For so many years, Ikea has held the position of being the untouchable, stalwart retail giant—the world’s go-to home furnishings store with something, or many things, for everyone. Who in their life hasn’t come across a Billy or Frakta? Most years, the dependable big blue box giant doesn’t make particularly splashy headlines. But 2018 was different, filled with signs, both stark and hopeful, of larger shifts in what consumers want, and how they’d like to shop.

The numbers, after all, indicate Ikea is due to reevaluate the direction of its business. Between 2017 and 2018, the world’s largest furniture retailer saw a nearly 40% drop in profits, and just last month, announced it’d be restructuring and cutting 7,500 jobs in the process. In September, Marcus Engman, Ikea’s mediagenic head of design for more than six years, abruptly exited the post to start his own consultancy—but not without first trying a string of bold and wacky attempts at reinventing the company’s product strategy and public image.

The story of Ikea in 2018, in many ways, is the story of big-box retail, now perpetually in crisis and set at odds with the swift rise and current dominance of online retail (hello, Amazon). Across industries, traditional department stores have struggled to maintain a foothold in the market: This year alone has seen the retail apocalypse take a hold of Sears and Toys R Us, as both companies shuttered their U.S. stores and filed for bankruptcy. Macy’s, Nordstrom, and Walmart, meanwhile, have seen significant declines in the recent years. Yet hope is not lost. Many retailers have found ways to survive and thrive. And Ikea seems to be taking a page from their notebook.

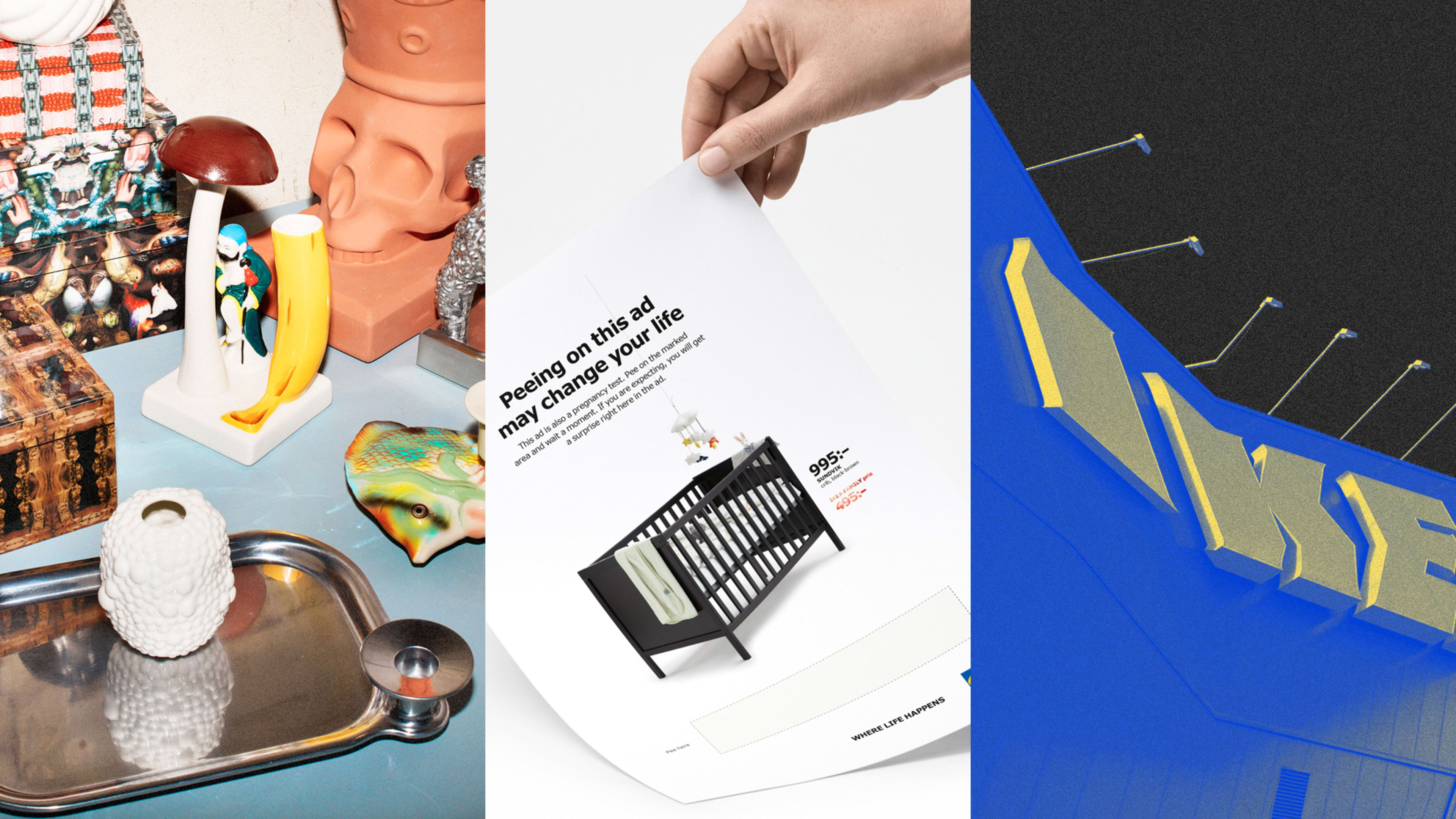

Read on for our big takeaways from Ikea’s rollercoaster of a year that, need we remind you, kicked off with a bizarre print ad that doubled as a pregnancy test asking users to pee on it.

Smaller is smarter

Gone are the days of making a day-trip out of the city and to the big box store, with plans to get everything in a one-shop stop, Swedish meatballs and hot dog lunch included. The outdated draw of big-box convenience has been trumped by the speed and ease of online shopping, and the retail game has gotten more competitive as a result. Enter the rise of experiential retail and concept pop-up stores by lifestyle startups like Floyd, Glossier, Everlane, or Burrow, that aim to be more than just a place to look at things you’ll buy. Even Amazon has taken note, with the launch of small pop-ups like the “Amazon 4-Star” store in Manhattan, which carries a cross-section of goods that have been rated favorably online by shoppers. Target, meanwhile, has managed to open three mini-locations throughout New York this year alone. Across the retail spectrum, startups and big-box brands are going for smaller stores in denser, more expensive city centers that give urban consumers direct access to products.

Ikea’s product line has long catered to small, urban living spaces; the scale and location of its physical stores have not. Next year, Ikea plans to roll out 30 new Ikea stores in urban markets–including one in Manhattan. This transformation has already begun in London and Warsaw.

Even big-box stores can master digital service design

Physical access is just as important as online access, as Michael Valdsgaard, leader digital transformation at Ikea, said to us earlier this year: “The business model of Ikea having a blue box in a cornfield, and you jump in the car with your family and have an ice cream [at the store], is not the only thing we should offer our customer. For the majority of people in the world, Ikea isn’t accessible. Apps can make Ikea accessible.”

It’s no secret that Ikea’s online shopping experience is in dire need of improvement. Other big retailers, like Target, are in the same boat. Ikea’s struggles to master digital platforms reflect larger shifts in the mass retail sector, and all of the top players recognize the investments they’ll need to make to stay in the game.

Give it a human touch

In the age of Amazon and social media—where every consumer desire can be planted and satisfied with a series of clicks—originally crafted, handmade designs are the new luxury: an artful antidote to the serialized, industrially produced cookie-cutter items and startup goods that are likely to end up in everyone’s homes. The resurgence of ceramics among makers and independent product and furniture designers—as well as the high-end collectibles art market—is no fluke.

Efficiency doesn’t always equal beauty, and wabi-sabi may not be an asset that can be fully achieved in a factory. But with its surprising collaboration with the glass and ceramics artist Per B Sundberg, Ikea sought to soften the hard-edges of its overly minimal, practical midcentury designs with more overtly decorative objects showing individual personality and that implacable jolie-laide. The resulting poodle candlestick holders, objets, and vases launched this August, in Ikea’s own words, was an attempt to harness some of that special and endearing mix of “Pretty, Ugly, Lovely.” The allure of handmade is here to stay, and other big retailers, including West Elm, which regularly folds limited-edition craft collaborations into the mix, are smartly betting on goods that convey a human touch.

Scarcity can transform the banal

Was 2018 the year of peak streetwear hype? Between skater brand Supreme’s ad hijinx on the front page of the New York Post and the dark, desperate side of hype it exposed among fans, who were willing to shell out anywhere from $5 to $100 for sold-out copies of the printing, this year showed us the power of generating demand through invented scarcity and digital marketing. The business of hype, surely, is a cunning cousin of planned obsolescence: Hype isn’t about making too many of something we desperately need and will need to keep fixing and replacing; instead, it purposely makes too few of something we never needed anyway, and convinces you that random, rarified object might even be worth a lot more one day.

Through a series of left-field collaborations with fashion designer Virgil Abloh and celebrity stylist Bea Akerlund, to name a few, Ikea tried its hand at orchestrating a trendy product “drop” with unconventional, limited-edition conversation pieces that included a rug printed with a giant receipt, a top-hat vase, and other designs that seem far and away from its Scandinavian modern sensibility. More name-dropping from their 2018 Democratic Days conference mentioned upcoming collaborations with Adidas, Sonos, Lego, artist Olafur Elaisson, perfume creator Ben Gorham, and Solange’s Saint Heron. The takeaway from Ikea’s year of taking on hype: Even big brands that bank on selling cheap, banal essentials in bulk can recognize that sometimes, less is more lucrative.

Quality trumps quantity

At the end of the day, while limited-editions and special experiences might move the needle in the short-term, quality is what keeps consumers coming back for more. Ikea has a mixed track record here. Ikea recalls from the past year alone range from defective bicycles and dog bowls to a collapsing ceiling sconce. Ikea’s quality problems offer an important lesson: Safety and usability is a baseline, not a goal. Bells and whistles are a bonus, so focus on making a quality product—from factory floor to doorstep.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.