Hims, a heavily branded online pharmacy with a limited range of products, began trading as a public company on Thursday at $17.08 per share. Its price dropped 7% over the course of the day. The company went public through a merger with special purpose acquisition company (SPAC) Oaktree Acquisition Corp, which closed on Wednesday. The deal valued Hims at $1.6 billion.

The IPO is notable because it suggests that Hims and its model of healthcare are here to stay. The company has made steady progress since its inception four years ago. It now has nearly 300,000 subscribing customers across its two brands: Hims (for men) and Hers (for women). For all of 2020, the company expects to take a loss of $20 million on revenue of $138 million. Next year, it plans to grow revenue 30%.

Hims started as a wellness brand, but has grown beyond that into full-on primary care. It now has great potential to reach the surprising number of people who don’t already have a regular doctor. However, it’s not clear that its business model will deliver the kind of health outcomes that traditional long term primary care can offer. Its rotating doctors and emphasis on branded products could end up exacerbating the existing problems with fee-for-service health care that already create hurdles for doctors trying to deliver good care.

“Front door to the health industry”

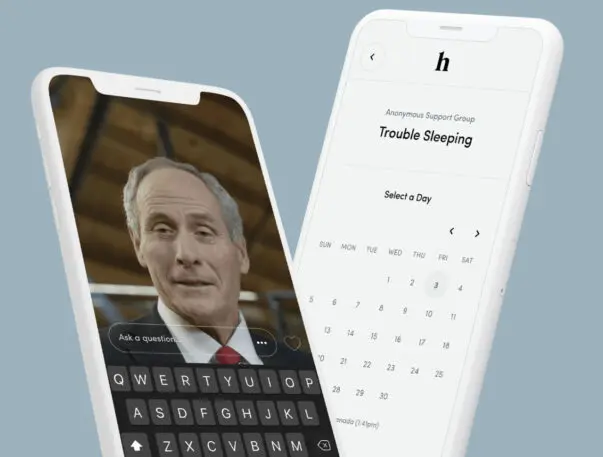

Andrew Dudum, the founder and CEO of Hims, describes his company as the “front door to the health industry.” The people who walk through that door may not have a primary care doctor and are looking for treatments for specific issues: erectile dysfunction, hair growth, acne, and anxiety and depression. The products are heavily branded with the dirty pastels that have come to represent the millennial generation. The ideal Hims customers are too busy to go to the doctor, even if they have insurance, and need a quick fix for what ails them that they can pay for in cash.

Dudum believes that people have been spoiled by ecommerce and fast delivery. “I don’t know, a $50 to $70 copay just to make an appointment and a four-week wait-time is just not realistically conducive with what they expect,” he says. About a quarter to a third of millennials in the United States don’t have a primary care doctor, according to surveys. The reason is largely a matter of convenience: it’s hard to get an appointment when you need it.

For this reason, the Hims model is a departure from traditional primary care. Patients pay the company a $20-$30 monthly fee for on-demand access to a doctor and regular prescription delivery. Conceptually, it more resembles urgent care: a quick interaction with a random doctor to treat of-the-moment issues such as fever, sore throat, flu, and rashes. Where the company makes its money is in chronic care, issues that it can bill for on a recurring basis. This started with erectile dysfunction and male pattern baldness, but Dudum has expressed interest in expanding into harder-to-manage health issues such as diabetes and hypertension.

Another area of interest is in prescribing pre-exposure prophylaxis for HIV. To expand into more areas of healthcare, Hims will eventually have to accept insurance, which it’s already making moves towards doing.

The bigger question is whether the company is just pushing prescriptions or if it really can bridge patients to fuller care. This year, the company started offering primary care visits and signed deals with Ochsner Health, Mount Sinai Health System, and Privia Health to connect patients with offline care. Dudum says that he understands that anywhere from 10%- 25% of patients care needs to happen in the doctor’s office. Still, he thinks the majority of care can happen at home.

“The legacy historical health care model has been around general care,” he says. “You have a [primary care physician] who’s kind of doing oversight work for the patient, which is great. But the reality is, is that the patients are actually suffering from any of a host of 10 or 15 different specialty issues. I think the beauty of the platform like ours is it not only allows you to maintain that general oversight care with a PCP, if you’d like, but it allows you to actually have as a part of your medical team through specialists—right there on call, available to you as needed—for urology issues, dermatology issues, psychiatric issues, or whatever it might be.”

However, what makes telehealth compelling is bigger than reliable prescription delivery. As Dudum notes, the great promise of putting medical appointments online is that it can connect people who cannot easily get to a doctor with care. “North of 80% of rural communities are considered primary care deserts,” he says. “Which means there’s not even a doctor within an hour or two. And so for those everyday things [such as] migraine, bug bites, sinus infection, UTI, the flu— whatever it is—there’s just a gaping hole in the market with regard to completely unaffordable access,” he says.

The continuity of care that traditional primary care offers is associated with better health outcomes.

Because of its focus on ailments that need chronic prescriptions, Hims technically provides continuous care. What’s unclear is whether that constitutes quality care. In October, Bloomberg Businessweek reported that some of the doctors Hims contracted with through a separate company called Bailey Health felt pushed to prescribe products. The report included excerpts from conference calls in which Bailey Health’s CEO told doctors to expedite approval for prescription applications. On the Better Business Bureau website, several complaints against Hims paint a portrait of aggressive sales tactics. Patients have complained they were charged for products that their doctor decided would not be good for them. Other complaints include being charged for recurring delivery of products that weren’t actually ordered.

Dudum pushes back on the idea that Hims’ business model encourages doctors to prescribe products with abandon. “Physicians are always and only incentivized to provide great quality outcomes and that’s all the way down to their payment model,” he says. “They’re paid on an hourly basis regardless of how many patients they’ve seen or what the patient outcomes look like.” He also says that new models like his always attract skepticism.

But telehealth and its promises are not monolithic. Two of the biggest telehealth companies, Amwell and Teladoc, do something quite different from Hims. Rather than a branded experience, they give health systems the technology they need to more easily reach their patients. In essence they’re giving doctors the flexibility to conduct medicine however they think is best for the patient, whether that’s over the phone, via video, or using a bevy of at home health monitoring devices.

By contrast, Hims thinks it can reach people who aren’t currently being served by the health system through a highly branded experience. There’s value there that the company can clearly capitalize on. Whether it can drive long-term positive health outcomes for those patients is still TBD.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.