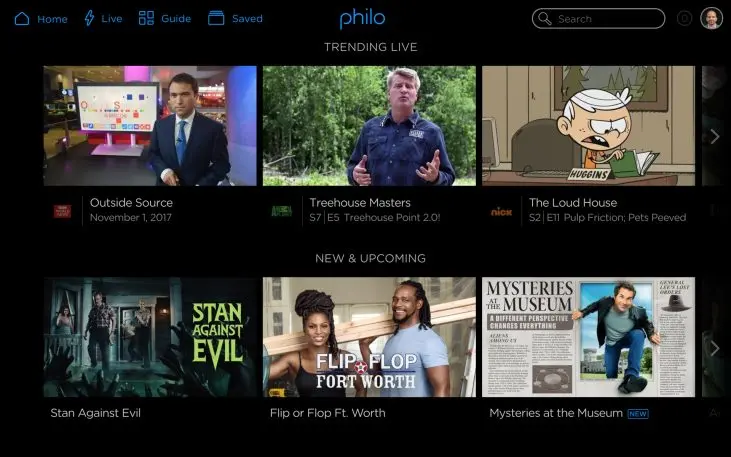

In an ideal world, cord-cutters would be able to choose from more live TV services like Philo.

Instead of making subscribers pay upwards of $40 per month for channels they may not want, Philo’s lineup of 40 channels costs just $16 per month. It accomplishes this primarily by omitting major broadcast networks–ABC, CBS, NBC, and Fox–and expensive sports channels. Only AT&T’s recently announced WatchTV service offers something similar for $15 per month.

If you haven’t heard much about Philo, that might change in the near future. The service, which officially launched last November, has just raised $40 million from existing investors, led by the three networks–AMC, Discovery, and Viacom–that already supply most of Philo’s channels. CEO Andrew McCollum says the startup will use a chunk of that money to get the word out through advertising and marketing. (The startup, which originated as a streaming service for college students, first garnered a wave of attention a few years ago, in part for its Facebook-like founding in a Harvard dorm room.)

“We feel really good about how things are going, and what the response to the service has been,” says McCollum, who declines to reveal specific subscriber numbers or future milestones. “We’re very much tracking to our plan and forecast around subscriber growth, and we hope to continue to do that.”

The new apps and funding have arrived at just the right time. Over the last two weeks, Sling TV, DirecTV Now, and PlayStation Vue all announced $5 per month price hikes for their respective live TV services. While Sling still starts at $25 per month, DirecTV Now’s base price is rising to $40 per month, and PlayStation Vue starts at $45 per month. Google also raised the price of YouTube TV from $35 per month to $40 per month in March.

In most of these cases, TV providers are tacking on more channels in hopes of reaching the broadest potential audiences, while also dealing with ever-higher costs for the sports and broadcast channels they already carry. Philo’s skinnier bundle provides a much-needed antidote, so it’s surprising that most of its competitors aren’t offering anything similar.

[Animation: courtesy of Philo]

Philo vs. bigger bundles

McCollum, who is a lesser-known member of Facebook’s founding team, has a few theories on why Philo’s competitors aren’t offering cheaper sports-free alternatives alongside their more expensive packages.

For one thing, he believes that other services’ fixation on live sports has become a “self-fulfilling prophecy.” TV providers view major sporting events like the World Cup as convenient marketing opportunities, and the sports fans who end up subscribing are willing to pay higher prices. But in attracting one kind of audience, McCollum argues that these providers are alienating and underserving others without fully realizing it.

“If you’re just looking at the universe of [traditional] TV watchers, you’re probably overestimating the importance of sports,” McCollum says.

Even if other companies wanted to offer sports-free packages, their contracts with major broadcast networks might preclude them from doing so. Disney, for instance, might stipulate that a TV provider must carry ABC, Disney channels, and ESPN channels, and require that ESPN be included in the service’s most popular bundles. A sports-free package that didn’t offer any Disney-owned channels could run afoul of contractual obligations if it became too widely adopted.

“There are lots of requirements in contracts about where networks have to be available, and to what percentage of subscribers they have to be available,” McCollum says. “It makes it hard to offer lots of different options at the same time under these deals.”

In other words, Philo is only able to offer a cheap, sports-free package because it doesn’t partner with any of the companies that carry sports networks. That’s not something other TV services are willing to do, because it would also preclude them from carrying all the channels–with or without sports–that Philo lacks.

“You could rethink what a TV network is”

Although McCollum won’t reveal subscriber numbers, he claims that on average, Philo’s users are tuning into the service for three and a half hours a day. This, he says, is proof that there’s strong interest in non-sports content that doesn’t come from over-the-top services like Netflix and Amazon Prime.

Now, Philo has to make a name for itself. The startup has already begun advertising on podcasts and on social networks like Instagram, and is now looking at terrestrial radio. Broadcast TV advertising it also a possibility, and McCollum says Philo is exploring the kind of streaming device deals that have helped boost Sling TV’s and DirecTV Now’s subscriber counts.

“I hear personally from a lot of people who say that they love Philo, they think it’s great, it’s their favorite OTT service, and they’re really surprised that they don’t run into it more in advertising and marketing,” McCollum says. “And that should change.”

The startup also continues to look for more organic ways to grow its reach. It now offers a referral program, in which new and existing subscribers each get a $5 credit, and it recently partnered with streaming music service Pandora on a three-month bundle deal. “We’re still learning about who the demographics are, and what kinds of offers and bundles we can create that would be really compelling,” McCollum says.

On the technical front, Philo is still working on some of the social features it demoed last November, such as the ability to see what shows friends are watching and to set up synchronized viewing sessions. McCollum says Philo pushed those features to the backburner while the company prioritized broader device support.

What gets McCollum most excited, though, is the prospect of changing the fundamental notion of what a TV channel is. Most live TV services, he says, only try to replicate the cable experience with a live TV guide, on-demand menus, and DVR. Philo isn’t much different today, but he hopes the service can eventually break out of the linear TV model.

“You could, if you wanted, send a different video feed to every subscriber,” he muses. “So thinking about that idea, and what we could do with that . . . how you could rethink what a TV network is in the OTT world is something I’m very interested in.”

It’s the kind of idea that becomes more practical when there are fewer networks to deal with and fewer sports schedules to juggle. With most live TV services opting not to go down that road, Philo could have the opportunity all to itself.

Recognize your company's culture of innovation by applying to this year's Best Workplaces for Innovators Awards before the extended deadline, April 12.