In 2017, Square debuted its pre-paid debit card for its mobile payment app, Cash, so people could use the money in their accounts out in the real world. Now it’s doing the same thing for business owners.

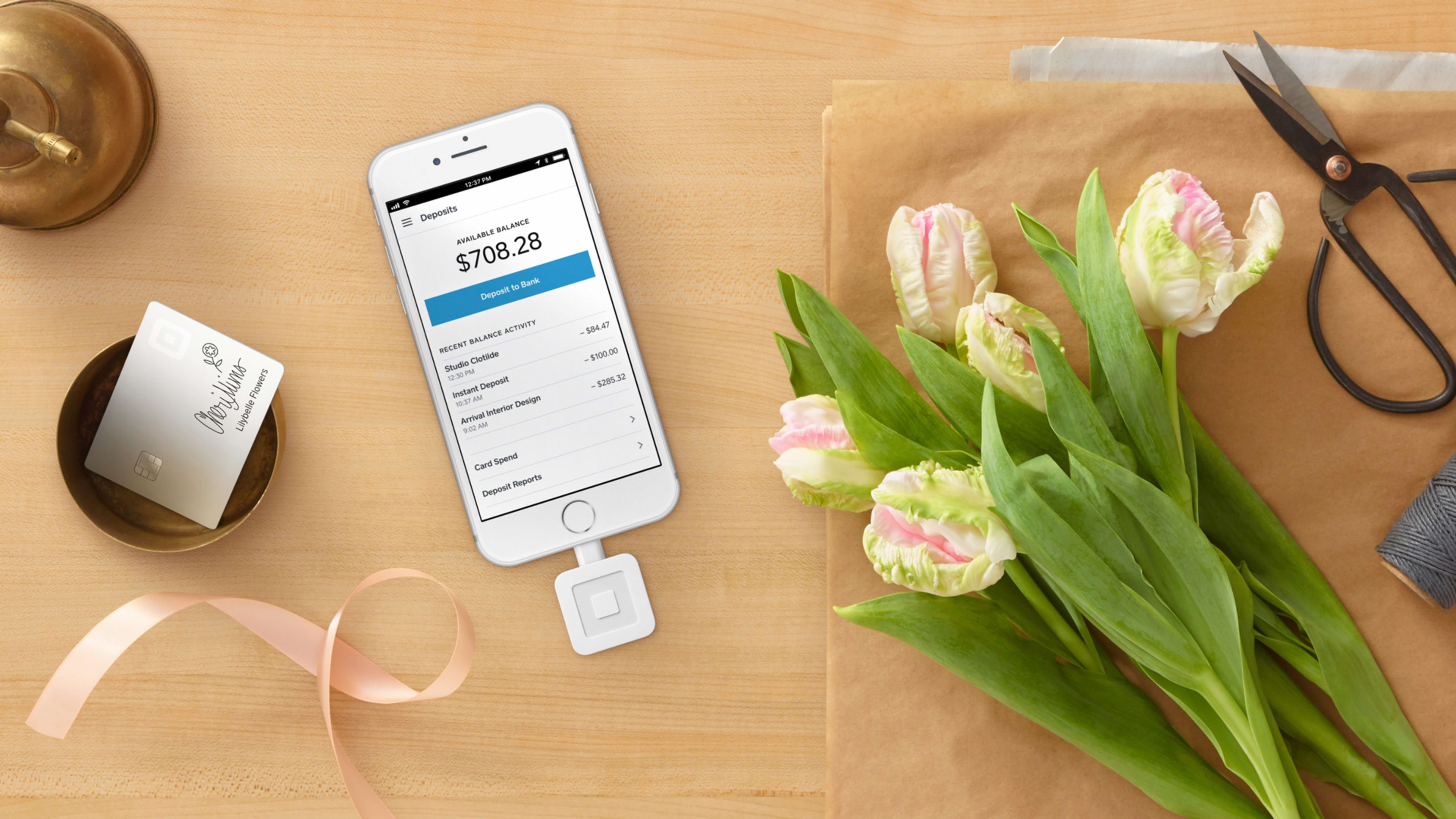

Merchants that use the Square card reader and business ecosystem can now get a debit card that accesses the cash that accumulates in it. The card is white and can be emblazoned with a specific signature, business name, or logo.

As soon as a customer makes a purchase, merchants with Square debit accounts can use that money to buy supplies or whatever other items they need. Business owners will also be able to withdraw cash at ATMs, thanks to a partnership with Sutton Bank. The Square app will have an interface for reviewing the balance, as well as credits and expenditures. It will also allow users to mark whether purchases they’ve made were for personal or business expenses, making it easier to delineate tax write-offs at the end of the year.

Unfortunately, there’s no current link between Square Balance and Square Capital, though Square’s seller lead, Alyssa Henry, said there is potential for a future integration.

Another bonus: Square merchants that shop with one another get a 2.75% discount on their purchases.

It is worth noting that the money that accumulates in the debit accounts are cash balances that are not insured by the Federal Deposit Insurance Corporation. “We take security very seriously. We have done a lot of work in that area,” said Henry on a phone call with press Tuesday. “That said, it’s not an FDIC-insured bank account; this is a stored balance.”

She didn’t provide further information on what happens in the event merchant accounts are compromised.

https://www.youtube.com/watch?v=FkWHlJ-AKJY

Recognize your brand's excellence by applying to this year's Brands That Matters Awards before the early-rate deadline, May 3.