When you’re buying a pricey sofa or a kitchen cabinet set from Ikea, you can pay for it in installments. Now, you can also buy smaller items—like rugs and lamps—and pay for them later.

Today Ikea’s parent company, Ingka Group, announces it is investing more than $20 million in a company called Jifiti, which provides “buy now, pay later,” among other financial services. According to a statement by Ingka, the new deal with Jifiti provides customers the option of buying Ikea products and paying them off over time. It is part of a broader trend in the retail space, as companies like Klarna, Affirm, and Afterpay make it easier for customers to make impulse purchases and worry about paying later. But are these services really better for customers in the long term?

The buy now, pay later (BNPL) industry has exploded over the past decade, with dozens of companies partnering with merchants to allow customers to stagger payments. During the pandemic, when online shopping soared, customers flocked to these services. But critics worry that the popularity of these tools could saddle consumers with debt. The Australian and British governments have both begun instituting regulations in the space; the U.S. has not yet done so on the federal level, but the California state government has begun scrutinizing the services to see whether they are somehow skirting the law.

This past February, when the British government studied firms offering buy now, pay later services, Chris Woolard, head of the Financial Conduct Authority, concluded that BNPL comes with “significant potential for consumer harm,” and the agency announced that it would begin to regulate the companies. Many of these platforms do not require credit checks for consumers to receive small loans, making it easy for consumers to spend more than they can afford and accumulate debt. The FCA’s regulations will force the lenders to conduct credit checks and allow consumers to lodge a complaint with the government if they feel like they are treated unfairly when they struggle to repay loans.

Since Ikea sells many expensive items—like kitchen systems and furniture sets—the company has always made it possible to pay for big-ticket items over time with interest. The difference is that now, with to Jifiti, customers can buy less-expensive items and stagger the payments. Depending on the transaction, customers may have to pay interest on these smaller loans; for some promotions, Ikea may absorb the interest to entice customers to make the purchase.

In some ways, Ikea is late to the party. BNPL services are now available across many retailers, from Sephora, which partners with Klarna, to Everlane, which partners with Zip (formerly Quadpay). Last week, Amazon announced that customers can now pay for products priced at $50 and higher in monthly installments thanks to its partnership with Affirm. And in July, payments company Square acquired Afterpay for $29 billion.

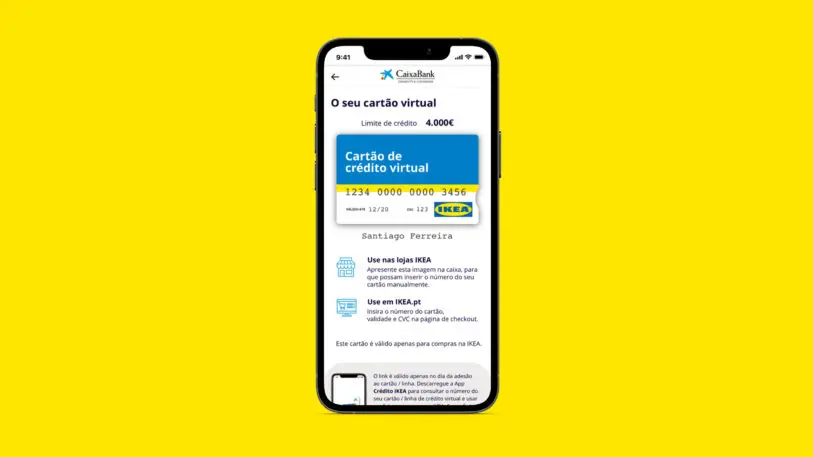

Jifiti doesn’t do the lending itself. Instead, it partners with established banks around the world, including Citizens Bank in the U.S. and Crédit Agricole in France. While brands like Klarna and Clearpay don’t require credit checks, Martin says that since Jifiti partners directly with banks, even small BNPL loans are subject to credit checks. This means that Jifiti actually turns away some customers who don’t have good credit scores.

While Jifiti, and by extension Ikea, is better regulated than some other platforms on the market, it is still making it easier for consumers to rack up debt. For some consumers who are financially literate, “buy now, pay later” offers another option besides using a credit card or PayPal to pay for an item, allowing them to compare interest rates and make smarter financial decisions.

But even with credit checks, BNPL may nudge some consumers to buy items they really can’t afford and overextend themselves financially. As John Glen, the U.K.’s economic secretary to the Treasury, told The Guardian in February: “With several buy now, pay later providers planning to expand to higher-value retailers, or offer their products in store, the risk that consumers could take on unaffordable levels of debt is increasing.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.