There was a time, just a few decades ago, when coffee was a simple affair. You’d wake up, mosey over to a diner or coffee shop, and drink whatever coffee they had brewed in their industrial-size pot. But those days are long gone. If you stop by a cafe today, your barista will pelt you with a stream of complex, existential questions: Do you want a single-origin brew from Guatemala with a tart palate? Or a blend with a sweet and smooth finish from an artisanal roaster based Topeka, Kansas? Or maybe you want to spring for $16 cup sourced from Yemen?

Welcome to the world of third wave coffee. Over the last 15 years, craft coffee startups like Blue Bottle, Ritual, Verve, Stumpton, La Colombe, and Intelligensia have burst onto the scene with coffee that was more sophisticated—and expensive—than anything that had ever come before. It’s often described as ‘third wave’ coffee because it builds on the previous two waves: The first, which began in the early 20th century, was when coffee first became widely adopted thanks to companies like Maxwell House and Folgers that invented cheap, instant coffee that people could drink at home. Then, in the 1990s, second wave companies like Starbucks, Peet’s, Costa, and Caffe Nero entered the scene, creating a cafe culture that made premium, $4-a-cup coffee normal.

Starbucks quickly rose to the top, scaling at a staggering pace. In 1990, there were only 84 Starbucks stores, but by last year, the company had 29,324 stores and generated $6.3 billion in revenues. Starbucks dominated the coffee industry, but it also cultivated a new kind of educated coffee drinker, creating fertile ground for a new crop of startups to enter the scene, offering an even more elevated take on the beverage. Starting in the early 2000s, brands like Blue Bottle and Ritual entered the market, sourcing beans directly from farmers around the world, and roasting them in small batches to create distinct flavor profiles.

Third wave coffee startups started as niche brands, catering to coffee aficionados in coastal cities and growing steadily. But industry experts believe that third wave coffee is about to hit a tipping point. Over the next five years, the sector is expected to enter a period of explosive growth that will make high-end craft coffee more mainstream, ballooning from $35 billion in 2018 to $85 billion in 2025.

The cash infusion

What’s behind this growth? Part of the answer is simply the cold, hard cash that is flooding into the industry right now. Investors see the potential for these startups to become massive, lucrative businesses, and perhaps replicate Starbucks’s success. One investor I spoke with said that coffee is a unique product, because it is something people consume every day, but unlike toothpaste, it’s not a commodity.

“It’s very rare that you have a daily-use product that customers feel passionate about,” says Ben Fischman, who has invested in the coffee subscription platform Trade. “People use shampoo or paper towels every day, and they’re fine with it. But they don’t have the same emotional relationship with these products that some people have with their morning cup of coffee, which is part of how they wake up; it’s part of their ritual.”

Over the last few years, investors and holding companies have poured tons of cash into third wave brands. In 2015, European holding company JAB bought Stumptown and Intelligentsia for undisclosed figures. In 2017, Nestlé bought a majority stake in Blue Bottle for $425 million along with Chameleon Cold Brew, for an undisclosed amount. And besides these acquisitions, other coffee startups are being fueled by VCs. Philz Coffee has raised $75 million to date, and Bulletproof Coffee has raised $68 million, largely from tech investors. Wandering Bear, a cold brew brand, raised $8 million in funding last year.

“There’s a lot of consolidation that is happening right now,” says Burak Alici, founder of VC firm QVIDTVM, which has invested in Blue Bottle, Costa Coffee, and the German coffee brand D.E. Master Blenders. “But this is also signaling to entrepreneurs that there is still lots more room for growth, and that there’s still space for startups to enter the market.” Indeed, new brands are popping up all the time. Just this summer, a startup called Canary Cold Brew entered the market selling single-size cans of cold brew on a subscription model, with morning cans and afternoon ones with half the caffeine.

All of this funding, along with the new brands that keep entering the market, means that third wave coffee brands now face both an opportunity and a challenge. They can now introduce their brands to a wider audience, but the increased competition also means they are now under pressure to scale quickly. One strategy for delivering that growth is developing new products and experiences that go beyond what most consumers expect. “When you have a category that people have an emotional connection with, it fosters the opportunity to offer it in new and innovative ways,” Fischman says. “When you have a passionate and engaged consumer, you can find ways to provide solutions to them all the time.”

There are brands like Blue Bottle, which are sourcing extremely rare beans and selling cups of coffee for $15 and $16. There are brands like Verve, which have built entire innovation labs to come up with new formats for their craft coffee, including flash-chilled coffee and high-end instant coffee. There are new Spotify-like platforms to help coffee drinkers discover small roasters they would never have stumbled upon. And third wave coffee brands in every single state across the country have developed beautiful, experiential coffee shops that surpass anything you could get at a Starbucks.

The stakes are high for these craft coffee startups, so many of which have taken on the kind of investments more typical of the tech industry. As a result, they aren’t just offering new beans and roasts—they’re completely redesigning the experience of coffee drinking.

Inside a coffee innovation lab

If you’re walking through the Arts District in Los Angeles, you might spot a new coffee shop that just moved into the neighborhood this past August. It was built by the cult Bay Area coffee brand Verve. Calling it a cafe doesn’t quite do it justice. Customers can come in for a cup of coffee decorated with latte art along with a meal designed to pair perfectly with the drink they’ve chosen, but the 7,000-square-foot space also has an industrial roastery on site along with an innovation lab where employees develop new coffee products.

After graduating from college, Colby Barr and Ryan O’Donovan founded Verve in 2007 in their hometown of Santa Cruz, California, with the vision of creating “farm to table” coffee in which they would source and roast the beans in small batches themselves. This was the very start of the third wave: When they launched, the only other artisanal coffee roasters in California were Ritual and Blue Bottle.

Over the last 12 years, Verve has grown to become a major player in the world of third wave coffee, generating tens of millions of dollars in revenue annually, with coffee shops in California and Japan. (As a private company, Verve does not disclose its earnings.) Verve’s growth pales in comparison to some other third wave coffee companies that started around the same time, partly because Verve’s founders have chosen not to accept venture capital funding. “We’ve said no to investment because we like having autonomy over the business,” says Barr. “We don’t like having five-year plans. And we like being able to experiment and innovate without worrying about the risk of failure.”

Nonetheless, the exponential growth in their industry has put pressure on Verve’s founders to continue to scale. They’ve focused on increasing revenue by developing new retail experiences along with new formats for consuming their coffee. For instance, while cold brew has been popular for years, O’Donovan believed that the traditional method of steeping coffee grounds in cold water did not accurately capture the taste of the brand’s coffee, which requires heat to bring out various notes. So Verve created a Flash Brew, which involves taking brewed coffee, quickly chilling it, then canning it. The company also entered into a partnership with a startup called Dripkit, which creates disposable paper kits that allow you to make pour-over coffee at the office or on a trip.

The brand’s latest innovation is an instant coffee that the founders believe accurately captures the flavor of one of Verve’s most popular blends, called Streetlevel. (Tagline: “This ain’t your grandma’s instant coffee.”) While instant coffee has been around for decades, it took Verve years of R&D to get the right formula. It’s not as simple as you might imagine to get the calculations right: First, you need to perfect the flavor of the coffee, then brew it into a concentrate, then dehydrate it into a powder. “The trick is to perfectly source and brew the coffee, then suspend it in time,” says O’Donovan. “You have to get all those pieces in place, and we know from experience that it is not easy to get it right.”

The Spotify of coffee

Now, in addition to the third wave brands themselves, there are new businesses emerging to help customers discover these new brands. In some ways, the scenario is similar to what happened in the early 2000s when streaming made music widely available, and platforms like Pandora, Spotify, and Apple Music tried to help listeners find music they might like.

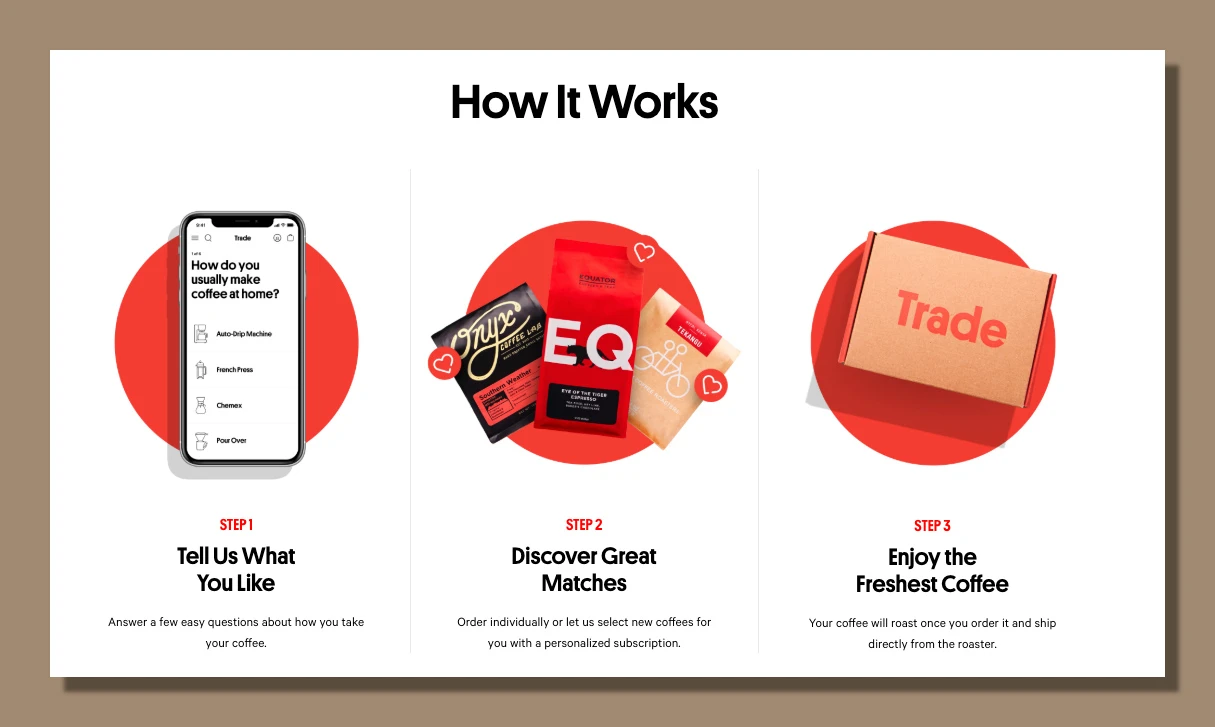

In the coffee world, coffee subscription businesses like MistoBox and Bean Box have effectively become discovery platforms. The fastest-growing and most high-tech among these subscriptions is Trade, a two-year-old startup that uses a matching algorithm to identify a customer’s personal tastes when it comes to coffee and match them with particular roasts from third wave brands. The brand has matched 2 million customers so far.

Trade has an in-house coffee expert who tastes each of the more than 400 coffees on the platform, assessing the flavor profile of each one. When the customer arrives on the company’s website, they answer questions about their tastes, and the platform matches them to a particular coffee. They receive a bag of coffee at home, then provide feedback to fine-tune the algorithm. Trade serves as a retailer for coffee roasters and takes a cut of each sale. For the roasters, Trade isn’t just a good way to sell bags of coffee; it also serves as a marketing engine, helping customers across the country discover them.

Some customers will pause their subscription when they find a coffee they really like, but the point of the platform is really to serve the needs of customers who are looking for variety. “We’re sometimes compared to a dating site, but that’s not exactly right,” says Mike Lackman, Trade’s CEO. “We’re much more like Spotify. Our goal is to offer people interesting new flavors that we believe they will like.”

Specialty coffee comes to small town, USA

From his vantage point, Lackman is able to see how the world of craft coffee is evolving. He’s noticed several trends. For one thing, there are hundreds of third wave coffee brands on the market now, and more are popping up every day. But where coffee shops and roasters exist is changing, too.

In the early days, specialty coffee brands tended to be in coastal cities like New York and San Francisco. But these days, Lachman frequently finds excellent roasters in small towns, including Doma, which is based in Post Falls, Idaho; Necessary Coffee, which is based in Lancaster, Pennsylvania; and PT’s Coffee, which is based in Topeka, Kansas. “Part of my job is traveling across the country to find these roasters, and it’s clear that the craft coffee movement is beginning to catch on around the country,” he says.

Lackman believes that the growth of speciality coffee is coming from beyond the young, urban consumers who were the early adopters to the third wave movement. He says that Trade’s customers often run the gamut, from people who are entirely new to the coffee drinking experience, to older consumers who are only just beginning to switch from their Folger’s coffee to better-quality stuff. “Coffee is a unique product because the market for it is enormous,” says Lackman. “This means that third wave brands have the opportunity to convert almost every demographic of coffee drinker. Now, it’s just about reaching them.”

Fischman, the investor, agrees. “Right now, specialty coffee is incredibly fragmented with small local breweries and coffee shops,” he says. “I believe there is an opportunity to put these brands in front of a national audience. This, in turn, will help them lower their prices, which means they could reach even more people.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.