The fashion retailer Express, a mall-culture staple, is on a mission to transform itself for the digital era. It manages a flock of social-selling influencers and is using data to personalize the experience of browsing its hot-pink crop tops and sequined statement blazers. The finishing touch on this brand makeover? A partnership with the buy now, pay later (BNPL) company Klarna to cobrand digital ads and offer Klarna’s “Pay in 4” product—which splits shopping-spree expenditures into four interest-free biweekly payments at checkout. “We want to give customers with a certain perception of us an opportunity to change that perception,” says Brian Seewald, SVP of e-commerce at Express. “We’re taking the risk out of a purchase with BNPL,” he says, adding that Express customers who opt to use Klarna have a higher average-order value.

Buy now, pay later services, which offer shoppers a financing solution and credit card alternative, have been embraced by more than 100 million people around the globe in less than a decade. Most BNPL companies operate two consumer products: an interest-free offering, which breaks up a purchase, typically a smaller-scale transaction, into three or four equal payments; and interest-based installment loans, which spread out the cost of larger purchases, like furniture. Market leaders Affirm, Afterpay (which Block, formerly Square, acquired for $29 billion), and Klarna are now ubiquitous on e-commerce sites. Meanwhile, leading digital wallets PayPal and Apple Pay are pursuing their own BNPL products. Affirm shares tanked 10% in July of last year when Bloomberg reported Apple’s intention to launch a pay-later product with Goldman Sachs.

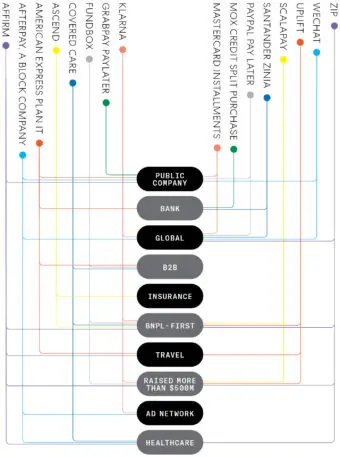

Buy, Buy, Buy: Mapping the Spreading BNPL Sector

But for retailers like Express, which aims to reach $1 billion in e-commerce sales by 2024, BNPL is not only an additional payment option for consumers but also an increasingly essential marketing tool for retailers. Klarna is embracing the opportunity to help merchants like Express by claiming dollars that might otherwise have been spent on Instagram or other digital ads. The company, which was valued at $45.6 billion in February, uses its app and email newsletters to promote partner brands, taking a small cut of any leads it generates. “We now speak as often to the chief marketing officer as we do the head of payments,” says David Sykes, head of Klarna North America, “and it’s because the value proposition has evolved.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.