To celebrate his 50th birthday, Scott Galloway planned a very special evening. It was November 2014, and the entrepreneur had booked Pioneer Works, a cavernous event space near the waterfront in Brooklyn. Inside the building, candles arranged on a long table set for 100 guests cast a warm, flickering glow across the space’s triple-height, exposed brick wall.

It was the sort of party befitting a man who’d made a small fortune but wasn’t yet a household name. An early e-commerce pioneer, Galloway had survived the dot-com crash, become a halfway successful activist investor, and joined the academy as a bald and bespectacled marketing professor at New York University. More recently, he had founded a branding intelligence firm, L2, where he was tinkering with a new YouTube series highlighting “Winners and Losers” in business.

Galloway would soon go on a winning streak of his own. In 2017, he would sell L2 for $134 million, predict that Amazon would acquire Whole Foods, and publish his first book—a best-selling anatomy of the power amassed by Silicon Valley’s “Big Four” tech giants.

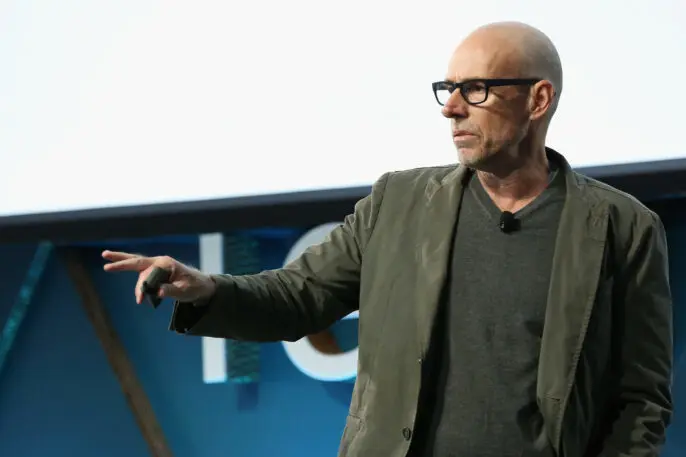

Through these many reincarnations, one thing had remained, and would remain, constant: Galloway’s ability to command a stage. Tonight was no different. In place of his typical material—rapid-fire compilations of data on business trends, paired with no-holds-barred analysis—he focused on the topic of happiness, and specifically Harvard Medical School’s famed Grant Study, a 75-year project that put scientific weight behind the idea that “happiness is love.” (In 2019, he would publish a book of anecdotes and advice titled The Algebra of Happiness.) Despite the softie subject matter, the speech was classic Galloway: diving right to the heart of the matter, whether personal or professional, with self-deprecating, alpha male showmanship.

Every era creates its thought leaders, and ours, it would seem, is Professor Galloway. “Ours,” in this case, being the knowledge workers who dream of innovation economy careers and find relief from corporate-speak in business straight talk that borders on the profane. On the spectrum of aspirational white maleness, from globe-trotting hedonist Anthony Bourdain to “Hot Douche” crooner Adam Levine, Galloway’s brand lies somewhere in the self-aware middle: Great intellectual company. Solid biceps. Maybe an asshole.

The wider world caught a fitting first glimpse of Galloway in 2010 when a blistering email he wrote to a tardy student went viral (“Get your shit together. . . . Get the easy stuff right”). Today, prospective NYU Stern students genuflect toward him in their applications, and Galloway earnestly talks of wanting to become “Peter Drucker for the digital age,” positioning himself as the successor to the renowned management guru and, potentially, as “the most influential thought leader in the history of business.”

Not everyone is rooting for him. His rise has united a cadre of haters, led informally by high-profile Silicon Valley investors, such as Jason Calacanis and Keith Rabois, who trot out the classic “those who can’t do, teach” retort to his critiques of their portfolio companies. Such is the enmity for “Prof G” amid the VC class that in August, someone associated with the @VCBrags parody Twitter account published an “official trailer” for “Professor Cold Takes.”

https://twitter.com/vcbrags/status/1295505519021633539

The two-minute video covers Galloway’s most egregious failed predictions, including his forecasts that Tesla would drop to below $100 a share (it rose to a 5-for-1 split-adjusted $498 at the end of August 2020 and as of late September is trading around $375) and that Macy’s would outpace Amazon (it has not). One anti-fan took a single notorious Galloway tweet predicting a bleak future for 15 tech companies and created an “Inverse Prof Galloway (IPG) ETF Performance Tracker,” showing that you’d have an annualized return of approximately 150% if you invested in the public companies that Galloway trashed.

Galloway brushes off his Twitter trolls, but other disputes cut closer to the bone. It’s best not to mention a certain partner at the storied venture firm Sequoia Capital, for example—and the feeling is mutual.

These days, thanks to L2’s sale (Galloway was the majority owner), Prof G could be kicking back and enjoying the ocean breeze at his $10 million beachfront home in Florida. Instead, in between taping episodes of Pivot, the Vox podcast he cohosts with journalist Kara Swisher, he’s embarking on one of his most ambitious ventures yet. Dubbed Section4, the startup is his first foray into higher education, an industry whose excesses and inefficiencies have been on his mind for several years. The idea is to condense semester-long business school courses into two- or three-week online intensives costing upwards of $750 and led by top professors—Galloway included, of course. So far, over 2,000 people have completed Section4 “sprints,” as the startup’s courses are called, many drawn in by Galloway’s pitch.

“For the last 20 years I’ve taught 5,000 students in person, and over the next five years I want to teach 50,000 online,” Galloway says. “But I don’t want [Section4] to be personality-driven. I’m hoping it becomes a place where people come to learn, not where people come to take a class from one professor.”

It is, as he suggests, a goal that is in tension with the story of his career. The autobiography of Scott Galloway is an apple-pie homily: the son of a single mother who got into UCLA, despite his middling academic record, and went on to start nearly a dozen companies, becoming wealthy and self-actualized along the way. The life lessons, which help sell the Galloway brand, are meant to be universal. But the history—of fights and failures, striving and salesmanship—is complicated.

Drucker, still regarded as the business world’s master philosopher 15 years after his death, wrote that he wanted to be remembered not for his successes, but for his contributions to organizations bigger than any one individual. Galloway, who often pokes fun at his own midlife crises, appears to be grappling with a similar concern as he dreams of bringing MBA-quality education to the masses: Can a personal brand outlive its creator?

Galloway has been starting companies for three decades. As early as 1990, he incorporated a video store called Stress Busters before matriculating at Haas Business School at the University of California at Berkeley. There, he met fellow student Ian Chaplin in line at Top Dog, a Berkeley institution, and immediately recognized a fellow entrepreneur. The two first teamed up on a marketing project for Yamaha, using an online survey to capture teenagers’ views on motorcycles.

“You weren’t supposed to use the internet for business at the time,” Chaplin recalls. “We just started doing it.”

To administer the market research survey, they recruited fellow B-school students from across the country, offering them titles such as “senior researcher” in return for the free labor (eventually, they paid by the hour). Chaplin broadcast the job opportunity to other campuses via fax, overnight-shipped laptops preloaded with assignment information to new hires, and pulled survey data from the field via modem. “It’s very Mission Impossible-like,” Galloway told an Inc. reporter in 1993.

The cofounders soon realized that clients were looking for a specific type of market research: They wanted to know how to build their brands. “This was the height of the brand era,” says Galloway. “This was Intel recognizing that their ability to create a premium brand was just as important as the R&D they were spending.”

But during the presentation, Galloway won the day. After CEO Bob Haas (of the same Haas family for which Berkeley’s business school is named) compared Levi’s to Coca-Cola, Galloway wouldn’t have it: “You can’t compare yourself to Coca-Cola. It’s the Jesus Christ of brands.” Everyone in the room froze. But Haas seemed to appreciate the candor. Levi Strauss soon became Prophet’s most important client, commissioning roughly a dozen projects.

Galloway’s gift became Prophet’s biggest asset. At client meetings, he’d let others present the data, saving himself for a high-octane close. In the last 10 minutes, “he’d uncoil himself and start ranting at people,” says Chaplin. “They loved it.” What looked like an act was built on a central insight: “There’s power in being able to just make a decision,” Chaplin adds. “We were solving an argument with data, and Scott could do it in a compelling way.”

Five years later, Prophet was thriving, but Galloway was ready to move on. He was drawn to the magical early days of a startup, when a small team can create something out of nothing. For him, the blood, sweat, and tears were an attraction, not a drawback. “He didn’t have a lot of patience for people who weren’t strong performers or weren’t working nights and weekends,” says Hallquist. “He thought a startup had to be your entire life.”

After advising clients such as Williams-Sonoma on their digital strategy and seeing the money that could be made in online retail, Galloway and Chaplin decided to have a go of it themselves. “You could just feel it all starting to happen,” Chaplin says. “The internet was a communications tool, but people were going to start making money off of it.” Or as Galloway put it over lunch with an Ad Age reporter at Asia de Cuba in 2000: “We decided that being a consultant was like being a sex therapist who couldn’t get a date.”

In a pre-Google web dominated by alphabetic directories, they tried to stand out by positioning themselves near the top. Literally. Their first online store, Aardvark Pet Supplies (think Pets.com before Pets.com), was one of the early destinations in the AOL marketplace, alongside a bookseller named Amazon. The following year, Galloway and Chaplin launched 911 Gifts, promising panicked gift-buyers salvation in the form of overnight delivery. Their experimental foray into e-commerce started to see some early traction, and by October 1999 they were ready to move upmarket, renaming the company RedEnvelope and raising $21 million from Sequoia Capital. During that Christmas season, the company sold more merchandise in two months than it had in the prior two years, including 750 full-body-massage mats and 1,100 chocolate body-paint kits, according to a New York Times Magazine feature on the up-and-coming site. (Never mind that those results required spending $4 on marketing for every dollar in gross sales.)

It was a heady time for Galloway. In early 1999, he had been appointed a Global Leader for Tomorrow by the World Economic Forum in Davos, Switzerland, placing him in the company of Jeff Bezos, CEO of Amazon, and Eric Schmidt, then the CEO of Novell. Meanwhile, Sand Hill Road’s top investors were throwing multi-million-dollar checks in his direction. “If you tell a 34-year-old that he should be a billionaire, he’s inclined to believe you,” he says. “And that’s what the market was saying.”

But Galloway had started to sour on e-commerce, on fundraising, on the weather, on his marriage, and even on himself. “I didn’t like myself a lot,” he says. “I didn’t like San Francisco. During the day [you’d see] some of the most rapacious business behavior in the world in terms of founders finding ways to substitute equity for a living wage, venture capitalists taking every opportunity to dilute founders. Then at night all of us would come together to save the whales.”

He was in his 30s, and he felt the clock was ticking. “The end, for me, always seems to be approaching really, really fast.” He booked a ticket to New York.

It wasn’t Galloway’s first time living in Manhattan. After spending his college years at UCLA, as he puts it, “making bongs out of common household items and watching The Planet of the Apes trilogy over and over again,” he talked his way into the investment banking analyst program at Morgan Stanley (by burying any mention of his 2.27 GPA). “I thought I’d be more awesome and impressive to my mom and more attractive to women if I became an investment banker,” he says.

As he describes it in The Algebra of Happiness, he spent most nights getting “shitty drunk at a very cool place with what appeared to be other successful people.” That cool place was often Limelight or Tunnel, where he splurged on bottle service and mingled with models and finance friends. By day at Morgan Stanley, he was confronted by the inevitable hangovers, as well as his neuroses. “I was too insecure to be successful in a big company,” he says. “Anytime people went into a conference room, I thought they were talking about me.”

This time around in Manhattan, Galloway was older, (somewhat) wiser, and more financially secure, because his Web 1.0 exploits in San Francisco had finally paid off. A Japanese conglomerate acquired Prophet for $28 million in 2002, giving him a chance to cash out. Then RedEnvelope went public in 2003—at a far more modest valuation than it might once have garnered, but an exit nonetheless. Galloway was now wealthy (if not by Silicon Valley’s standards, then by the wider world’s). Soon he was back to his old habits at new haunts, such as Lotus and Pangea.

On a trip to St. Barth’s after his move, Galloway met Jay Friedlander, a banker and native New Yorker. “I had organized a house with a group of friends, and he was in a house with some other friends,” Friedlander says. “I got the impression that he was less than enamored with his house guests. He said, ‘I like your crew.’ He just sort of attached himself to us.”

Galloway was keen to develop a new set of relationships to match his new life. In 2004, he and Friedlander cofounded Carbon, a $5,000-per-year men’s club for entrepreneurs and executives. (That same year, he joined NYU Stern’s faculty as a marketing professor.) Galloway provided startup capital to get the club off the ground, and Friedlander took the lead in planning the club’s events, which ranged from cognac-tasting dinners to weekends in Montreal for the Formula 1 Grand Prix. During the summer, Galloway would host unofficial after-parties for Bridgehampton Polo Club matches at the Water Mill house he co-owned.

Friedlander soon learned that Galloway had a knack for identifying trends—from poker to John Varvatos—before they went mainstream. Over time, Carbon got more sophisticated about partnering with luxury brands, which were interested in reaching the club’s membership. There was a day of off-roading with Land Rover and, what Friedlander considers the club’s peak, a round trip jaunt to London via Eos, the (now defunct) all-business-class airline. Forty of the plane’s 48 lie-flat seats were taken up by Carbon members and their plus-ones, all of whom flew on the airline’s dime. “How am I ever going to do anything better than this?” Friedlander recalls thinking.

The gossip press eventually got wind of the group. Guest of a Guest described it as a “frat for millionaires”—”sort of like the thing Chuck Bass would whip up on a whim, except for a much older set.” It also reported that 30% of members had a net worth of over $10 million. “Desperate middle aged guys longing for those ‘models and bottles’ scenes,” sniped one anonymous source. When pictures of Carbon events started to emerge in 2009 and 2010, amid the depths of the Great Recession, they only served to reinforce the idea that Carbon was cringeworthy—or, even worse, lame.

“I wanted to create a more social version of YPO in New York,” Galloway says of his original intent, referring to Young Presidents’ Organization, a CEO community. He recalls the first two Carbon events he organized as talks delivered by a cardiothoracic transplant surgeon and an economist; the third was a Halloween party. “Fifty people came to the first two events, and 400 came to the party. It slowly but surely digressed into what I’ll call, basically, hedge funders and bankers partying.” He sold his stake in 2008.

While Galloway was establishing himself in New York’s downtown social scene, he was also earning a reputation as a brash and polarizing figure in corporate boardrooms.

Galloway had stepped down from RedEnvelope’s board of directors in 2000, but he returned in 2002, before the company’s IPO. His homecoming didn’t last long. In 2004, with RedEnvelope’s stock in decline, Galloway began agitating for change, including a management shakeup. He also questioned the company’s decision to sign a $2 million contract with an inventory management software provider that Sequoia had invested in just months before, when RedEnvelope’s existing inventory software was operating at 99% accuracy. “The timing smells bad,” Galloway told the San Jose Mercury News.

Undeterred, Galloway initiated a proxy fight, urging shareholders to elect his board of directors slate, including himself. “This is a stock that should be 30 [dollars a share] and is at 7,” he told The New York Times. ”I’m not a corporate rights crusader. I’m looking to get rich.”

The fight quickly turned ugly. “I started getting calls from old girlfriends and people I worked with, saying, ‘Kroll [Inc.] is calling, trying to dig up dirt on you.’ So before there were even any sort of discussions around trying to come to some sort of an agreement, they hired a firm to investigate me,” Galloway says. “They were trying to intimidate me.” He was also grieving: That July, just a week after filing his initial proxy statement, his mother died of cancer.

Moritz, for his part, told the Times that he was trying to pursue a more patient path to growth than Galloway’s hotheaded one. ”We are not about to make the mistake of emulating a crash-and-burn dot-com strategy,” he said in the weeks leading up to the August 2004 annual shareholders’ meeting. (Moritz declined to comment for this article.)

Management, meanwhile, did not take kindly to Galloway’s decision to invite a RedEnvelope equity analyst to a Carbon event while the proxy battle was raging. By the time the annual shareholder meeting took place, CEO Alison May had to warn attendees that a sergeant at arms was on hand to remove anyone who brought a “personal attack” against a board member.

In the end, Galloway wasn’t able to garner the shareholder votes to launch his coup, despite spending roughly $250,000 on legal fees and related expenses. “A grand total of 2% of the shares that weren’t mine voted with me,” he says. “My proxy solicitor said those were probably a mistake. They probably filled out the form incorrectly.”

In a surprise twist, his proxy war caught the eye of activist investors. “A hedge fund called me and said, ‘You seem to be crazy—and right about RedEnvelope. Would you like to join up and—I think their term was, ‘rattle some other cages of underperforming management,'” Galloway recalls. He was game. The hedge fund would provide the majority of the capital, and Galloway would provide the fire and brimstone.

Galloway and his activist backers had an early win with Avenue, a plus-sized-clothing company. They argued that the company should invest in digital; management dutifully launched a website; the stock tripled in value. “I thought, ‘Wow, this is an easy way to make money,'” says Galloway. He began to set his sights on bigger fish and found a ready partner in Phil Falcone’s Harbinger Capital. In spring 2008, Harbinger amassed a 4.9% stake in the New York Times Company and installed Galloway on the board.

As with Avenue, Galloway’s demands were relatively simple: invest in digital, and divest any ancillary assets (he also wanted the media company to “turn off” Google). But management, in this case, was far less receptive. New York magazine quoted Times publisher and chairman Arthur Sulzberger Jr. as saying he “can’t believe the guy’s arrogance,” in reference to Galloway. According to The Washington Post, meetings between the two were “awkward.” The experience was “contentious and exhausting,” Galloway says, looking back.

However prescient Galloway and his allies may have been, their timing was off. The Times Company’s stock price fell past the point that the activists could sustain, and they were forced to sell for a significant loss.

Galloway might have continued on the activist track if it weren’t for the birth of his first son to his girlfriend, now wife, in late 2008. (The financial crisis, which knocked many hedge funds out of business, didn’t help either.) “It’s one thing when your career isn’t going well, and it’s just you,” he says. “Once you have a kid, other people are depending on [you]. And so I really wanted to get L2 right.”

L2, Galloway’s most successful venture to date, was also his most calculated. No longer the twentysomething founder scratching a personal itch, Galloway built L2 based on a Deloitte study that compared private companies that had sold for 5 or even 10 times revenue and private companies that had sold for one or two times revenue. Over a decade later, he can still cite the distinguishing characteristics of the most successful exits without hesitation: one, they owned a niche; two, they had recurring revenue; three, they had technology at their core; four, they were international; and five, they had defensive intellectual property.

L2, he decided, would master each attribute.

Remarkably, it did. As a niche, Galloway gravitated toward luxury, after discovering that the sector had attracted very little in the way of academic analysis or analyst coverage, despite its massive size and recent growth in Asia. His first product, a ranking of the digital competence of over 100 luxury companies, made its debut in 2009 under the aegis of “NYU think tank LuxuryLab” (rebranded L2 after Procter & Gamble came calling to inquire about its respective ranking).

Over time, he charged any company that wanted access to their data—over 1,000 data points regarding brands’ digital operations, as well as a ranking of their performance versus their peers—an annual subscription fee. He opened a London office. And he codified L2’s “Digital IQ Index,” expanding it to incorporate adjacent sectors, such as beauty.

Even L2’s sale timing was calculated. After self-funding the business for its first several years, Galloway was approached by more than one prospective buyer. Instead of exiting, he ended up taking venture dollars from General Catalyst. Paul Sagan, the partner who led the deal, had previously invested in RedEnvelope as an angel investor, following Galloway’s fight for control from the sidelines. “Scott can be a pretty acerbic guy,” Sagan says. “But my experience was, he always seemed to be fighting for the right thing—taking care of everybody else, not taking care of himself first.”

With General Catalyst’s backing, L2 was able to further invest in technology and grow. By the time Gartner came knocking in 2017, Galloway was able to command the revenue multiple he had envisioned. As majority owner, he made out handsomely.

But L2 got more than lucky. Former employees recall Galloway, who now calls himself “the Dawg,” working like a dog. Every Thanksgiving, he would fly to Europe to court clients on the days when other U.S.-based pitchmen were taking turkey naps. In the evenings, he would go home to join his young sons for dinner and bedtime, and then return to the office, often staying until 2 a.m. Occasionally, when deadline stress was running high and morale was running low, he’d channel his former party-host persona and take L2’s young staff out for drinks at Eataly or La Esquina. Afterward, they’d return to the office and finish their projects in the wee hours of the morning. (This drove some managers nuts.)

L2 also marked Galloway’s turn to celebrity. Although he’d become a regular talking head on Bloomberg TV, to market the company he began recording weekly YouTube videos on the theme of “Winners & Losers,” touching on business trends with accessible framing (“Apple, Android, and the Seven Dwarfs”). Each one features Galloway speaking with confidence against a simple white background, as animated data charts sprout alongside him. The videos were soon getting hundreds of thousands of views.

“That really put Scott on the map,” says Katharine Dillon, L2’s chief creative officer and a professor at NYU’s Interactive Technology Program. “He started getting recognized on the street.”

For the first time, the wider world could see what had made Galloway such a compelling (and provocative) boardroom figure. “He has a lot in his head and kind of spontaneously combusts with it all, but he’s also entertaining and authentic,” says Dillon. “He speaks the truth, and he has the data to back it up.”

The videos, as well as his growing number of public appearances, were as carefully planned as L2 itself. “Almost like a sketch comedian, he workshops these things in front of thousands of students and hundreds of executives before they ever make it into a book or these viral moments on a TV network,” says early L2 employee Colin Gilbert. “He’s got a very hard-working apparatus behind him that has gone down a lot of rabbit holes.”

Galloway’s biggest viral moment of all happened in 2017, several months after his appearance at an annual tech conference in Munich.

His talk there caught the eye of longtime technology journalist and Recode/Decode podcast host Kara Swisher, who invited Galloway on her show in June. The two discussed Amazon, and Galloway predicted that the e-commerce giant would buy Whole Foods.

“I’ve been predicting they’re going to go into stores for five years,” he told Swisher. “They haven’t found [a] model that’s going to work for them yet. I still believe they’re going to buy a Macy’s or Carrefour or something like that. I can’t imagine why they wouldn’t buy Whole Foods, for example, just because of their urban locations.”

Four days after the episode aired, Amazon announced its deal to acquire Whole Foods for $13.4 billion.

With Whole Foods, Galloway readily admits, “I got very lucky.” He’s more willing to take credit for his other notable call, a brutal skewering of WeWork—a favorite target since 2017—after the real estate startup filed to go public in August 2019. “I just feel like I brought this unique attribute to that, called math,” he deadpans. “I got the S-1 and started reading through it, and it just seemed so outrageous and comical what was going on there. Having been on the other side, having been one of those charlatans, I guess—you were the emperor with no clothes, so you have an easier time spotting people that are naked.”

He counts his takedown of WeWork as not simply a smart call, but a moral victory. “Just because they’re supposed to go public at a valuation of $50 billion, just because a successful investor has said they’re worth $50 billion, just because Goldman Sachs says they’re worth $50-$80 billion, does not mean they’re worth $50 billion,” he says. “What’s it worth now? $3 billion? Public markets investors—teachers and firemen and anyone invested in a pension fund or an index fund—they would have registered those losses. Instead it was SoftBank and WeWork employees.”

He adds: “I enjoy and feel an obligation to highlight when VCs are flinging unicorn feces at tourists to the unicorn zoo.”

In this current moment, with its glut of unicorn feces, that attitude has struck a chord. Galloway’s first appearance on Recode/Decode, for example, generated a spike in the podcast’s audience. “The numbers weren’t as high as Elon Musk, but they were up there in terms of downloads for someone who was marginally known,” says Swisher. When she went on the hunt for a cohost for her new podcast, Pivot, Galloway’s name rose to the top of the list, which also included Chamath Palihapitiya (another Recode/Decode audience favorite).

The Galloway-Swisher dynamic is an unusual hybrid of Old Hollywood-style repartee and adolescent tech bro humor (“The nipples on my brain are aroused, Kara!”). Despite its business-news subject matter, the show, which now releases two episodes a week and spawned a five-week summer live stream series in lieu of what had been a series of live events, can also be surprisingly personal. The news of a Robinhood trader’s recent suicide, for example, prompted Galloway to reflect on the role of technology in his sons’ lives.

“Someone at Vox Media said to me, you know Scott’s really offensive, maybe we should do something about that,” says Swisher. “I said, the whole show is, Scott says something offensive, I hit him, and then we get the pearl of wisdom. That’s what people love.”

Galloway’s pivot to stardom has opened new doors for his career and his entrepreneurial aspirations. He reaches hundreds of thousands of people each week via his weekly No Mercy/No Malice newsletter, the twice-weekly Pivot podcast, and his own podcast, The Prof G Show, and more than 284,000 followers on Twitter and more than 70,000 subscribers to his YouTube channels. Meanwhile, he continues to teach at NYU.

“There’s a general kind of gestalt in academia that you can say anything you want, you can offend whoever you want, as long as it’s in the pursuit of truth,” Galloway says. “You know, that matches my personality really well.”

Now, with Section4, he is looking to monetize that audience in new ways, as well as expand beyond it.

Higher education has been a recurring theme for Galloway, who these days returns his teaching salary and in 2017 donated $4.4 million to Haas for a scholarship program. He sees the sector as an extension of the luxury world that he studied at L2, with elite institutions charging eye-popping prices and strategically limiting supply in order to burnish the exclusivity of their Ivory Tower brands. It’s a model that runs counter to his oft-proclaimed public university roots, and the opportunities that California taxpayers afforded him.

During the pandemic, as Section4 has been ramping up and unveiling its first courses, Galloway’s haranguing of higher ed has reached a fever pitch. New York magazine published a feature-length interview with Galloway in May on “The Coming Disruption” in higher ed, without mentioning Section4. He has criticized universities for choosing profit over safety in resuming in-person learning, analyzed dozens of universities that he believes are likely to fail, and predicted that top schools such as MIT will partner with Big Tech companies to develop new forms of credentials.

As for his own piece of the puzzle, he says he is carving out a segment of the market that is distinct from his role at Stern. “It’s just an entirely different product,” he says of Section4’s condensed MBA course “sprints,” which cover topics such as brand strategy in an interactive online format. “There’s no in-person. It’s two to three weeks. It’s 10% of the price. So it’s not as if I’m saying negative things about [higher] education, and [then] people are saying, ‘Oh, I’m not going to enroll at MIT; I’m going to go to take the Prof G sprint.'”

NYU, he adds, does not see Section4 as competitive. “The words I would use is they’re just very supportive. Keep in mind, I gave NYU stock in L2, which worked out really well for them.” (L2 investor General Catalyst is backing Section4, as are former Time Warner CEO Jeff Bewkes and former AOL CEO Tim Armstrong.)

Founded on the heels of Galloway’s 2017 bestseller, The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google, Section4 was described by its first CEO, Tom Phillips (the founding CEO and publisher of Spy magazine), as an effort to build “a rebel force to speak truth-to-power and arm the resistance (startups and Fortune 1000 firms) with data and analysis to compete with tech monopolies.” Section4 would accomplish this, Phillips wrote on his LinkedIn profile, by developing a “business media company that delivers data-driven journalism and insight via video and audio.”

These days, Section4 has toned down the references to rebel forces and media brands. Current CEO Gregory Shove, who got to know Galloway nearly two decades ago as a fellow RedEnvelope board member, says Section4 is focused on “helping leaders compete in the age of tech monopolies, platforms, and change.” He’s been pleased to see half a dozen companies send teams of employees to enroll in the courses as a group. “That’s an indication to me of what the opportunity is: executive ed,” he says. In particular, he is aiming to serve marketers, who are likely to find value in Section4’s contemporary case studies. “They need to get reskilled every few years. We want to serve that decision-maker and offer them a robust but not exhaustive catalog of courses.” So far, two other professors have joined the learning platform. The first to lead his own Section4 course will be Adam Alter, who, like Galloway, is a popular professor at NYU Stern. Alter’s “sprint” on product strategy is scheduled to launch later this fall.

For now, however, Section4 remains at its core a Galloway production, a vehicle for the Big Dawg to entertain and enlighten. When a Fast Company reporter made the pilgrimage to a live Section4 event at NYU on a chilly evening in mid-January, the lobby of the Kaufman Management Center had been adorned with banners heralding fabled Galloway prophecies. Dubbed “Prof G Predictions 2020,” the $50 “experience” promised a live unveiling of Galloway’s crystal ball slide deck, plus a champagne reception afterward. Inside the auditorium, the crowd was mostly white and male, with men outnumbering women 9:1. (Like a progressive Jordan Peterson, Galloway is the rare figure willing to talk openly about his perspective on masculinity. “Feeling masculine is hugely rewarding,” he writes in The Algebra of Happiness. “As a younger man, I felt masculine by impressing my friends, having sex with strange women, and being ripped. . . . Masculinity now means relevance, good citizenship, and being a loving father.”)

About 90 seconds before the 6 p.m. start time, Galloway emerges from backstage and stands near a lectern positioned stage right. His tall, muscular frame is accentuated by his outfit: black blazer, slim-fitting white dress shirt with a skinny grey tie, and dark wash jeans. His signature chunky-framed glasses rest mid-sternum, affixed around his neck by a lanyard. Galloway notes that in addition to the 400 people present at $50 a head, another 600-plus are watching via live stream ($40 per ticket) in 22 countries, from Albania to Argentina. Do the math and that’s more than $40,000 for teaching one evening class.

Before racing through 190 slides in a breathtaking “4,200 seconds,” as he says, Galloway explains why he’s so fond of making predictions—and why he doesn’t care if he gets them wrong (and why you shouldn’t care, either). “Eisenhower said that ‘Plans are useless, but planning is invaluable.’ I think predictions are fairly useless, but predicting is invaluable.” Ultimately, he says, he does this because “scenario planning is important.”

For fans of the Galloway oeuvre, the evening plays like seeing the Rolling Stones at Carnegie Hall. He’s a bit reined in—the rock-n’-roll marketing professor constrained in a tie—and playing the hits. Disney has won round one of the streaming wars (No Mercy/No Malice, November 22, 2019). FedEx would be acquired or lose 30% of its value in 24 months (No Mercy/No Malice, December 20, 2019). SoftBank Vision Fund 2 would not happen (flicked at in pieces published on October 11, 2019, and January 10, 2020, four days before this event). If anyone in attendance seems to mind, they don’t let on. The crowd laughs at every road-tested riff, no matter how often they’ve heard it before, as when he calls Jeff Bezos the mother of all welfare queens.

Only in the Q&A at the end of the evening does Galloway resemble the bomb-throwing podcast star he’s become. As everyone from former students to his book agent lob questions his way—about niche streaming services, the 2020 Democratic presidential campaign, crypto, and yes, Tesla—he relaxes a bit while occasionally confessing his latent insecurities. During a discursive monologue about why the frothy startup climate made it a terrible time to launch a new business, he stops for a moment to ask rhetorically, “Why did I do it?” referring to Section4, ostensibly the company behind this event. “I have a desperate need for relevance, and I am worried that if I don’t stay mentally engaged, I’m gonna die.”

Additional reporting by David Lidsky

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.