the COVID lockdowns helped to instigate a recent boom in the collectible industry—with sports card sales treading at all-time highs.

“The pandemic not only motivated people to sit down and think about all their stuff but there was time to reminisce about past experiences,” says Jeter, finding that people often have very different emotional reactions to the same card. “It’s all individualized. They bring back these personal memories. For instance, a Don Mattingly card may remind you of when you went to Yankee Stadium as a kid. Unfortunately, we missed many of those experiences because of the pandemic.”

Last August, a 1952 Topps Mickey Mantle card sold with Heritage Auctions for $12.6 million. It became the most ever paid for any sports item, card, or memorabilia, superseding the recording-breaking $7.25 million sale for a 1909 T206 Honus Wagner card, which sold only a few weeks prior, and the $6 million sale for Babe Ruth’s 1914 Baltimore News pre-rookie card in 2021.

“Momentum will continue, especially with vintage cards. The overall industry peaked during COVID, and it has come down since. So many folks looking for quick bucks have disappeared, and I think the hobby is in a much healthier place today,” says Lee, affirming Arena Club is for collectors who are in it for the long haul. “We’re looking for community members who are very passionate about the industry. We’re not looking for those just looking to buy and sell quickly.”

While the pandemic and the macroeconomic landscape have played a role in “overheating” the marketplace, Laufer stays optimistic by examining the past ebbs and flows of the trading card market and what can be assessed from the mistakes of the hobby’s past.

“When you look back at some of the innovation that happened in the late 1990s and early 2000s, you find that the industry probably stayed dormant after the ‘Junk Wax Era’ longer than it might have otherwise,” he says, referencing an infamous period between 1986 to about 1993, where a previous gold rush of interest and sales led card companies and leagues to overproduce and overlicense, causing an oversaturation in the market.

“So many young collectors got caught up in a bubble in the 1980s that they had no interest in returning to the hobby when it began to heal. I see the industry like a bungee cord that was held back. When it was finally let go, it jumped ahead further than it should have and had to fall back to equilibrium,” says Laufer. “The passion is still there, and high-end collectibles are still selling for prices that would have been unbelievable a few years ago.”

Arena Club founders says they will use the new round of funding to hire staff, add more functionality and social components to the website, and host a series of promotional events.

“We’re super excited. We all know where we’re headed during this period in a macroeconomic sense,” says Lee, as the threat of an impending recession remains alive. “To shore up our capital base right now puts us in a very strong position moving forward into this time of uncertainty.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.