Coinbase, the San Francisco-based cryptocurrency exchange, is going public on April 14. The company will trade under the ticker COIN and list 114,850,769 shares on the NASDAQ with an initial valuation of $100 billion.

Instead of following the traditional initial public offering (IPO) route, Coinbase plans to post its shares straight on the NASDAQ exchange via a direct listing, a technique pioneered by big names like Spotify and Palantir in recent years. Whereas an IPO involves a company creating new shares and having an underwriter that buys them for a set price and then sells them to the market, in a direct listing a company sells existing shares and has no underwriter.

But what is Coinbase and why is this such as important development in the cryptocurrency market?

The Coinbase business model

Coinbase was founded in 2012 by Brian Armstrong, a former engineer at Airbnb, and Fred Ehrsam, who was a trader at Goldman Sachs. Their mission was to make investing and transacting in cryptocurrencies easier, more efficient, and fairer.

The company has since risen to become the largest cryptocurrency exchange in the U.S. Even though there are numerous other exchanges around the world with considerably larger trading volumes, including Binance, Huobi, and OKEx, Coinbase’s growth has been incredible lately.

It has just reported preliminary results for the first quarter of 2021, with revenue surging to $1.8 billion. This is a ninefold increase from the first quarter in 2020 and more than the $1.3 billion that the company made in the whole of 2020. Net income for the first quarter is expected to be in the range of $800 million, compared to $322 million in calendar 2020. In the past three months alone, the verified userbase has risen 30% to 56 million people.

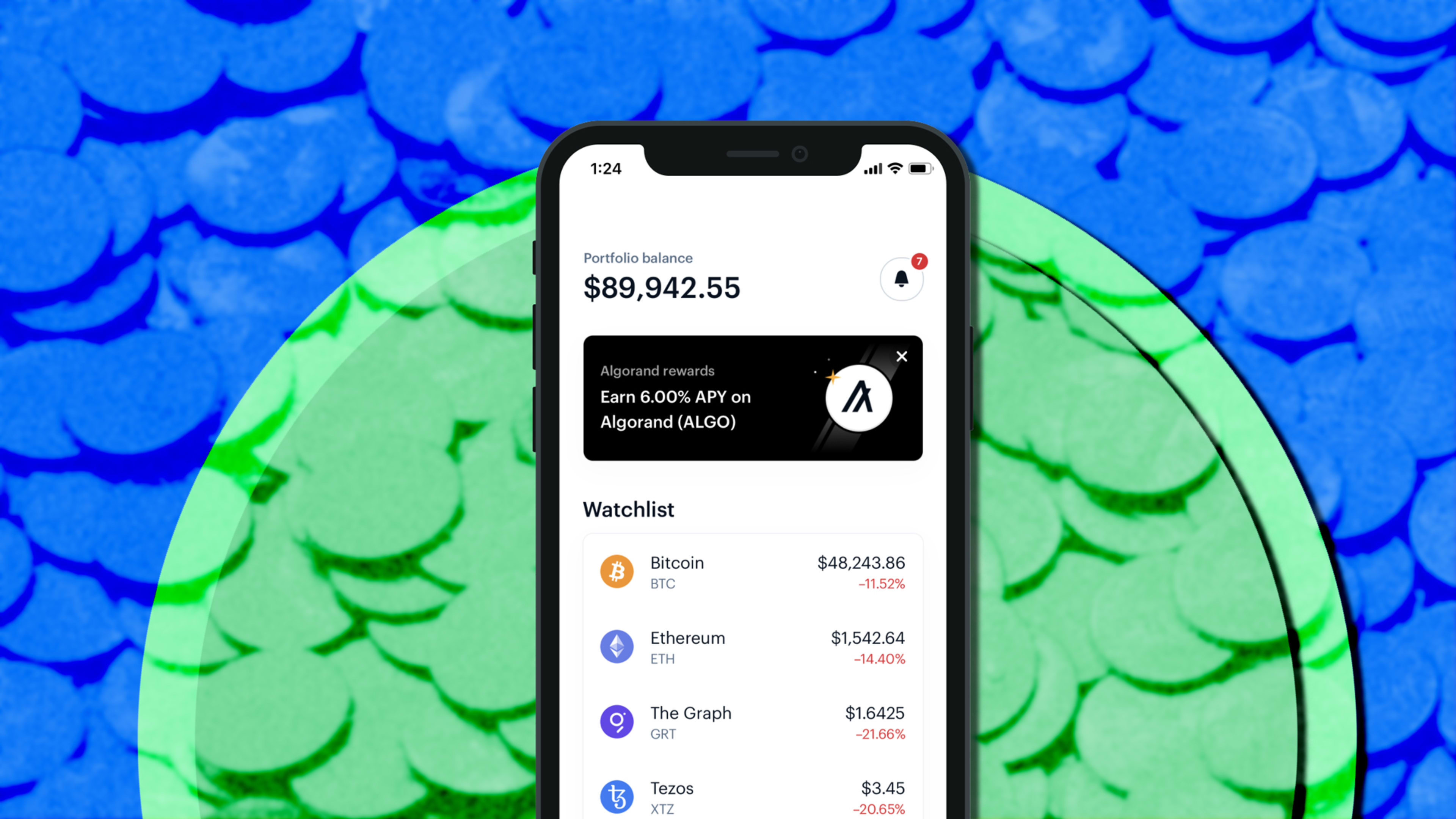

So how does Coinbase make money? It earns fees and commissions when customers buy or sell cryptocurrencies, though there is no charge to store cryptocurrencies in customer wallets. The fees include margin fees, where Coinbase charges 0.5% for purchases and sales, although this figure can vary depending on market conditions.

It also charges a “Coinbase fee”, which is commission on all crypto transactions which depends on your location and the total amount of your transaction. The company also has other lines of business including international payment system Coinbase Commerce, a Coinbase Visa card, and USD Coin (USDC), a stablecoin cryptocurrency whose price is pegged 1:1 to the US dollar. Coinbase co-founded USDC along with crypto financial services platform Circle, and makes money from the stablecoin by reinvesting the dollars that users exchange for it in safe assets such as short-term U.S. Treasury bonds.

How sustainable is it?

When it comes to investing in Coinbase, the same rules apply for buying any stock—there is risk and the performance of the stock will depend on demand and the company’s future success. Coinbase’s fate is obviously tied to the performance and uptake of bitcoin and other cryptocurrencies. If investors lose interest in cryptocurrencies, Coinbase’s business will be in trouble. Coinbase also has to contend with competitors arriving every day, many of whom become big very quickly. Binance, the market leader with $39 billion in daily volumes, only launched in 2017 for example.

But given the surge in cryptocurrency prices, especially bitcoin, in the last year, there are more and more individuals and large institutions such as MassMutual and Tesla looking to gain exposure to this alternative investment. And with the COVID-19 pandemic forcing governments to spend heavily on support measures and central banks creating lots of extra money to stimulate their economies, many investors worry about the inflation that this could cause, which would devalue “fiat” currencies like the dollar and pound. Since bitcoin is designed to never have more than a maximum of 21 million in circulation, it is seen by these investors as a store of value to protect their wealth from this problem.

Brian Armstrong himself is very bullish in terms of the uptake in cryptocurrencies. In a letter celebrating the platform filing to go public, he wrote:

Trading and speculation were the first major use cases to take off in cryptocurrency, just like people rushed to buy domain names in the early days of the internet. But we’re now seeing cryptocurrency evolve into something much more important. People are using cryptocurrency to earn, spend, save, stake, borrow, lend, vote, and perform many other types of economic activity.

Nonetheless, much of this is an argument for holding cryptocurrencies themselves, so why would investors want to buy shares in a crypto exchange instead? It is a way of tapping into the huge rise in this market without actually buying cryptocurrencies directly. For investors who worry about the high volatility in crypto prices, as well as the fact that it can be stressful trying to store cryptocurrencies safely, Coinbase could be an attractive alternative. This might particularly appeal to financial institutions like pension funds that take a very conservative approach to investing.

No doubt when Coinbase lists under the ticker COIN, it will draw a lot of attention. Demand will be high and with any listing of this size, there will be major fluctuations throughout the following few days as trading volumes will be large. But if you are interested in investing in cryptocurrencies, you are probably still better off investing in the digital coins themselves as their performance depends only on the level of demand for them.

The performance of COIN will depend on Coinbase staying ahead of the pack and offering cheap and secure access to cryptocurrencies, so it has an underlying vulnerability that is distinct from the assets themselves. Nevertheless, the listing will expose more investors to the cryptocurrency world and is another sign that the financial ecosystem is starting to take notice of cryptocurrencies.

Andrew Urquhart is an associate professor of finance at ICMA Centre, Henley Business School, University of Reading. This article is republished from The Conversation under a Creative Commons license. Read the original article.

Recognize your company's culture of innovation by applying to this year's Best Workplaces for Innovators Awards before the extended deadline, April 12.