Congress is finally moving this week on the Inflation Reduction Act, a bill that could drive a 40% reduction in carbon emissions over the next decade. But another government arm, the Nuclear Regulatory Commission, made its own (far quieter) news this month when it gave final certification to a new kind of nuclear reactor called a small modular reactor (SMR). While the announcement received basically no fanfare, proponents say it could play an important role in decarbonizing the world’s energy supply.

The agency first performed a safety review of reactor company NuScale Power’s SMR design in 2020. A year later, the NRC completed its standard rulemaking process, which included a review of public comments. On August 2, the commission issued a final approval for the SMR, though NuScale says it’s unlikely to become operational until 2029.

Technically, nuclear power is capable of delivering large amounts of emissions-free power. In fact, with 93 commercial nuclear plants around the country, nuclear fission already produces about 55% of all carbon-free power in the U.S., and yet it constitutes only about 19% of the country’s overall power supply. (See below for a map of the US’s nuclear plants.) Fossil fuels still account for an astounding 63%.

And nuclear contribution to the overall energy sector is diminishing, due to safety concerns and high costs, especially compared with declining prices in solar and wind. The Energy Information Administration has projected that the share of all electricity generated from nuclear power in the U.S. will decline from 20% today to just 12% by 2050. Disasters at large gigawatt-scale plants, including Three Mile Island (1979), Chernobyl (1986), and Fukushima Daiichi (2011) continue to fuel public misgivings about nuclear power. Explosions at Europe’s largest nuclear plant—in the Ukrainian city of Enerhodar, currently occupied by Russian forces—prompted renewed fears that Russian rockets could unleash a nuclear catastrophe.

But over the past two years, nuclear has been getting a serious second look from many people in the scientific and policy communities. They believe a new generation of reactors, including smaller and safer ones, could remake the image of nuclear power and clear the way for the technology to play a bigger role in achieving a carbon-free future.

“I am cautious to say those five dangerous words: Something is different this time. But It feels like a zeitgeist is changing with growing public support and positive regulatory attention,” says Josh Wolfe, a partner at the science-focused VC Lux Capital. “If we really want to reshape and green our energy supply, the single smartest thing to do is build more of the elemental energy plants (formerly known as nuclear) we already have producing clean, zero-carbon electricity.”

A slow march toward a nuclear future

Rising temperatures, rising fuel prices, and rising demands for energy independence have recently prompted some to reconsider their nuclear retreats. South Korea is resuming construction on two reactors, Japan plans to restart four reactors this year, and Germany is considering extending the life of three formerly left-for-dead plants. In California, Governor Gavin Newsom is reconsidering his decision to close the state’s last nuclear plant, which provides 9% of the state’s electricity.

Like most of the world’s reactors, these are huge, complex, and based on decades-old designs. Yet smaller, modular nuclear reactors have been the subject of speculation and research for many years. They fit into the category of “advanced nuclear” power technology, which the Department of Energy has identified as a key tool for decarbonizing the country’s energy supply.

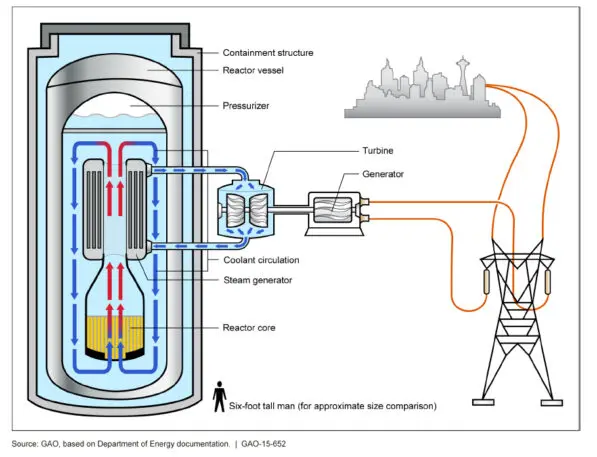

While traditional nuclear power plants are built on-site, SMRs can be built in a factory and shipped to a facility for deployment. They use smaller amounts of radioactive material, which makes them easier to cool and secure—and lessens the potential damage of a leak.

In contrast to current gigawatt-scale reactors, the DOE defines SMRs as reactors that can produce up to 300 megawatts. NuScale’s pressurized water reactors, which look like oblong tubes and are 65 feet tall and 15 feet in diameter, can generate about 77 megawatts of electricity each. (For reference, an energy industry rule of thumb is that 1 megawatt is enough to power 1,000 households, although this varies widely among homes in colder and warmer parts of the country.)

An energy producer can seat up to 12 of the NuScale reactors together at one site, for example, to produce up to 924 megawatts of power. The reactors sit together in an underground cooling pool. In the event of power failure, the reactors automatically shut down and self-cool. This passive, operator-free safety approach is already in use in some conventional reactors, as well as in dozens of proposed SMR designs, from thermal-neutron and fast-neutron to molten salt and gas-cooled reactors.

NuScale’s is the seventh reactor design and the first SMR to be approved by the Nuclear Regulatory Commission, although the agency is in the early stages of reviewing other SMR concepts. (The Tennessee Valley Authority is preparing to apply to the NRC for initial certification of a new SMR by GE-Hitachi on the site of an old coal plant near Oak Ridge.) Getting approval is a painstaking process. According to NuScale, it involved more than a quarter million review hours, “about 2 million pages of documentation made available for review or audit, and about 100 gigabytes of test data.”

So far, only one reactor design, Westinghouse’s AP1000, a conventional pressurized water reactor, has progressed to construction in the U.S., with two now being built at the Vogtle plant in Georgia. After long delays and cost overruns (construction was originally planned to conclude in 2017, and the cost has ballooned to more than $30 billion) the Vogtle plant recently received approval from the NRC to start fuel loading and head toward operation.

As with any new nuclear project, further cost overruns—or one accident—could set the industry back even further. Proponents of SMRs are banking on catapulting the industry forward.

SMRs’ contested role in decarbonization

While the nuclear industry has gotten behind SMRs, and companies like NuScale have attracted considerable investment, the technology still faces skepticism.

“It’s a solution in search of a problem,” says Edwin Lyman, director of nuclear power safety at the Union of Concerned Scientists. “[The nuclear industry] is looking around for something new to show that it’s not just going to try the same old things, but its options are fairly limited.”

Lyman says the economics of SMRs don’t make sense. “If you shrink down the reactors, it goes against the economies of scale that you get with larger reactors.”

As a result, Lyman predicts, energy providers will be forced to find ways to lower the cost of operating SMRs in order to sell the power generated at a competitive price. That would introduce significant safety and security concerns because they may try to spend less on safety systems and on securing the facilities.

Or, the nuclear industry might argue that because SMRs use less radioactive material and are easier to cool, it’s safe to locate them nearer to population centers. (Indeed, the Montana Legislature, as well as West Virginia Senator Joe Manchin, have proposed putting them in retired coal plants). Even worse, Lynan fears, operators could cut corners on safety guidelines, dispensing with evacuation plans that might be needed in emergencies.

NuScale says that because its reactors can be made in a factory setting using “off the shelf” items, plant operators avoid the high cost of fabricating custom parts on-site. In addition, NuScale says, its SMRs save money because if power demand increases, an operator can simply add more reactors to the plant instead of shouldering the major capital expense of building new reactors and structures.

The problem that won’t go away

Along with economic challenges, one central question for any nuclear project is location—both where to install reactors and where to bury their waste. SMRs have been billed as small enough to fit behind someone’s house, but historic fears of nuclear energy will likely continue to keep reactors out of the backyards of all but the poorest communities. And after decades, the waste question continues to plague the industry. And waste adds to the risk of proliferation.

Some argue that SMRs could make the problem worse. In a paper coauthored by Allison Macfarlane, former chairperson of the NRC, and published last month in the Proceedings of the National Academy of Sciences, an analysis of three SMR designs—from NuScale, Terrestrial Energy, and Toshiba—concluded that SMRs will generate more nuclear waste than a standard pressurized water reactor by a factor of anywhere from 2 to 30.

NuScale and other proponents of SMRs balked at the study. “The paper uses outdated design information for the energy capacity of the NuScale fuel design and wrong assumptions for the material used in the reactor reflector, and on burn-up of the fuel,” Diane Hughes, VP of marketing and communications for NuScale, said in a statement to Fast Company.

“With the correct inputs,” she said, “NuScale’s design compares favorably with current large pressurized water reactors on spent fuel waste created per unit of energy. These inputs are publicly available to the paper’s authors, and their omission undermines the credibility of the paper and its conclusions.” (In response, the paper’s authors contended they based their analysis on the only publicly available reactor designs at the time.)

Hughes added: “NuScale’s design does not create waste and material streams that are novel to the nuclear power industry.”

Compared to their Russian and Chinese counterparts, “advanced nuclear” companies in the U.S. like NuScale face relatively greater regulatory and financial hardship. The Russian and Chinese governments use a lighter regulatory touch for new nuclear technology and are more forthcoming with funding grants. Thus, those countries have taken the lead in SMR deployment.

Akademik Lomonosov, a floating nuclear power plant in Russia’s Far East, was as of May 2020 the world’s first and only operating prototype SMR. In July 2021, construction began on the world’s first commercial land-based SMR at the Chinese power plant Linglong One, where a prototype is due to start operation by the end of 2026.

Above: a map of nuclear plants in the U.S., the world’s largest producer of nuclear power

Policymakers in the U.S. are of course aware of this and have begun taking steps to bolster the country’s nuclear industry. Last year’s Bipartisan Infrastructure Law included $6 billion for a Civil Nuclear Credit Program to support plants at risk of economic closure. And the Inflation Relief Act just passed by the Senate contains billions in energy-related subsidies, including some that could impact SMRs specifically.

In addition to $60 billion for renewable energy like wind, solar, and hydro, the act includes $700 million for domestic mining and production of high-assay, low-enriched uranium and a 6% tax credit for energy providers investing in “advanced nuclear” technologies. For technology in the “microreactor” class (SMRs) the investment credit can go up to 30%.

The provisions are part of the more $250 billion that the bill would devote to combating climate change, with the aim of reducing U.S. greenhouse gas emissions by an estimated 40% below 2005 levels by 2030.

“By creating tax incentives that include all carbon-free technologies, we are one step closer to deploying new, cutting-edge nuclear technologies that will meet the growing demand for more clean energy,” Maria Korsnick, president and chief executive officer at the Nuclear Energy Institute, said in a statement. “The climate provisions in the IRA advance us on a path to decarbonize our economy. And nuclear energy, alongside wind and solar, will be critical to achieving this goal.”

Obviously, the tax credits won’t de-risk investments in new kinds of nuclear reactors like SMRs. But by improving the economics of their development and deployment, the government may help new nuclear technology play a larger part in the mix of clean energy sources that will be needed to wind down our increasingly dangerous dependence on dirty fuels.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.