In March 2021, digital artist Beeple sold a work at Christie’s for $69 million. A year prior, his prints had never sold for more than $100 apiece. But this was no print. It was an NFT—aka, a nonfungible token.

What does that mean? It means that while anyone could copy a JPEG of Beeple’s work, only the buyer owned it, according to a digital paper trail. This distinction between reproduction and ownership made all the difference in valuing the work, as the artist became one of the world’s wealthiest creatives overnight.

But according to new research, Beeple’s success is an extreme outlier. A team of researchers out of the University of London, including Andrea Baronchelli, an associate professor in mathematics, and data scientist Matthieu Nadini, analyzed the sale of 4.7 million NFTs, exchanged by more than 500,000 buyers and sellers, representing nearly $1 billion in transactions. The general takeaway is that, while you might think nonfungible tokens are a skyrocketing business for collectors and creators, the vast majority of NFTs can’t buy you a meal at McDonald’s.

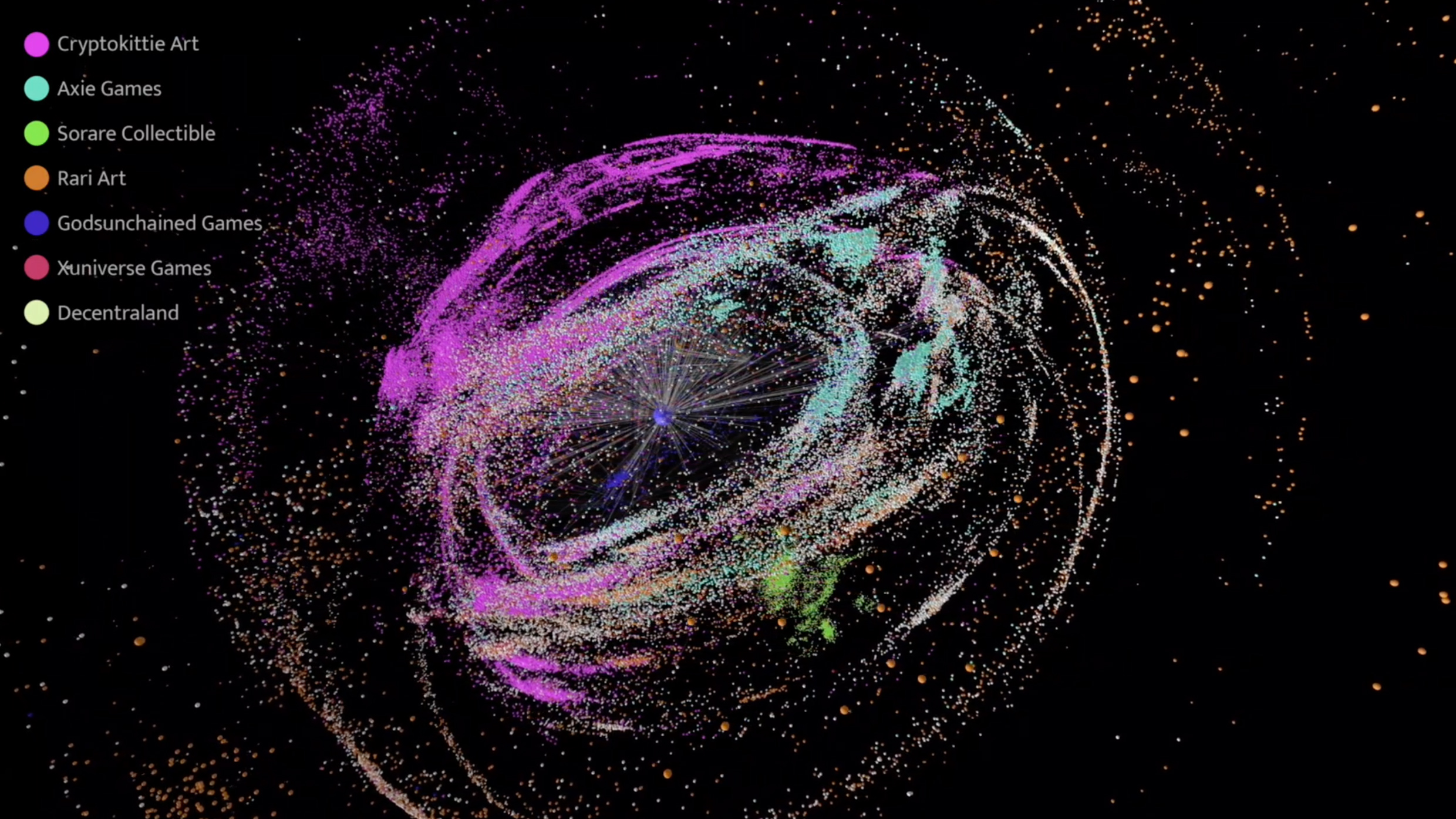

[Image: Mauro Martino]It’s a topic Martino is intimately familiar with, given that he spent nearly a year visualizing the aforementioned research into a network of trades, or what you might consider a snapshot of the NFT market—a task he considers one of the most complicated of his career. With frames that contain 7 million network links, a single change could necessitate minutes of rendering time before Martino could see the results.

“I learn by doing, playing with nodes, and modifying the visual to see where to go,” Martino says. “But when you have to wait five to ten minutes for a frame? It’s hard work.”

You can see much of Martino’s work in the video embedded above. His data visualization occurs in two parts. The first part, beginning at 1:48, demonstrates the growth of NFTs between 2017 and 2021. The spheres are NFT traders. Links between them are actual NFT trades. The larger the sphere, the more active the trader.

[Image: Mauro Martino]What you see from 2017 to 2021 is basically a universe coming alive. At first, a relatively small conglomerate of traders—rendered in pink for trading cards in the CryptoKitties game—dominate the frame. But then nodes start appearing in every direction and color. White stars represent solo NFT projects. Blue represents items from the NFT-based online game Axie Infinity. The green trunk that slowly grows beneath the rest of the visualization is for Sorare collectible cards, from an NFT fantasy football game that basically exists in its own vacuum.

Now, Martino didn’t include every piece of data from the paper’s own starting data set. And that data set is only a slice of the $10 billion NFT market. Still, Martino demonstrates that NFT communities are logically structured rather than completely haphazard.

The pink CryptoKitties smear across the visualization because individuals can actually breed and trade their own new cats, driving the sort of peer-to-peer trading that NFT fans love, swapping cat cards among themselves. But Gods Unchained, a role-playing game in which every item is an NFT, appears like a black hole in the middle of the entire visualization. Why? It’s the key distributor of its NFTs. And it appears that people who play Gods Unchained are highly active in other NFT endeavors, so it branches out from a single position.

While Martino admits that NFTs aren’t likely to make you rich, working on the project did move him to respect the market.

“There are people who think it’ll just be here for a few years—a temporary trend. We really discovered the market is growing, and is starting to have some structure, rules, and behavior we can track. So we feel NFTs will stay with us for a long time,” he says. “[Collecting digital objects] is not an expected behavior from humanity. [But] it’s emerged, and we think it will stay growing.”

Recognize your brand's excellence by applying to this year's Brands That Matters Awards before the early-rate deadline, May 3.