Almost from the moment that Donald Trump launched his improbable campaign for president in 2015, questions that had swirled for decades about his net worth and finances took on a new urgency—especially when his links to Russia started to emerge. Over the last four and a half years, throughout the campaign and the Mueller investigation and an endless series of scandals, one detail nagged at reporters for an explanation: Trump has been largely shunned by Wall Street, due to his multiple bankruptcies and loan defaults, with most banks refusing to do business with him—with the almost sole exception of Deutsche Bank, which continued to lend him hundreds of millions of dollars.

Starting in late 2015, I spent months chasing claims that one of Russia’s state-owned banks had guaranteed Deutsche’s loans to Trump, effectively making the then-presidential candidate indebted to one of America’s chief adversaries. Along with dozens of other reporters, I turned up no hard evidence, with former bank staffers offering plenty of speculation but neither firsthand knowledge nor documentary evidence.

But since Trump took office, we’ve learned plenty of other details about his relationship with Deutsche Bank, as well as the extent of the bank’s dealings with other figures, including the Kushner family and Jeffrey Epstein. And that’s almost all due to the intrepid reporting of The New York Times‘s David Enrich, whose reporting on the bank has shed light on the dark corners of Wall Street and the favors that financial firms do for their favorite clients. In his must-read articles, Enrich has revealed how Trump sought a loan from Deutsche Bank during the 2016 campaign, that anti-money-laundering specialists at the bank flagged multiple transactions involving entities controlled by Trump and his son-in-law Jared Kushner, that federal prosecutors subpoenaed bank records from Deutsche about entities associated with Kushner’s family, and that the bank introduced Trump to wealthy Russian investors.

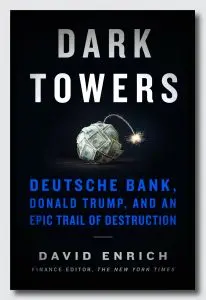

In his new book, Dark Towers: Deutsche Bank, Donald Trump, and an Epic Trail of Destruction, Enrich traces the full arc of the relationship, offering plenty of juicy details—including the amazing story of a bank executive’s suicide and how it led his son to dig into confidential files, which he has shared with government investigators.

This interview has been edited for clarity and cohesion.

Fast Company: Given his history as a debtor, why would Deutsche Bank work with Donald Trump? Or unsavory clients like Jeffrey Epstein?

David Enrich: The bottom line is greed and short-sightedness. And Deutsche Bank was eager to do business with people who were off-limits for the mainstream banking world. Both Epstein and Trump fit that bill perfectly. And the reason they were off-limits is that they had done things, whether personal or professional, that were kind of abhorrent ranging from sex crimes in Epstein’s case to being a recidivist defaulter and acting like a demagogue in Trump’s case. Deutsche Bank, as one executive there told me, needs damaged clients. And the reason it does is because if you’re an established wealthy business man or business woman, you often have your pick of which banks you are going to go to. And Deutsche Bank would not top the list. So Deutsche had to be content with clients that were off-limits to other banks.

Considering the risks that were involved with lending to or managing money for Epstein and Trump. It’s an extremely narrow view of what constitutes risk—it was looking at it purely from a financial standpoint and trying to evaluate whether or not these people would make money for the bank and whether or not they would default on their loans. And the bank decided that, if it structured loans in a way that they had collateral that they could take in the event of default, that essentially eliminated most of the risks the bank was taking and would make financial sense. But it failed to look at the reputational and legal consequences of doing business with these men and that that turned out to be the much more damaging part of it in the long term.

FC: Has the bank’s relationship with Trump hurt business?

DE: There are those who are wary of doing business with an institution that’s so closely linked to Trump because it’s radioactive. And I’ve heard rumblings about nonprofits and things like that that are opposed to the Trump administration not wanting to do business with the bank.

But recently I’ve been talking to people at the bank who say that they actually are optimistic that they will come out of this in the long run, because they’ve been so publicly tight-lipped about their relationship with Trump. They’re hoping that their reputation for probity and discretion will be strengthened. Especially in the private banking [unit], where you’re dealing with extremely wealthy people who are extremely focused on keeping their financial secrets secret in some ways. And in fact, I know that some people at the bank are optimistic that they will emerge from this a little bit stronger than they had been, which is obviously the height of irony.

FC: Is there any hint or indication that the president has either overtly or more subtly exerted pressure on the SEC or DOJ on some of the multiple investigations into Deutsche since taking office?

DE: Yeah, there are indicators I’ve seen of that. I certainly don’t have any proof that that’s what happened, but there’s kind of circumstantial evidence that suggests something strange is afoot. At the end of the Obama administration in late 2016, there were a number of investigations into the bank’s laundering of money for wealthy Russians. And that included a Justice Department criminal investigation. And I had been hearing that the DOJ was pretty close to bringing some sort of charges against the bank and possibly individuals at the bank. And I believe those were likely to be criminal charges, but I’m not 100% certain.

And it sounded like they were very close to wrapping up an investigation and punishing the bank. And then Trump gets sworn into office and the investigation goes silent. And initially people at Deutsche Bank, who had braced themselves for the punishment and for it to be quite large and quite damaging publicly. And at first they figured that this is just the product of one administration transitioning to another. And that it’s a matter of time—and the weeks pass and the months pass and a year passed and still nothing. Just complete radio silence. And at this point, a lot of people within the bank have breathed a sigh of relief that this has essentially gone away in the Trump administration. And I think the view from some people I’ve spoken to is that it is not a coincidence, that there is a belief in some quarters, I know there’s a belief in some parts of the bank, that Trump viewed Deutsche Bank and Russia as completely off limits.

And the last thing in the world he wants for his Justice Department to do is bring a public case that is raising more questions about Deutsche Bank’s coziness with Russia and its oligarchs and the Kremlin and about laundering money for them. So again, I definitely do not have evidence that the Justice Department has backed off because of Trump not wanting to have this out there. I do not have evidence of that. But at the very least it’s a coincidence, and certainly inside of the bank some people believe that it is connected.

FC: You write that Deutsche considered letting Trump off the hook for his personal guarantees—amending it to make the Trump organization responsible—but that it backtracked in the face of criticism. But have there been subtler changes that Deutsche has made to his loan terms that haven’t been made public or received much attention?

DE: This is one of the things that I’ve found very frustrating. It’s very difficult to penetrate what is going on currently with Deutsche Bank’s loans to Donald Trump. When he was sworn in, he owed around $350 million to the bank. As is the case with loans in general, there are repayment terms that require you to make periodic interest payments and sometimes principal repayments as well. With Trump, over the past three years he’s been president, if he’s up to speed with the loans, he probably owes less now than he did.

The thing that I’ve not been able to figure out is whether Trump is up to date with his loans. I don’t know if he’s been making interest payments. I don’t know if he’s making principal payments. The bank won’t tell me. And you can read that two ways. One is that maybe they’re hiding something. On the other hand, maybe they’re just being tight with a client.

What I do know is that for a couple of years now the bank has been wrestling with what they would do if Trump were to stop paying back his loans, were to default. And then they’re faced with a series of very ugly, unpleasant choices.

FC: What could they do in that circumstance?

DE: On the most recent loans, they’ve got personal guarantees attached to them, which cover the bulk of the loan. And if Trump were to stop repaying them or otherwise default on the loans, the bank in theory would have recourse to Trump’s personal assets—whether it’s real estate or his planes or the money in his bank accounts at Deutsche Bank. Seizing the assets of the president of the United States—that’s a pretty aggressive thing to do—would obviously have serious consequences for the bank.

It’s hard to imagine Trump just quietly allowing that to happen. On the other hand, if they were to not do that, if Trump were to default on the loans and if they were to not pursue his personal assets as recourse—that would be the bank essentially giving money to the president and that’s completely inappropriate. God only knows what laws, if any, that would be violating. And keep in mind that Trump has repeatedly, just as a matter of course, defaulted on his loans to banks and on his contracts with any party that he’s interacted with over the decades. And so it’s not really a theoretical question. There’s a decent chance that Trump will not pay his loans.

FC: I wanted to ask you about Val Broeksmit, the son of the Deutsche executive who hanged himself in 2014, and who has since accessed his father’s computer files. When Val met with two FBI agents last year, they told him they had started investigating Deutsche money laundering in Russia but had widened their scope. Is there any indication that included Kushner moving money to Russian individuals or any Trump deals?

DE: All I know is what the FBI has told people about their investigation. And one of those people is Val. And I’ve got a very complete recounting of everything the FBI told Val in those meetings. But I’ve also talked to at least two other people who had been interviewed by the FBI about things related to Deutsche Bank. And in both of those cases, the FBI agents have been looking at or been asking questions about aspects of the Trump relationship—in one case, asking about suspicious activity reports that were filed related to Trump and Kushner. And in the other case, they were asking about some transactions that Trump had been involved with, and all of them [were] people outside of the United States.

Just to be crystal clear, the act of the FBI agents asking them questions is not evidence that that is the focus of their investigations. They may be asking a million questions, maybe they’re making small talk, maybe they’re just exploring things. So I want to be really careful not to overstate that. There have been some erroneous reports about this, based in part on what Val has told other people. But I know for a fact that there are these two FBI agents who’ve been going around interviewing a lot of the people I’ve been talking to as well.

FC: Let me run something by you: When Trump sells a property to a Russian at an extremely inflated price, isn’t that effectively a mirror trade? [Mirror trades were at the heart of Deutsche’s money laundering scandal and involved firms in Moscow and London buying and selling identical quantities of the same stock, turning rubles into dollars and skirting the attention of regulators.] For example, if Trump sells a property to a Russian, whether it’s a condo or the mansion in Palm Beach, at an extremely inflated price, it can be done through opaque entities and serve as basically a gift or loan to Trump, no?

DE: Well, that’s the beauty of it. If you’re trying to hide assets or give a big financial gift to someone, the beauty of real estate is that the value is subjective. So yes, in theory, if you have an asset that you bought for $100 and then you turn around a day or a week or a month later and sell it for $1,000, it seems like that’s obviously an inflated price. It’s hard to say because maybe the buyer is stupid or they have a ravenous need for that asset.

Real estate is one of the preferred vehicles for people who are looking to hide money or launder money or whisk money out of countries where it’s not safe to keep it. And Trump is a real estate guy and has done business over the years with a lot of people who fit those characteristics. Back in the mid-2000s, a role that Deutsche Bank played for Trump was helping him find investors, including a bunch of wealthy Russians and people tied to the Kremlin, to invest in or purchase condos in resorts that he was planning or that his name was going to be on. Look, that is kind of what banks do and it’s kind of what wealthy Russians do, but the way it was being done definitely raised some concerns among some executives. Trump is a guy who has worked with organized crime figures in the past. He’s doing business with a lot of people and institutions and countries that are sources of flight capital, and there are big money laundering risks associated with doing business like that. That does not mean that what Trump was doing or what Deutsche Bank was helping Trump do constitutes money laundering or anything else. But there’s certainly a lot of smoke there.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.