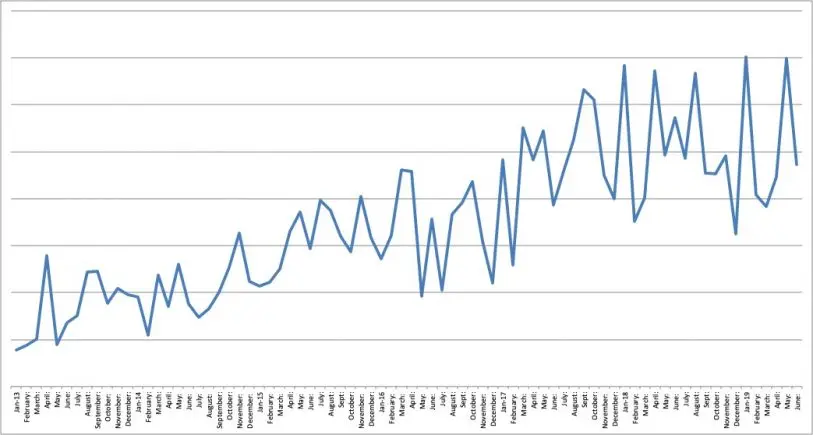

Though it may look like a crude drawing of a mountain range, this is actually a graph that represents my salary as a freelance journalist, starting from the day I quit my full-time job in January 2013, right up until the end of June 2019.

While the wide swings between peaks and valleys might induce severe anxiety in some, to me (and millions of other freelancers out there) they represent boundless opportunity, complete autonomy, and believe it or not, job security. Okay, and maybe a little anxiety too, but it’s a small price to pay.

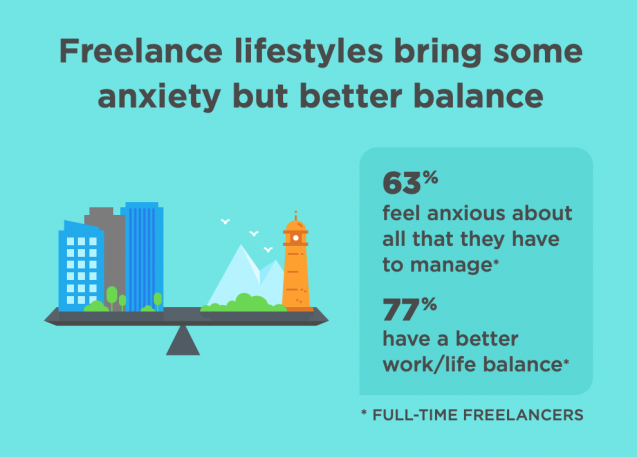

Dealing with pay instability is no small feat, but those who learn to manage a fluctuating income often outearn their full-time colleagues and enjoy greater job security, autonomy, and flexibility. According to Upwork’s Freelancing in America 2018 study, nearly three-quarters of full-time freelancers report earning more than when they had a full-time job, and 87% are optimistic about their future careers. In fact, more than half say there’s no amount of money that would get them to switch to a full-time role, despite the fact that 63% are anxious about the unpredictable nature of their work.

“What you find is they make substantially more money than they did before, substantially more money than their peers are making, and that they’re generally more satisfied than they were as full-time employees,” says Stephane Kasriel, the CEO of Upwork, referring specifically to freelance knowledge workers rather than gig economy employees like Uber drivers.

Accept that your money isn’t yours

In my early days as a freelancer there were times when I had to stretch out my last few dollars until a big check arrived, and when it did my lifestyle quickly switched from famine to feast. I made the classic mistake of assuming the money was mine to spend, when it really didn’t belong to me.

Part of that big check must go to the government in the form of income taxes, and the sales tax portion was never mine to begin with. Then there’s all the other stuff most people don’t have to worry about, like insurance, overhead costs, and putting some money away for the next inevitable rainy day—not to mention retirement savings.

When you’re an employee, those costs are deducted automatically before you have the opportunity to convince yourself you’ve got extra cash to spend. As a freelancer, it takes a lot of discipline to avoid spending during those peaks.

Charge more than you think you should

While many who make the switch into freelancing use their previous, full-time compensation as a basis for their freelance rates, Kasriel says freelancers are expected to charge more.

“You have to pay for your own benefits in a way that may not be subsidized and is more expensive, and because you’re taking the risk of volatility you need to be compensated for the risk,” he says. “It’s a form of self-insurance; I want to make sure I’m really killing it when I’m getting jobs so that if I have a dry spell three months down the road I’ve saved enough.”

Kasriel says that employers are typically willing to pay higher rates for freelance labor on a contract basis, as it’s still more cost-efficient than hiring someone long-term.

Offer discounts for consistency

When your income graph looks like the rocky mountains there’s a lot of value in predictability, and that value should be passed on to clients. When I’m asked for my rates I typically give two numbers—one for single assignments and another, lower rate for recurring work.

“Offer people different packages that can create some sustainability,” recommends Matt Baker, vice president of strategic planning for small business and freelance accounting software provider FreshBooks. “Give someone a better rate if they sign up, and that can fill a little bit of the gap.”

Keep the pipeline full

Most people get into freelancing to do more of what they love (in my case, writing), often failing to realize that they now have another, equally important job: running a business.

When you’re finally in a position to “pursue your passion” it’s easy to get caught up in the former while dropping the ball on the latter. What I (and many others) have learned the hard way is that if you’re only focused on your current assignment, you’re only doing half your job.

“Whether you call it ‘client development’ or ‘sales’ or ‘prospecting,’ you should always be spending some time on that,” says Baker. “It’s not always about the work; it’s about building that pipeline up front.”

If your pipeline is going from a heavy flow to a light trickle, it’s important to start looking for more work—either from existing clients or by reaching out to new prospects—before it dries up entirely.

Get organized

The unpredictability of freelancing becomes infinitely more difficult without a strong organizational foundation to support it. Whether you’re using an automated software program or doing everything manually, meticulously tracking expenses and income, upcoming bills, and earning projections is vital to managing a fluctuating income.

New York–based freelance voice actor Debbie Irwin says that many freelancers fail to set up a strong organizational foundation when they begin their freelance career because there’s not much to track in those early days.

“When you’re starting out it’s hard to anticipate the avalanche, the number of clients, the amount of work you’re going to have,” she says. “Establish your invoicing system, your accounting system, your CRM system, so that when the information comes in it’s well-organized, and you’re building a solid foundation for your business.”

Play in the valley

Freelancing involves a lot of high peaks and low valleys, but the key to strong financial (and psychological) well-being is striving to stay balanced through it all. That means maintaining financial restraint when business is booming as well as striving to make use of—and dare I say, appreciate—the slow periods.

“Try to enjoy the slower times,” says Irwin. “Contact clients you haven’t been in touch with lately, ramp up your prospecting efforts, ramp up your networking activity.”

When things inevitably start to slow down, I do whatever I can to find more work, but with the understanding that it won’t always happen right away. If I can’t secure paid work I move onto other, unpaid work that can help my business in less direct ways, like blogging, updating my website, networking, or taking meetings I wouldn’t normally have time for. If I’ve done everything I possibly can to fill the workday but am still left with more hours, I try to take time off and relax. It isn’t always easy when you’re worried about how you’re going to pay your bills, but I’ve learned that it will ultimately allow me to return to work more rested and productive when things begin to pick up again.

Though it can be difficult at first, learning to accept the inevitability of the valleys, and even learning to enjoy them, can turn the biggest drawback of freelance life into a nonissue.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.