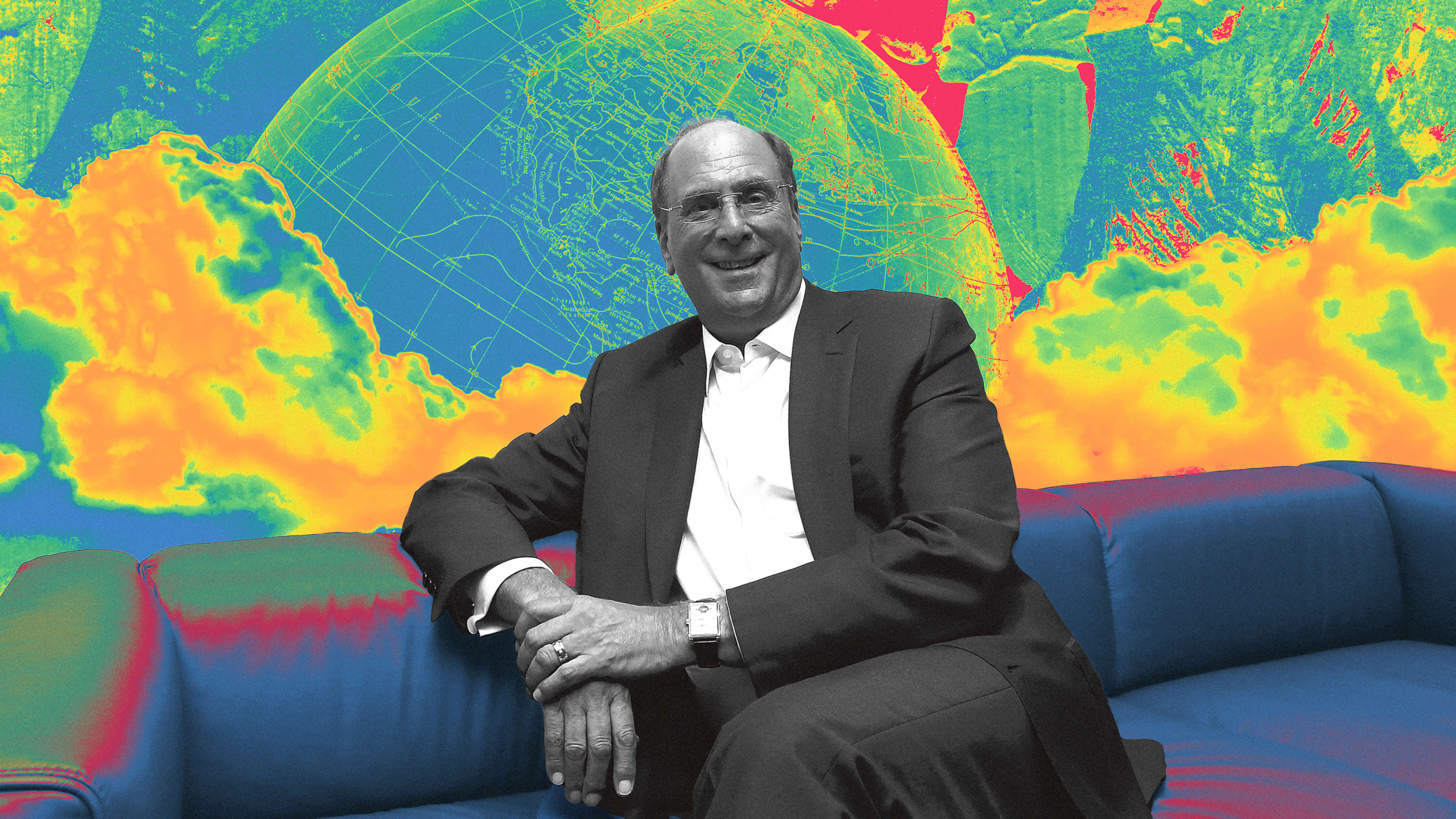

When Larry Fink speaks, companies listen. As CEO of BlackRock, the world’s largest asset management firm, his annual open letter to chief executives sets the tone each year for investors, companies, and, most recently, environmentalists.

Thanks to the $10 trillion under management at BlackRock, Fink holds a substantial influence over companies of all types. In recent years, his annual letter has focused on the importance of managing environmental, social, and governance (ESG) issues, specifically climate change. This year’s letter continues the theme, but takes a more market-oriented tone.

In reaction to criticism of his championing of climate action, Fink argues that “it is not ‘woke.’ It is capitalism, driven by mutually beneficial relationships between you and the employees, customers, suppliers, and communities your company relies on to prosper. This is the power of capitalism.”

Here are eight key takeaways from his letter:

1: The Capitalist’s Case for ESG

The core of Fink’s philosophy is that businesses that are connected to stakeholder needs deliver better and more sustainable returns over the long term. Under this thesis, purpose-driven companies will be the ones that will achieve long-term success for all stakeholders—including shareholders. This year’s letter makes it clear that BlackRock “will invest in the most dynamic companies—whether startups or established players—with the best chances at succeeding over time.” He doubles down on the connection between profit and purpose with this statement: “Access to capital is not a right. It is a privilege. And the duty to attract that capital in a responsible and sustainable way lies with you.”

2: The Tectonic Shift Toward Sustainable Investing Will Accelerate

Sustainable investing is at the highest it has ever been, and Fink claims “this is just the beginning—the tectonic shift towards sustainable investing is still accelerating.” The recently launched Glasgow Financial Alliance for Net Zero, a pledge from the world’s largest financial institutions aligning $130 trillion to net-zero strategies, supports this claim.

3: Investors can’t do it alone

The most interesting feature of Fink’s annual letter is the “man bites dog story” of the forces of capitalism aligning with the needs of people and the planet. But even Fink recognizes that businesses cannot police themselves. He makes a strong call for governments to “provide clear pathways and a consistent taxonomy for sustainability policy, regulation, and disclosure across markets.” He uses the analogy of the public-private partnership that led to the development of COVID-19 vaccines in record time as a model for what we must do to get to net zero.

Similarly, finance writer Clara Miller points out that investors are not capable of decarbonization alone. Investors provide capital, but it is real companies run by enlightened leaders that create sustainable innovations.

4: Innovate to Net Zero or Become Extinct

The COVID-19 pandemic rattled the economy, creating many new winners and losers. Some capitalized on the new normal, while others could not adapt quickly enough. There will be an encore of this economic sorting created by the accelerating climate crisis.

Fink points out how, in just a few years, the automobile industry has been completely reimagined with virtually every car manufacturer racing toward an electric-fueled future. A similar massive transformation will touch every sector. Some companies will fail to adapt and go the way of the dodo, while others who embrace the transition will be a phoenix and thrive.

5: The Next 1,000 Unicorns will be Climate-Tech Companies

With the enormous scale of the energy transition, Fink predicts that “the next 1,000 unicorns (startups worth $1B or more) will be sustainable innovators and startups aiming to decarbonize the world.” 2021 was a record year of investment in climate technology, and Fink predicts this trend will continue.

6: Create Carbon Targets and Report Emissions

Returning to the theme that capitalism and environmentalism are mutually supportive, Fink states that BlackRock’s focus on sustainability is “not because we’re environmentalists, but because we are capitalists and fiduciaries to our clients.”

With this backdrop, the letter calls for companies to produce short, mid-, and long-term greenhouse gas reduction targets and align their reporting with the framework from the Task Force on Climate-Related Financial Disclosures.

7: Engagement Over Divestment

In a somewhat defensive tone, this year’s letter explains BlackRock’s continuing investment in the fossil fuel sectors. Fink writes: “Divesting from entire sectors—or simply passing carbon-intensive assets from public markets to private markets—will not get the world to net zero. And BlackRock does not pursue divestment from oil and gas companies as a policy.”

The main point is that divestment doesn’t work. Fink argues that we will go through “several shades of brown before we get to green”—stating the obvious that the economy will not shift to clean energy overnight. BlackRock sees its role as picking the winners and providing them capital to accelerate the transition.

8: Stakeholder Capitalism is Here to Stay and Evolve

While certain that his version of “stakeholder capitalism” will serve the needs of investors, Fink shares that there is still much to learn about how a company’s relationship with stakeholders impacts long-term value. To build this knowledge, BlackRock announced a new Center for Stakeholder Capitalism, to create research, dialogue, and debate on the links between stakeholder engagement and shareholder value.

Every company has the option to embrace this type of capitalism. Fink poses the fundamental question: “Will you lead, or will you be led?”

Tim Mohin is the chief sustainability officer for Persefoni. Formerly, Mohin served as chief executive of the Global Reporting Initiative; he also held sustainability leadership roles with Intel, Apple, and AMD, and worked on environmental policy within the U.S. Senate and Environmental Protection Agency. He is the author of Changing Business From the Inside Out: A Treehugger’s Guide to Working in Corporations.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.