Google loyalists are sure to thrill at the company’s newly redesigned mobile payments app.

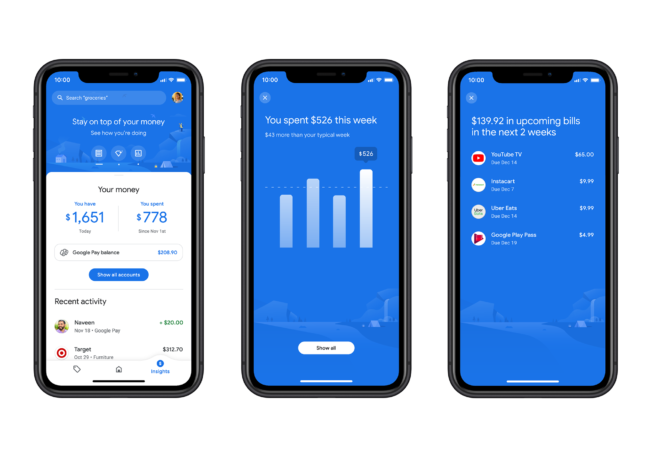

The app’s peer-to-peer payments are intuitive and conversational, packing a host of features into a remarkably simple interface. Its integrations with retailers like gas stations bring touch-free magic to the most tedious of transactions. And perhaps most impressively, its customized financial insights are surprisingly engaging and useful, in sharp contrast to the bulky, color-coded pie charts still favored by many banks and credit cards.

But this Google Pay update, geared toward the U.S. market, is more than a facelift. It’s a transition step toward the launch of Plex, a mobile-first banking service that Google plans to introduce in partnership with financial institutions including Citi next year. It’s also a tacit acknowledgement that mobile wallets, as currently designed, are failing to win over the majority of U.S. consumers.

“Many Americans still find managing money really challenging,” says Caesar Sengupta, head of payments. “People shouldn’t have to work so hard on money. Money should be working hard for them.”

Google’s decision to lean into financial services may raise eyebrows at a time when the company is being sued by the Justice Department for violating antitrust laws. Outside of the U.S., Google Pay specifically is currently the focus of an antitrust suit in India, where the Competition Commission has alleged that the company favors its own payment solution in the Android operating system and strong-arms app developers into paying hefty commissions via Google Pay. In both cases, Google is contesting the allegations.

[Animation: courtesy of Google]While those cases proceed, it falls to consumers to draw the line on acceptable corporate behavior. Here, Google Pay’s revamped app provides them with privacy options, even as it showcases the benefits of giving the app sweeping access to other Google touch-points, like email.

For example, Google Pay powers its tailored financial “Insights” using transactions processed within the app. (Depending on your usage of the app, these can be more or less compelling.) But that’s just baseline. To improve Insights, the app presents you with an opt-in choice: incorporate receipts from Gmail and Google Photos, by linking accounts. The added data gives users a more comprehensive view of their spending—but also requires that they share more information about their financial habits with Google.

Similarly, the section of the redesigned app dedicated to offers and deals from retailers becomes more valuable if you opt-in to allowing businesses to access your transaction data.

“We’re really acting almost as a distribution platform here, trying to connect those customers to businesses,” says Josh Woodward, director of product management for Google Pay U.S.

Thanks to its advertising tools, Google already acts as a connector of customers conducting searches and businesses looking for clicks. That platform becomes even more valuable if the company, like Amazon, knows which searches lead to purchases. (Google Pay says it will not share a consumer’s transaction history with the rest of Google for the purpose of targeting ads.)

“This is just the start,” says Jane Fraser, Citi president and CEO for global consumer banking, nodding to the artificial intelligence that will power Plex’s goal-setting functionality and other features.

Plex will join a crowded field of neobanks; Chime, for example, already boasts over 8 million customers. Meanwhile, even in the midst of a pandemic, mobile wallet penetration in the U.S. remains stubbornly low. Google Pay rival Apple Pay, despite the many retailers where it is now accepted, is still mentioned in the same breath as Starbucks when it comes to the mobile wallet leaderboard. Google Pay may be hard-pressed to achieve more.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.