Facebook’s much-rumored move into cryptocurrency is official. On Tuesday, the Facebook-led Libra Association introduced itself and its mission to the public. This alliance of financial and tech titans will function as an independent not-for-profit organization headquartered in Geneva, responsible for overseeing the development and governance of a new blockchain built for payments. The group aims to create a cryptocurrency that is stable, scalable, and compliant, and designed for a mass consumer market that bitcoin and other cryptocurrencies have not yet served—including consumers in countries where even having a bank account at all is not the norm.

Libra’s 28 founding members include some of the world’s biggest brands; humanitarian organizations focused on financial inclusion; an impressive brain trust that includes bitcoin pioneers Mickey Malka and Wences Casares, Coinbase’s Emilie Choi, A-list venture capitalists Katie Haun, Fred Wilson, and Josh Kushner; and crypto startups funded by investors Naval Ravikant, Max Levchin, and Elad Gil; and even a nonprofit backed by Israeli-Russian billionaire Yuri Milner that is searching for extraterrestrial life.

By category, the 28 members include:

Marketplaces: Facebook, eBay, Farfetch, Mercado Pago, Lyft, Uber, Spotify, Booking Holdings (Priceline, Kayak)

Payments: Visa, Mastercard, PayPal, Naspers/PayU, Stripe

Telecommunications: Vodafone, Iliad

Blockchain: Coinbase, Xapo, Anchorage, Bison Trails

Venture capital: Andreessen Horowitz, Union Square Ventures, Thrive Capital, Ribbit Capital, Breakthrough Initiatives

Nonprofits: Kiva, Women’s World Banking, Mercy Corps, Creative Destruction Lab

Noticeably absent are tech giants such as Apple, Amazon, Google, and Square. Also among the missing: Gemini, the cryptocurrency exchange owned by Cameron and Tyler Winklevoss, best known for their battle with Mark Zuckerberg over the ownership of Facebook.

At a press briefing at Facebook, Dante Dispartes, head of policy and communications for the Libra Association, told me that the organization is still looking for additional members. It aims to have 100 members contribute a minimum of $10 million apiece in Libra tokens by the time the cryptocurrency launches in early 2020. That billion-dollar goal will fund the operating costs of the association and an incentive program for acquisition of merchants and customers. As each member is responsible for running a node that validates transactions on the blockchain, the association has set a high bar to join. Among the criteria is whether a company has $1 billion in market value, a reach of over 20 million users globally, and/or recognition by a notable trade association or media outlet as a leader in its field.

Libra expects to use the money it raises from its token sale not only to cover the operating costs of the association but also to fund merchant and wallet incentives, some of which could be in the form of discounts for people who use the currency as a form of payment. No details on such deals are yet available. (There have been rumors that Lyft and Uber might offer a price break to people who pay with Libra.)

As easy as email

So what’s Libra’s overarching goal? “We should be able to send money across the internet as quickly and easily as we send photos and email,” says Katie Haun, a general partner at Andreessen Horowitz. But if the cryptocurrency takes off, it might not be because it appeals to the people who currently use traditional means of payment such as credit cards.

“The developing world is a huge market, and I was really stunned to see that half of the adults in Argentina don’t have bank accounts—1.7 billion adults on this planet don’t have bank accounts,” says Haun. “We saw that leapfrogging of technology that the mobile phone has had, way out in places like in sub-Saharan Africa. And yet they don’t have things that you and I might take for granted, like lending or borrowing money for basic human needs.”

I asked Haun why Andreessen Horowitz is helping to build a new blockchain and cryptocurrency from scratch when the firm is already invested in other more established blockchains. “We want to have a seat at the table, because we believe this is going to have a further mainstreaming effect on crypto and that will be very beneficial to grow the pie,” she says. “We also bring a lot of technical know-how about governance, regulation, policy, economic models, incentives, and security.”

Facebook’s role

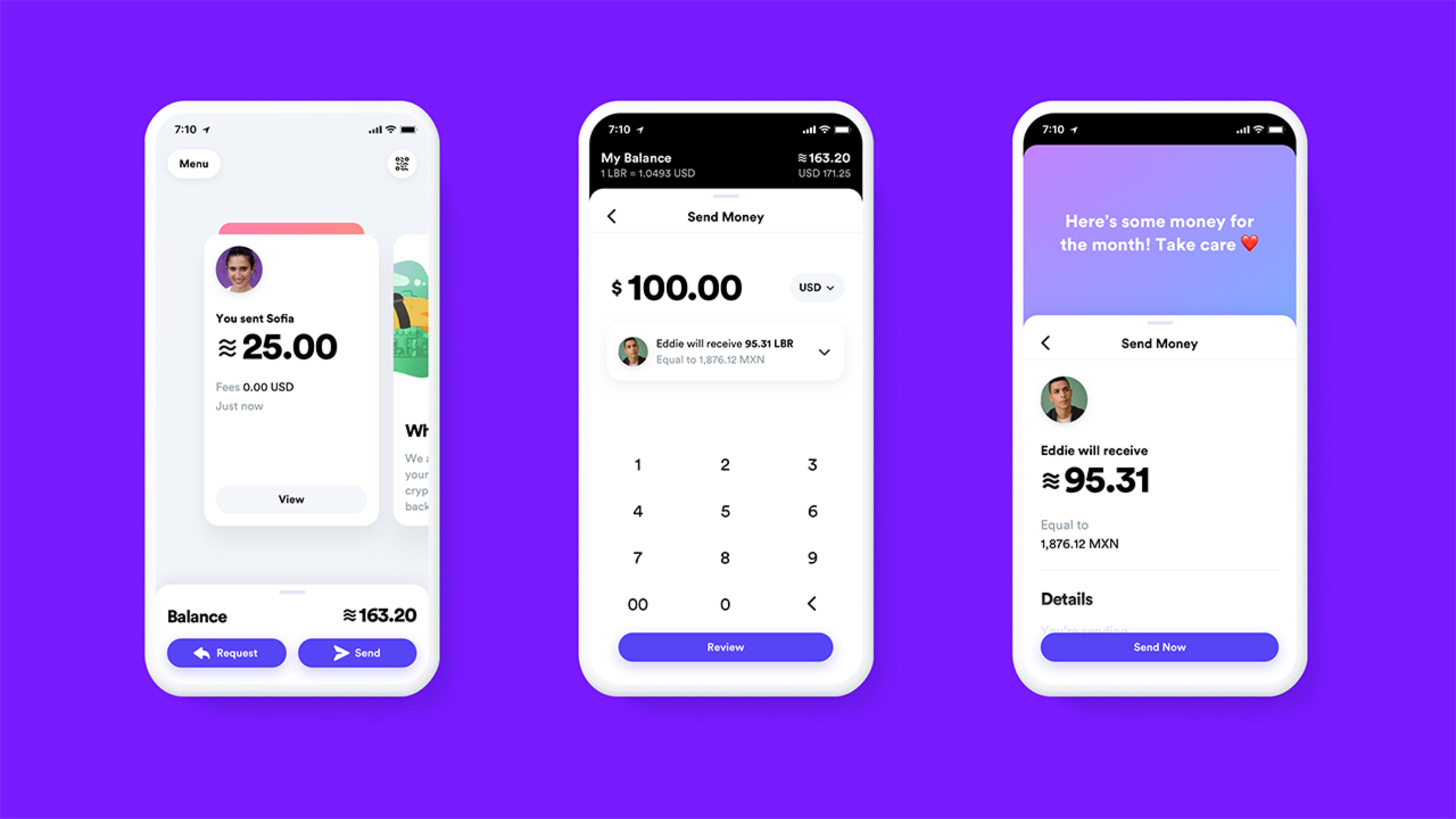

Once the Libra blockchain launches—which is scheduled to happen in early 2020–it will be possible for consumers to send and receive Libra. In addition to participating as a founding member of the Libra Association, Facebook will offer its 2.7 billion users the option to pay for things with Libra through its wallet, Calibra, which will be available as an iOS and Android app. The wallet will also be embedded within Messenger and WhatsApp, wherever these apps are available and cryptocurrencies are legal.

Calibra will be operated as a wholly owned subsidiary of Facebook and headed up by the company’s blockchain lead (and former Messenger chief) David Marcus, and his head of product, Kevin Weil, who formerly occupied a similar role at Instagram. At Facebook’s press briefing, Weil presented an early look of the app and discussed how Facebook designed an onboarding process to comply with “know your customer” policies and anti-money laundering laws.

Depending on jurisdiction, customers may be required to provide a phone number, country of residence, and government-issued ID. Weil said that all personally identifiable financial data will be encrypted and used only for verification purposes, and that users will be provided a small amount of free Libra upon completing the registration process to help them get started.

From a user experience, the Calibra wallet appears to be as quick, easy, and intuitive to use as Apple Pay, PayPal, and Venmo, with the added benefit of being able to transact with anyone in the world instantaneously with almost no fees. That stands in stark contrast to the hassle and expense of sending a wire transfer or waiting for international payments to clear.

When I asked whether Facebook will introduce any gamification aspects with the chance to earn Libra by completing tasks or watching ads, Weil responded with an emphatic “no,” explaining that the company was trying to be careful not to send the wrong message that the currency could be gamed.

The trust factor

In the era of #DeleteFacebook and multiple Facebook privacy scandals, some people will be instinctively skeptical about entrusting the company with something as important and personal as their financial transactions. Mark Zuckerberg’s Facebook post about Libra seemed to anticipate some of these concerns:

Calibra will be regulated like other payment service providers. Any information you share with Calibra will be kept separate from information you share on Facebook. From the beginning Calibra will let you send Libra to almost anyone with a smartphone at low to no cost. Over time, we hope to offer more services for people and businesses—like paying bills with the push of a button, buying coffee with the scan of a code, or riding public transit without needing to carry cash or a metro pass.

[snip]

All of this is built on blockchain technology. It’s decentralized—meaning it’s run by many different organizations instead of just one, making the system fairer overall. It’s available to anyone with an internet connection and has low fees and costs. And it’s secured by cryptography which helps keep your money safe.

This is an important part of our vision for a privacy-focused social platform—where you can interact in all the ways you’d want privately, from messaging to secure payments.

Privacy and safety will be built into every step. For example, Calibra will have a dedicated team of experts in risk management focused on preventing people from using Calibra for fraudulent purposes. We’ll provide fraud protection so if you lose your Libra coins, we’ll offer refunds. We also believe it’s important for people to have choices, so you’ll have the option to use many other third-party wallets on the Libra network.

These points are meaningful. Libra is not just a “Facebook cryptocurrency,” but rather a new digital money system backed by companies that people already trust with their money and data. Facebook is a 1/28 participant in the creation of this currency, with many checks and balances.

Libra is also not bitcoin, with all of that cryptocurrency’s volatility and intrigue. Instead, it’s aiming to be a regulated, stable currency for payments that answers to local jurisdictions and corporate interests. It’s not borderless, it’s not anonymous, and it’s not truly decentralized. Servers can be shut down, transactions can be reversed, and Libra (unlike bitcoin) can be confiscated. These factors matter, even if they aren’t visible to consumers who merely seek an easy way to pay for stuff.

Libra’s foundation, in other words, shows some promise. But it’s still an idea in the process of becoming a reality. Before it has a shot at solving anything about payments, its creators have to finish building it.

Recognize your company's culture of innovation by applying to this year's Best Workplaces for Innovators Awards before the extended deadline, April 12.