Finance apps are a dime a dozen these days. You can download apps to buy groceries, pay your friends for dinner, check your savings account—the list is seemingly endless.

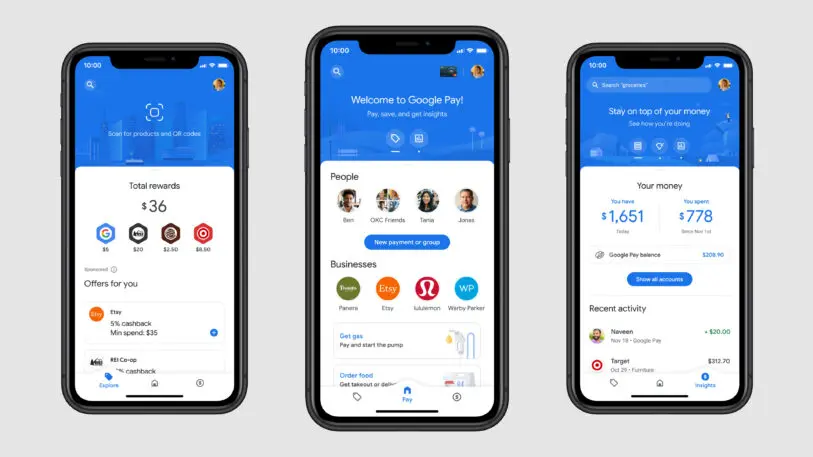

And that’s part of the problem, according to Google. The search giant’s relaunched payment app, Google Pay, aims to bring all of those functions under one roof. Its streamlined interface and intuitive usability make it the winner of this year’s Innovation by Design Award in finance.

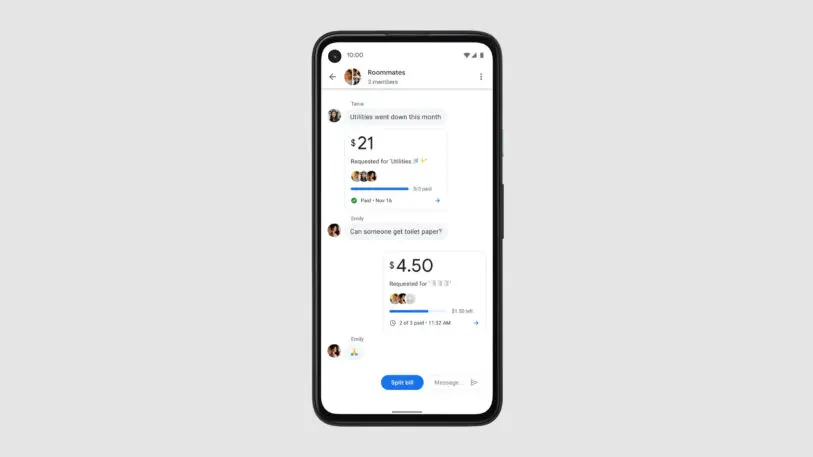

The first iteration of Google Pay (originally called Android Pay) launched in 2015 and functioned largely as a form of contactless payment (think Google’s version of Apple Pay). But as the years progressed and the team conducted user research, “the big insight was people were starting to have multiple finance apps on their phone doing very different things,” says Josh Woodward, director of product management at Google. “People really wanted a simpler way to think about their money.”

Of course you can’t talk about this wealth of data without privacy alarm bells going off. Woodward stresses that this was top of mind in the design process. Any integrations with Gmail or Google Photos or other personalization features are opt-in and any “transaction data that you link in G Pay stays in G Pay. We wanted to make sure we were very clear about that,” Woodward says. “[We looked at] how do we do it in a way so the person feels in control. So that it’s not a negative surprise, it’s a delightful surprise.”

If people’s data in G Pay is essentially a walled garden, it’s worth asking what’s in it for Google, a company known for amassing data and deploying it in countless clever ways—both seen and unseen. For starters, there’s a clear business incentive to drawing people further into the Google ecosystem. For instance, if you save a credit card to G Pay, it’s also saved in your Chrome browser. The convenience and interoperability could entice users to more heavily rely on Google’s other products. Woodward says there’s also a “broader strategic value to Google. Where we see the industry going is really two types of services getting digitized: merchant services and financial services.” That means both offers, discounts, and where you’re shopping, as well as where, when, and how you’re banking. “The vision is G Pay fits in in both places,” he says. “It helps digitize both of these mega trends in the industry.”

See more from Fast Company’s 2021 Innovation by Design Awards. Our new book, Fast Company Innovation by Design: Creative Ideas That Transform the Way We Live and Work (Abrams, 2021), is on sale now.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.