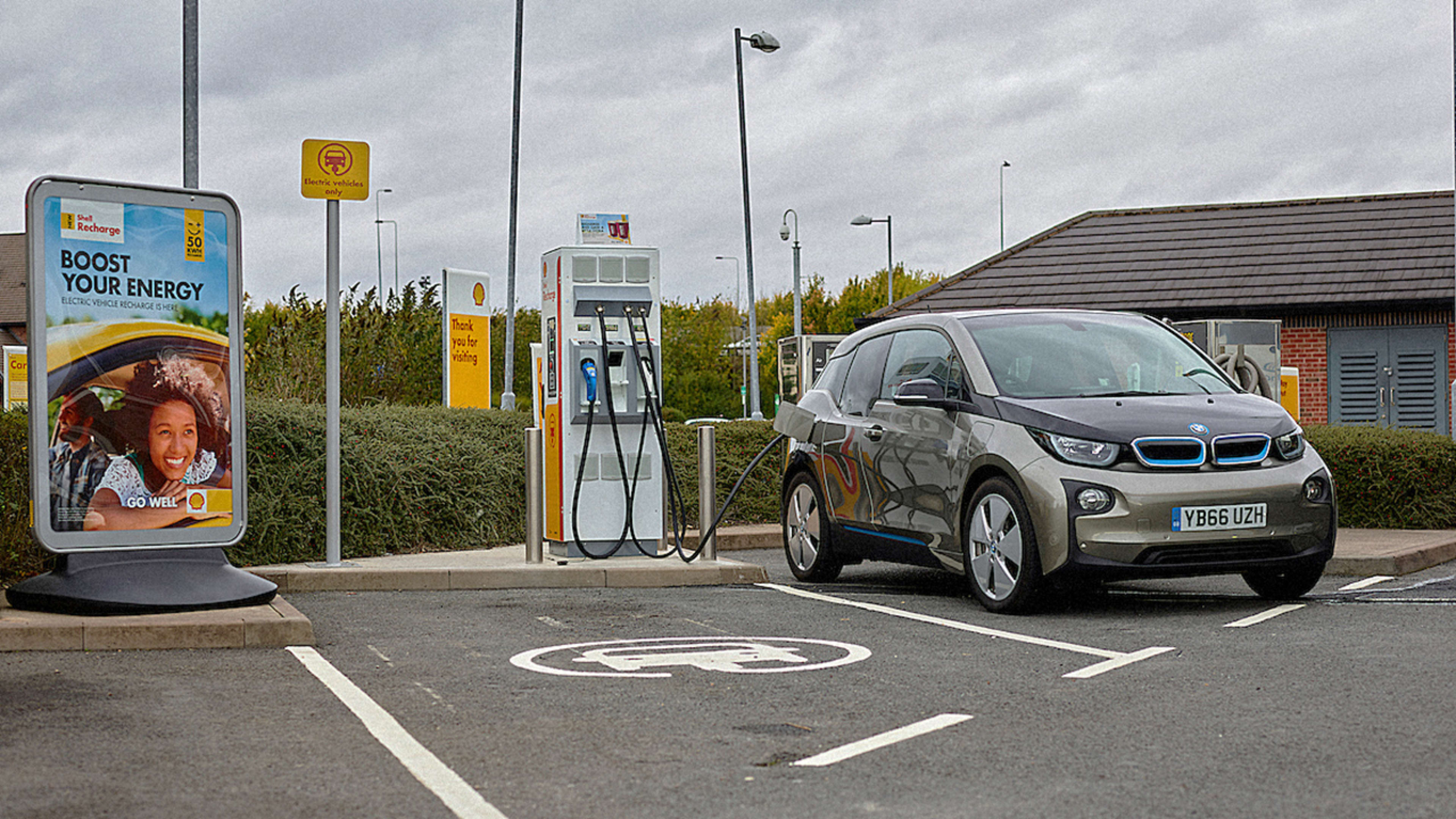

A year ago, Royal Dutch Shell, now the largest oil company in the world, acquired NewMotion, a company with thousands of electric car charging points throughout Europe. A month later, Shell started installing fast chargers at some of its largest gas stations. In late October, the company started installing ultrafast chargers that can fully charge the newest electric cars in 10 minutes.

It’s one small piece of a company in transition as it grapples with how to address climate change. “If you want to be a long-term relevant company that is on the right side of history, you have to be involved in this discussion, because it’s the most important discussion of our time,” CEO Ben van Beurden tells Fast Company.

By 2035, Shell plans to cut its carbon footprint 25%, and 50% by 2050–including the emissions not only from its own operations but from customers using its products. The cuts are in line with the company’s “Sky scenario,” a vision released earlier this year that considers what it might take for the world to meet the first goal of the Paris climate agreement, to keep global warming well below 2 degrees Celsius.

“If we know that in order to stay well within 2 degrees C, these are things that will need to happen in the energy system and in different countries, we can sort of size up the challenge and understand how difficult it may become, and value the opportunities as well,” van Beurden says.

The company’s carbon footprint reduction goals are hugely ambitious. At the same time–like other corporations that have made similar commitments under the Science-Based Target Initiative–aiming to keep warming below 2 degrees isn’t ambitious enough. Scientists now say more is needed to prevent the worst impacts of climate change: A recent landmark climate report from the UN explains how critical it is to aim to limit emissions to 1.5 degrees–and suggests that to do that we need to reach net zero carbon emissions by 2050. In Shell’s Sky scenario, the world wouldn’t reach net zero emissions until 2070.

“2050, in our mind, is simply too fast for that to happen, given what we know about the energy system, given what we know about the policy changes that we see coming, the mind-set of governments, and the technologies available now,” says David Hone, the chief climate change advisor for the company. “So that gives you 2070, and we think that that’s technically possible.”

If massive reforestation–planting forests in an area the size of Brazil–is added to the scenario, it would be possible to reach net zero emissions by 2060, Hone says. The world would warm more than 1.5 degrees, but then return to that level by the end of the century. But overshooting the goal, even temporarily, would be risky; there’s a bigger chance of triggering irreversible impacts, including going past a tipping point for melting ice sheets in Antarctica and Greenland.

Still, given our current trajectory, even keeping global warming below 2 degrees would itself be an enormous achievement for society (and something that another recent report said that has almost “zero chance” of happening). In Shell’s Sky scenario, the company says it thinks that it would be impossible to buy an internal combustion engine anywhere in the world. That decade, they predict that renewable energy would overtake fossil fuels as the primary source of energy. Global deforestation would end. An enormous number of plants with systems to capture carbon–around 10,000 by 2070–would capture emissions. Global warming, according to an independent analysis of the scenario from MIT researchers, would stop around 1.75 degrees Celsius.

Hone argues that the crucial step will be to set a global price on carbon; without it, he says, adding carbon capture technology to power plants isn’t economically feasible. (Shell does already have carbon capture tech on some plants in Canada, where carbon pricing exists now.) The recent UN report suggests that emissions need to peak in 2020. Hone says that widespread carbon pricing isn’t likely until at least a decade later. With that economic lever in place, emissions could begin to drop and the large-scale energy transition could occur quickly over the subsequent decades–but not quickly enough to reach net zero by 2050.

“From a science perspective, the ideal situation is emissions fall rapidly immediately, but Sky has built into it thinking the necessary industrial and political and policy steps that need to be taken to get emissions to fall sharply,” says Hone. “We believe the minimum time that would take is 10 years.”

Shell envisions that oil demand won’t peak until 2025, and natural gas demand won’t peak until the mid-2030s. It expects that demand for oil products–from petrochemicals used in plastic to jet fuel–will continue to grow in the near future, even as some other markets, like fuel for passenger cars, begin to shift to electricity. The company is growing its portfolio of natural gas, which has a lower carbon footprint than oil; it also plans to expand further into the electricity market and invest in more renewables as the transition continues.

Over the last 12 months, the company has invested in companies including GI Energy, which designs solar microgrids and other sustainable energy solutions, Sonnen, which makes home batteries to store solar power and creates “virtual power plants” for neighborhoods,” Solar Now, which provides off-grid solar in Uganda and Kenya, and others.

In December, it acquired First Energy, a digital power company in the U.K. that owns no power plants or transmission lines. In January, it invested in Husk Power, a company that makes mini-grids that run on solar, biomass, and batteries for rural India and Africa. In May, it invested in Axiom Energy, a company that makes thermal energy storage. In August, it invested in Ample, a Silicon Valley startup still in stealth that makes a robotic electric car charging system. Each year, the company expects to spend $1 billion to $2 billion growing its “New Energies” business–though this is still a tiny fraction of the company overall. Oil and gas still remain very much the core.

Critics and climate activists suggest that Shell shouldn’t wait for a price on carbon or other potential future policies–like bans on gas and diesel cars, to move more quickly. “In the last 30 or 40 years since climate change science has been pretty well established, companies that have continued to rely heavily on fossil fuels–and profit at very high levels, like Shell and Exxon and others–have an obligation to bear significant costs now to contribute to addressing the climate change problem,” says Brian Berkey, assistant professor of legal studies and business ethics at the Wharton School at the University of Pennsylvania.

Adding carbon capture technology would cut into the company’s profits without a price on carbon, but Berkey argues that they have a responsibility to do it anyway. “My own view is that to whatever extent companies do have obligations to shareholders to pursue profit, these obligations are constrained by more general moral requirements not to engage in practices that involve contributing to serious harm to society more broadly,” he says. He makes the analogy to someone running a business out of their house, who can’t use profit as an excuse if their business pollutes their neighbor’s yard.

Documents leaked earlier this year show that Shell’s own researchers were studying climate change, and aware of the likely impacts, as long ago as the 1980s. In 1998, Shell researchers published an internal memo envisioning a Hurricane Sandy-like storm on the East Coast in the 2000s that would spark climate action. “They should have been retooling their own business model for a carbon-constrained world based on what they knew about the harmful effects of the products that they produce and sell,” says Kathryn Mulvey, accountability campaign director for the Climate & Energy Program at the nonprofit Union of Concerned Scientists. “That certainly was within their enormous technical and financial capacity.”

Instead, she says, Shell, along with other fossil fuel companies, was a member of trade groups that worked to sow public doubt about climate science. The American Petroleum Institute, for example, wrote an internal strategy memo in 1998 with a roadmap of how to spread doubt. While Shell supported efforts for cap-and-trade legislation in the U.S. in 2009, dedicated resources to supporting California’s emissions trading scheme, continues to ask Congress to support economy-wide, market-based carbon pricing, and told the Trump administration not to weaken fuel efficiency standards, it is still a member of API and other organizations with dubious records on climate communication. The Western States Petroleum Association, another group Shell belongs to, is currently lobbying against carbon pricing in the state of Washington. Shell didn’t donate to that campaign, but argues that Washington’s specific policy is flawed, and didn’t endorse it, either. (Other oil companies have also sent conflicting messages; Exxon, which recently pledged $1 million to a campaign for a carbon tax, gave around $36 million over the past 20 years to spread disinformation, Mulvey’s group has calculated.)

It’s unlikely that Shell will choose to voluntarily adopt a competitive disadvantage to cut emissions faster than it already plans to as some form of moral penance for its past emissions. But as the company considers the current science, it could choose to spend more time thinking about how to meet a 1.5-degree target beyond relying on planting trees.

“We don’t want to ignore the value of Shell’s work,” says Amanda Levin, a policy analyst for the climate and clean energy program at the nonprofit NRDC. “Just an oil company even admitting that climate change is a large problem, and that they need to address these emissions, is a huge change in thinking. We welcome Shell’s input and thoughts about how to achieve the emission reductions that we need. That being said, they need to also start rethinking the way that they fit into a 1.5-degree world.” The company, she argues, could have gone further with energy efficiency in the Sky scenario.

NRDC is also revisiting one of its own scenarios that had considered how the U.S. could get on track to stay below 2 degrees of warming, and will now target the more ambitious 1.5 degrees instead. Most companies that have considered “science-based targets” so far have looked at a 2-degree target, but a few leaders, like British Telecom, are now committed to achieving 1.5 degrees.

Shell may continue to argue that getting to net zero by 2050 isn’t feasible. The most critical question is: What would it actually take for Shell, and the rest of the world, to achieve as much as is technically possible to limit climate change? Much stronger political pressure for a widespread price on carbon and other ambitious climate policies, as the company says, would help–and if that could happen far faster than the company expects, we might get on track. “Our goal is aligned with where society needs to go, but it is a goal that will be dependent on how society makes the journey as well,” says Hone. “If the world has carbon pricing, in every country and every place where Shell’s operating, you’ll see that overall picture change quite rapidly.”

Strong policy–from carbon taxes to fuel efficiency standards and bans on gas cars–is important not only for Shell, but to push other corporations that aren’t changing as quickly. But even before that policy is in place, consumer pressure could also help; at the moment, for example, there’s no special label on “zero carbon” plastic made using carbon capture tech, because there’s no demand for it. Investors can support alternatives, such as plastic that can be made from food waste or fuel made from carbon sucked from the atmosphere, to help them scale up more quickly. Mass change in consumer behavior–like driving less–would help. Shareholder pressure could also continue to push Shell farther.

Investors are already looking to the company as a leader in the industry. “We’re starting to see larger and larger institutional investors simply moving out of this segment,” says Danielle Fugure, president and chief counsel of the nonprofit As You Sow. As shareholders have pressured companies to make clear plans for climate change, those that don’t make those plans are likely to be left behind. “If you’re an investor, I think you’re going to want to look to those companies that are best positioned to survive in a new energy economy.”

Like some other European companies in the industry–such as Statoil, which changed its name to Equinor as it moves to become an “energy company” rather than an oil company, or Spain-based Repsol, which has stopped investing in new oil and gas–Shell is planning for large-scale changes and is far ahead of its American counterparts.

It’s not clear yet if all other oil companies will step up to match Shell’s ambition, or if Shell will speed up its climate action enough to prevent, for example, the nearly total loss of coral reefs. What is clear is that the oil and gas industry is responsible for around half of global emissions. Without the industry’s taking (or being forced to take) ambitious action, the civilizational project to tackle climate change can’t succeed.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.