David Gandler, the cofounder and CEO of FuboTV, is tired of hearing that his live-TV streaming startup is an underdog.

Fubo’s rivals include some of the largest companies in the media, telecom, and technology businesses, including AT&T (which runs DirecTV Now), Dish Network (which owns Sling TV), Hulu (which is jointly owned by Disney, Fox, Comcast, and AT&T), and Google (which launched YouTube TV last year). Those companies have used their vast resources and brand awareness to acquire subscribers at a much faster rate than FuboTV, despite offering many of the same channels at a similar prices.

In an interview, Gandler says he’s become tone-deaf to those concerns.

“Look, I can’t tell you how many people since 2015 have told us we’re dead because there’s some company that’s going to kill us,” Gandler says. “And we’ve been able to withstand some serious competition.”

“Because they’re a startup, and they’re a small team, that agility shouldn’t be underestimated,” says Emma Lloyd, the group director of partnerships and startups for Sky, which has invested in FuboTV alongside 21st Century Fox, AMC, Scripps Networks, and others. “It’s amazing to see, as an investor in Fubo, what they’ve managed to achieve in a very short space of time–certainly compared to other bigger players in the market–with very little investment.”

Still, it’s unclear when Fubo’s nimbleness will begin to pay off. The company won’t reveal current subscriber numbers, but at last check in October 2017, it had only 100,000 of them, far behind Sling TV (which had more than 2 million subscribers at the time according to Comscore) and DirecTV Now (which crossed the million-subscriber mark a couple months later). A recent investor report by UBS, comparing subscriber numbers of live-TV streaming services, didn’t mention FuboTV at all.

Gandler says there’s no reason FuboTV can’t become a top four streaming service in the United States, or even a top three streaming service globally. But sooner or later, his startup will have to prove it.

“Netflix of soccer”

FuboTV wasn’t always going to be a big bundle of cable channels. Gandler, who worked as an account manager at Telemundo in the late aughts, says he’s always been interested in emerging markets for their potential for rapid growth. About five years ago, after sales stints at Scripps Networks and Time Warner Cable, he became the vice president of monetization at DramaFever, a streaming service that offers Korean dramas and other foreign-language programming. That service was acquired by Softbank in 2014, which is when two of Gandler’s colleagues, Alberto Horihuela and Sung Ho Choi, started thinking about a new business venture.

Gandler got wind of their plans, and pitched them on his own idea: Looking at trends on Google and Facebook, Gandler saw pent-up demand in the United States for overseas soccer leagues. Streaming those games legally was difficult or impossible, and traffic for pirated feeds was rising. Perhaps, Gandler thought, it was time for a “Netflix of soccer,” which would stream live games to a global audience.

Horihuela says he was skeptical at first, but Gandler won him over.

“You’ve got to understand this about David, when he gets something in mind, it’s basically nonstop, so you’ve got to hear the guy out,” Horihuela says. “And we started looking at the numbers and realized the opportunity was there–especially compared to Korean drama.”

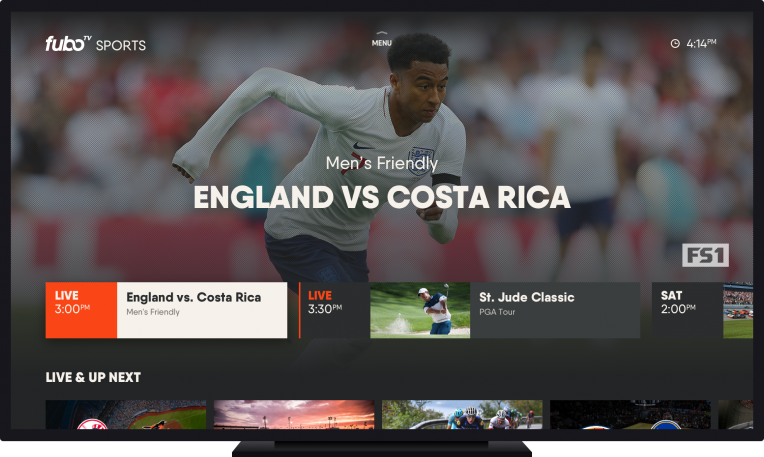

Along the way, a couple of things happened: As Fubo negotiated for more sports channels, television programmers started requiring the startup to carry their entertainment channels as well. And while Fubo’s menus emphasized sports, subscribers began to discover and watch the entertainment programming that Fubo made available. At the same time, Fubo sensed that it could become a much bigger business by expanding beyond the niches of live soccer and Spanish-language programming.

In early 2017, Fubo pivoted, discontinuing its cheaper soccer-centric package, striking carriage deals with Fox and NBC Universal, and charging $35 per month for a broader package of TV channels. Deals with more networks followed, including CBS, Scripps Networks, and AMC Networks. FuboTV still calls itself “sports-first,” but instead of being the Netflix of soccer, it’s now pitching itself as a direct competitor to cable TV and to live-streaming bundles such as Sling TV and DirecTV Now.

“We could have been a great mom-and-pop shop that had a nice 30% margin business, with, say, 100,000 or 200,000 subscribers, but we see an opportunity to build a business that could be worth anywhere from $5 billion to $10 billion within the next 48 months,” Gandler says. “We just couldn’t sit there as television was being disrupted.”

[Animation: courtesy of FuboTV]

Minimum viable product

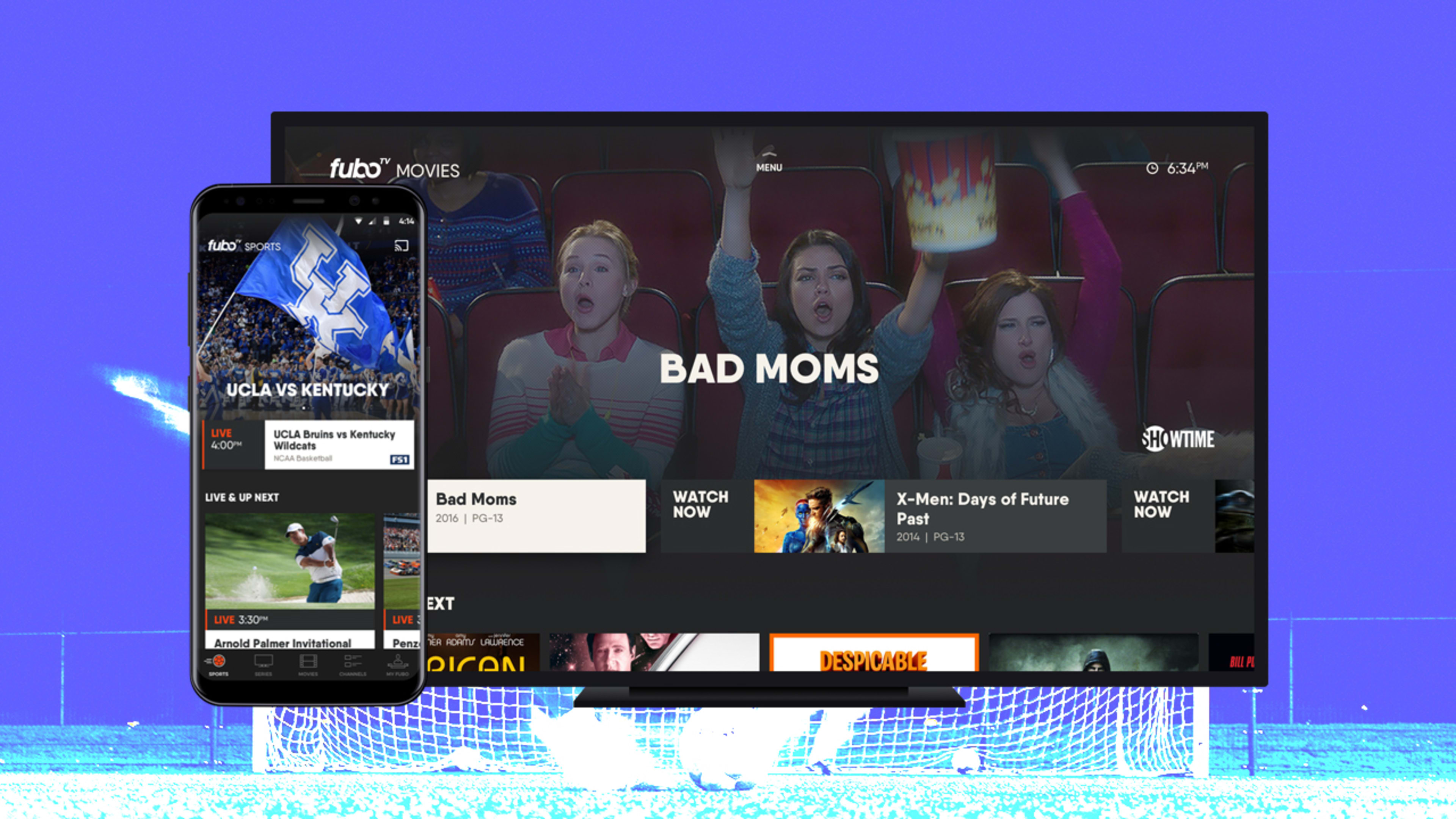

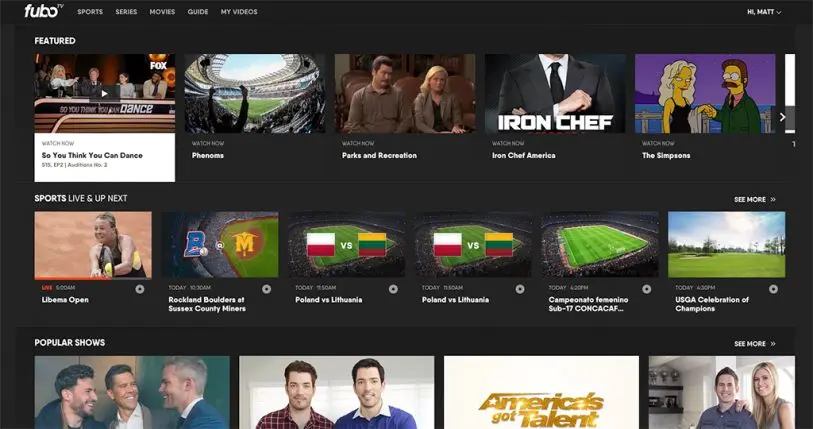

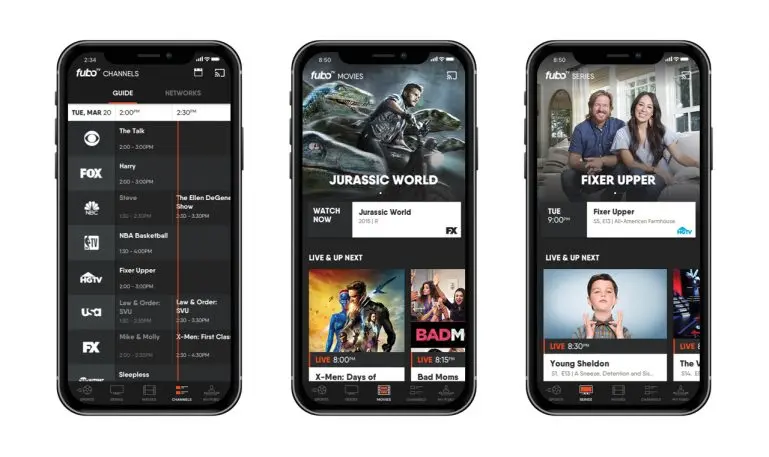

At first, FuboTV’s live TV service wasn’t pretty. When I reviewed it for another website about a year ago, I found that its apps (still labeled “beta” on several devices) were buggy and inconsistent. On-demand video and DVR weren’t yet available on my TV devices, and its cloud DVR used an odd system of recording “slots” instead of hours like a traditional DVR. While the service did have some redeeming qualities–it offered, for instance, the lowest latency of any streaming service, so you could watch a big game without seeing spoilers on social media–it was tough to recommend overall.

Within six months, FuboTV had transformed itself. Its apps gained a slick new design, and its DVR switched to a more traditional 30 hours of recording time, with the option for 500 hours as a $10 per month add-on. FuboTV also added more channels to its lineup including NFL Network, NFL Redzone, and the New York sports staple MSG, which remains absent from other streaming services.

Matt Biscuiti, a FuboTV spokesman, later explained the company’s modus operandi to me in an email: “Get the most viable product out the door now and continue to make improvements and enhancements, rather than wait two years in development until the product is perfect.”

Emma Lloyd, the Sky investment director, says Fubo’s ability to move quickly comes from not having to adapt legacy systems and business models. Being able to learn from Fubo’s team is one of the main reasons Sky became an investor.

“The ability to develop tech at speed is because they’ve started with a blank piece of paper,” she says. “When our tech guys look at what Fubo achieved, they can’t quite believe it.”

Chasing subscribers

Even with a solid product, FuboTV must contend with several threats that aren’t directly related to its competition.

The biggest is its ability to keep costs down. Like other live-TV streaming services, FuboTV faces ever-higher costs from TV programmers, especially for live sports, and has increased its base price over time from $35 per month to $45 per month. (Subscribers still get a $10 discount for their first month.)

DirecTV Now, Sling TV, YouTube TV, and PlayStation Vue have all raised their own prices this year as well, but unlike those other bundles, FuboTV does not have a deal with Disney, so it’s missing ABC and all ESPN channels. At an estimated $9 per month per subscriber for ESPN alone, including those channels would make FuboTV much more expensive. Disney isn’t under much pressure to reduce its fees, either, as the company looks to extract maximum value from TV bundles before transitioning to its own streaming service.

Gandler says Disney would be “a fantastic partner,” but its absence underscores the difficulties of being a startup in the live-TV streaming business. Without an existing business to leverage, FuboTV will have a tougher time negotiating lower prices or excluding unpopular networks from its lineup. And without a willingness to bleed money, as Google is reportedly doing with YouTube TV, FuboTV won’t be able to compete on value. This could lead to a vicious cycle in which FuboTV can’t keep up with other services on subscriber numbers, further limiting its leverage.

“People may not want to cut Fubo the deals that they have in the past,” says Alan Wolk, the cofounder and lead analyst for TVRev, who has floated the idea that FubotV should partner with Verizon on streaming TV over 5G wireless. “The biggest risk is not growing and getting lost in the shuffle.”

Betting on execution

Gandler has heard all of these criticisms before, but doesn’t seem worried about them. He argues that eventually FuboTV’s larger rivals won’t be willing to price themselves below cost or spend lavishly to acquire new subscribers.

“This to me is all artificial for now,” Gandler says of other companies’ ability to acquire subscribers. “If you’re a shareholder of one of the major players, at some point you say, ‘This doesn’t make any business sense.'”

To further grow its subscriber count, Fubo made a deal last year with the National Cable Television Cooperative, a group of small cable and broadband providers, which can now repackage FuboTV with internet service in lieu of traditional television. The providers who’ve opted into this arrangement serve more than 2 million customers.

Sky’s Emma Lloyd also points out that FuboTV has figured out how to acquire subscribers cheaply through targeted digital ad campaigns, which the startup is constantly refining. That could prove more sustainable in the long run than device deals and giveaways, which DirecTV Now and Sling TV have used to buy up subscribers.

“They’re able to leverage the live sports that are on the platform very effectively to acquire customers in that crucial run-up to a live game, and they have that down to a fine art,” Lloyd says.

Meanwhile, Gandler is also focused on improving the service, and happily points out that FuboTV subscribers already spend an average of 32 hours per month using it on connected TV devices. (That number rose to 40 hours per month after the World Cup.) Fubo has also been building up the advertising side of its business, and now brings in $2 per month per subscriber with the small portion of live-TV ad inventory that the company controls.

Even so, Gandler acknowledges that FuboTV will need more funding. In April, the startup brought in $75 million from AMC, 21st Century Fox, Sky, and Discovery, among others, and the plan is to raise “a much larger number” within the next year. Funding could come from both domestic and overseas backers, he says, as FuboTV eyes an international expansion. He also doesn’t rule out an acquisition.

Despite being surrounded by industry giants, Gandler doesn’t think FuboTV will have a problem getting more investors to buy in. “If you ask, ‘Show me a company today that is sitting on the crossroads of technology and media,'” he says, “this is one hell of an example of a company that’s able to figure it out.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.