Intuit says it’s done acting like an absentee landlord of Mint, its long-neglected personal-finance app. The new iPhone release landing Wednesday morning represents its first major investment in updating this service in years—and the venerable financial-software firm says there’s more to come for users of Mint’s Android, iPad, and web apps.

“We basically have a brand-new team overseeing Mint,” said Varun Krishna, senior vice president and head of consumer finance, at the start of a Zoom briefing Monday. “There’s never been a stronger or more committed team focused on Mint.”

Krishna acknowledges that both outside criticism of Mint (for example, my January 2020 Fast Company story, which “served as a little bit of a wakeup call for us”) and the rising quality of financial institutions’ own apps pushed Intuit to make this effort. The novel-coronavirus pandemic then compounded the importance of giving people better financial guidance as incomes crumpled or went to zero.

Along with two colleagues, product-management director Jamie Belsky and design head James Fell, Krishna sketched out a reinvention agenda for the once-groundbreaking app Intuit bought for $170 million in 2009—including possibly adding premium versions to a service that’s always been free with ads targeted to your perceived financial interests.

But some of their answers also revealed how much work Intuit has left itself to do.

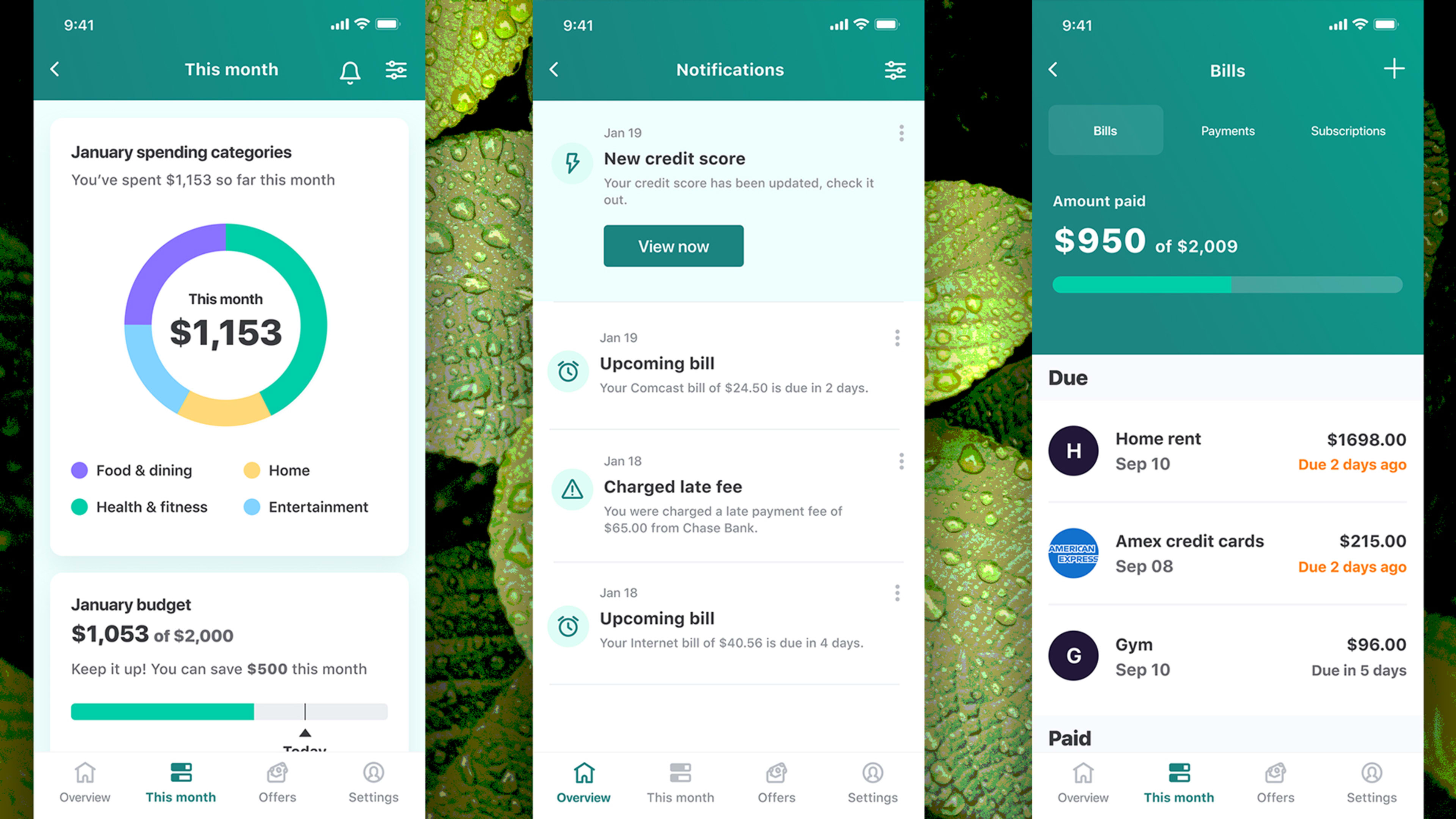

Saying “a huge percentage of our user base is focused on budgeting,” Krishna explained that the new iPhone app aims to make that “a little less work” by bubbling up insights more frequently. For example, this updated app will graph monthly spending as compared to the previous year’s figures and let users batch-edit multiple transactions to add their own tags—both options previously confined to the web version of Mint.

It will display monthly expenses by category in a bubble chart and add a “This Month” dashboard that compares income, expenses, and savings goals.

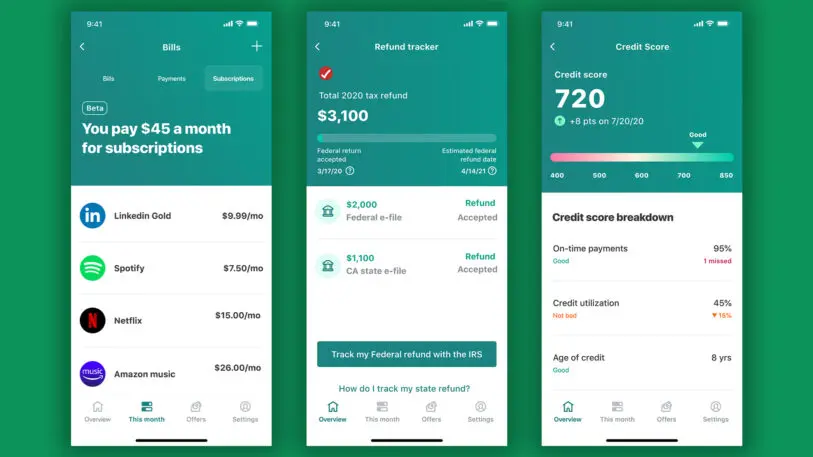

And the new app will automatically track subscription costs, as identified through its own algorithms, and offer to alert users of rate hikes. Belsky notes how often people forget to cancel a free trial or a duplicate subscription: “They’re paying for Dropbox and Google Drive at the same time.”

The revised app will try to encourage good financial behavior through “micro-celebrations,” Belsky says. For instance, it will applaud your meeting a savings goal by spraying some virtual confetti.

Krishna compares the app’s “celebrating those sort of small wins” to the way fitness apps aim to use gamification techniques to help motivate people toward their goals. “It’s easy to deliver somebody a plan,” he said. “It’s much harder to actually stick to the plan.”

Many Mint users will have to wait to see these new features. Although more than half of Mint users are on iOS, the iPad version remains the same as before because it, unlike many iPad apps, remains on a separate code base.

Intuit is testing an Android app with the new features, which Krishna said should ship in “about a month.” Updates to the web app, the primary experience of Mint for about a quarter of its users, “will come a little bit later.” The company didn’t offer a timetable for iPad updates.

One of the top requests of longtime Mint users—integration with Intuit’s TurboTax tax-prep app so they won’t have to copy and paste numbers between the two—is on a multiple-year plan.

“We don’t yet have the ability to integrate Mint data back into TurboTax,” Krishna says. Instead, as a first step the company will let Mint users track their tax refund within Mint, then connect apps already linked inside TurboTax to Mint as well. But allowing data to flow from Mint into TurboTax will probably not happen until next year’s tax season.

Krishna blames that lack of integration on Mint previously being “sort of a separate organization” within Intuit until a reorganization about two years ago.

More ways to manage your money

Mint users tired of waiting on Intuit have a few options. As Krishna observed, the mobile apps of many financial institutions now offer “five-star experiences”; for people who don’t spread their money around multiple banks and credit cards, they may provide sufficient insight.

For those looking for a similar overview of their financial activity across all of their accounts, competing apps such as You Need a Budget ($84/year), Simplifi ($29.99/year from the developers of Quicken, the desktop-based app Intuit spun off in 2016), and Monarch ($89.99/year) offer similar features but not the same business model.

As in, their subscription-based business models don’t rely on mining your financial data—in anonymized and abstracted form—to generate insights to target ads.in anonymized and abstracted form—to generate insights to target suggestions for financial products. Although Intuit touts its worldwide compliance with such strict laws as the European Union’s General Data Protection Regulation and says it doesn’t disclose your data to other firms without upfront permission, privacy isn’t a big factor in Mint’s pitch.

For that matter, until the 2019 debut of the Apple Card, few financial institutions worked too hard to make that a selling point for their services. “From a privacy perspective, they all are atrocious,” vented Megan Gray, general counsel for the privacy-optimized browser DuckDuckGo (but speaking only for herself as a privacy professional, not her employer), in an email.

That angle—as well as a reluctance to trust financial credentials to a cloud service, although Mint and other firms have moved to secure data-exchange systems that don’t store usernames and passwords—may explain why many users still maintain their own financial-planning spreadsheets.

Monarch cofounder and CEO Val Agostino, one of Mint’s original executives, said in an email that “a large number” of subscribers had previously relied on Excel, although he’s also drawn customers from Mint, the investor-oriented Personal Capital, and You Need a Budget.

Intuit can count on a fair amount of inertia: As Moody’s Investors Service said in a June note, its “consumer and small-business customer base tends to be loyal.” Switching to smaller, younger competitors can also entail compatibility issues with connecting to some accounts, something Monarch’s Agostino said the company is working to fix.

But privacy concerns won’t go away. And Krishna says Intuit has heard from customers willing to pay for an ad-free version of Mint. While he stresses that there will always be a “highly functional” free version of Mint, he adds that the company will be testing various premium features that could include such options as more advanced analytical tools.

That’s no guarantee of a privacy-enhanced version. But at least there will be new versions, something that seemed improbable a year ago.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.