President Biden and Democrats in Congress want to move forward with a new way to tax billionaires in order to help pay for the essential services hundreds of millions of Americans need. However, two groups of people don’t like this idea: Republicans in Congress and many of the billionaires themselves.

Specifically, the groups opposing the new tax plan don’t like it because it wouldn’t tax income, and instead, it would tax unrealized capital gains. This is so critical and game-changing because most rich people are rich not because they are making millions or billions a year in income, but because they own assets that are appreciating by millions or billions a year.

Currently, these assets—property, shares in companies, cryptocurrencies, artworks—aren’t taxable until they are sold. Only then are the assets taxable, usually in the form of capital gains tax. This is why the rich can grow their wealth so much without paying a cent in tax.

To see how this compares to ordinary income earners, look at it this way: If you make $50,000 a year at your job, you need to pay income tax on all that money. But if a billionaire makes $5 billion a year due to their assets increasing in value, they don’t have to pay a cent on those assets until they sell them—and even then there are ways they can get around paying the rates they would pay if such assets were taxed as income.

So what do Biden and most Democrats want to do?

As The Wall Street Journal (WSJ) explains, the Dems want to change the way assets are considered from a tax perspective. They want to make assets owned by the ultra-rich taxable just like income is for ordinary people. In other words, they want to tax billionaires’ unrealized (not sold yet) capital. As the WSJ explains, this new unrealized capital gains tax would look at the value of the asset on January 1 and then again on December 31 of the same year. If a billionaire’s real estate property, for example, went from being worth $5 billion on January 1 to being worth $6.5 billion on December 31, the billionaire would be taxed on that $1.5 billion increase in value even if they did not sell the property.

And this new tax plan would not affect ordinary Americans in any way—even those that own stocks or homes they don’t sell. In order for you to be affected by this new tax plan, you would need to make at least $100 million three years in a row or have a net worth of $1 billion or more. The WSJ estimates the new tax plan would impact fewer than 1,000 people—all of them exceedingly wealthy.

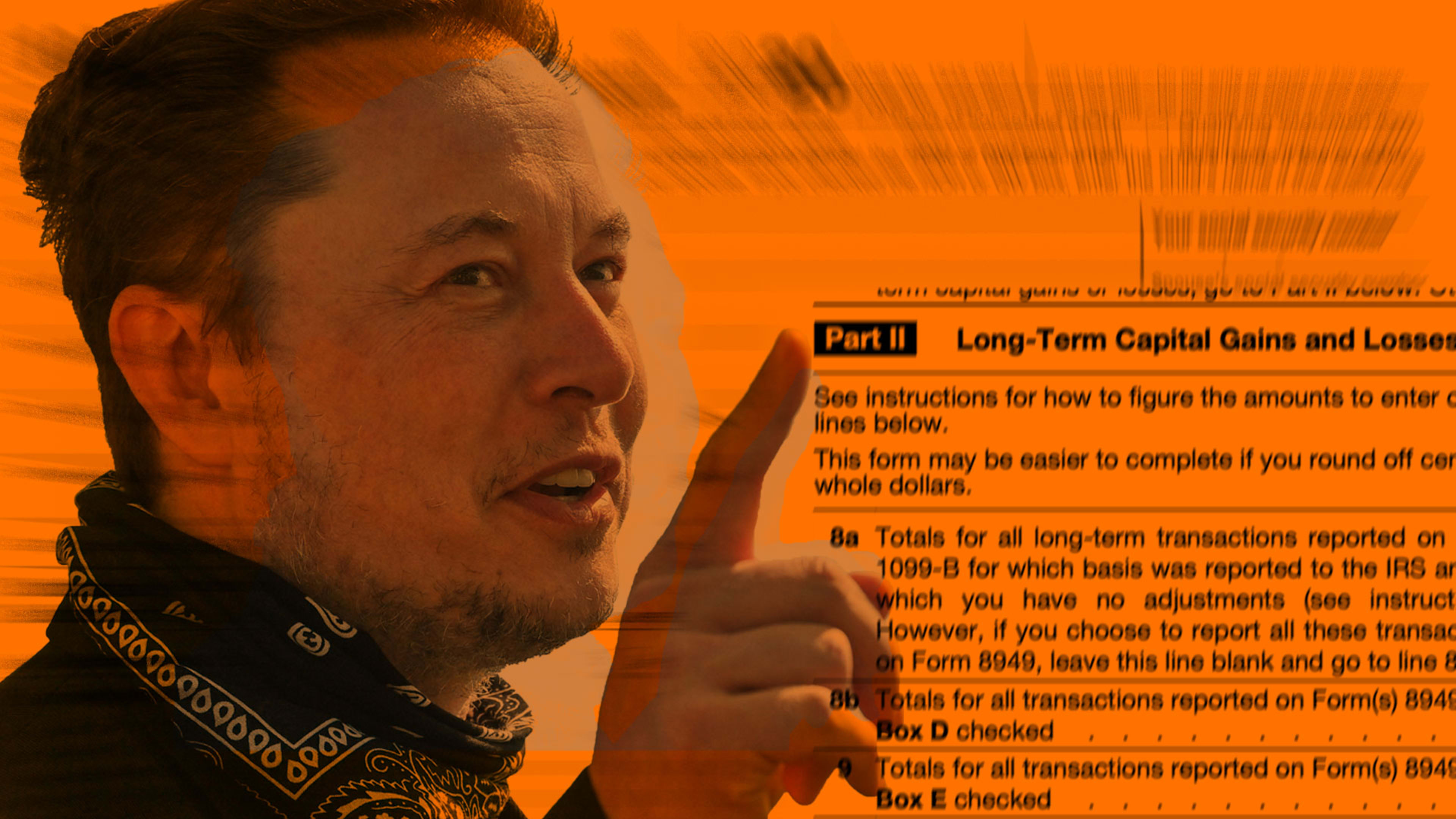

Of course, some billionaires don’t like this plan. One in particular is Elon Musk, the richest man on earth with a net worth of $289 billion. As Gizmodo points out, Musk increased his net worth by $36 billion yesterday—all in one day. That’s $36 billion he is currently not taxed on, but would be under Biden’s new plan. No wonder he issued a fear-mongering tweet about the plan.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.