If you only read United States-based media, you might think that Stripe is the most valuable, buzziest payments startup around. But it’s a different story across the pond in Europe. There, the most celebrated payments startup is an Amsterdam-based company called Adyen, which is both profitable and growing rapidly.

Now, Adyen is claiming its place in the spotlight. The company announced today that is plans to IPO in Amsterdam next month, seeking a valuation of between €6 billion ($7 billion) and €9 billion ($10.5 billion).

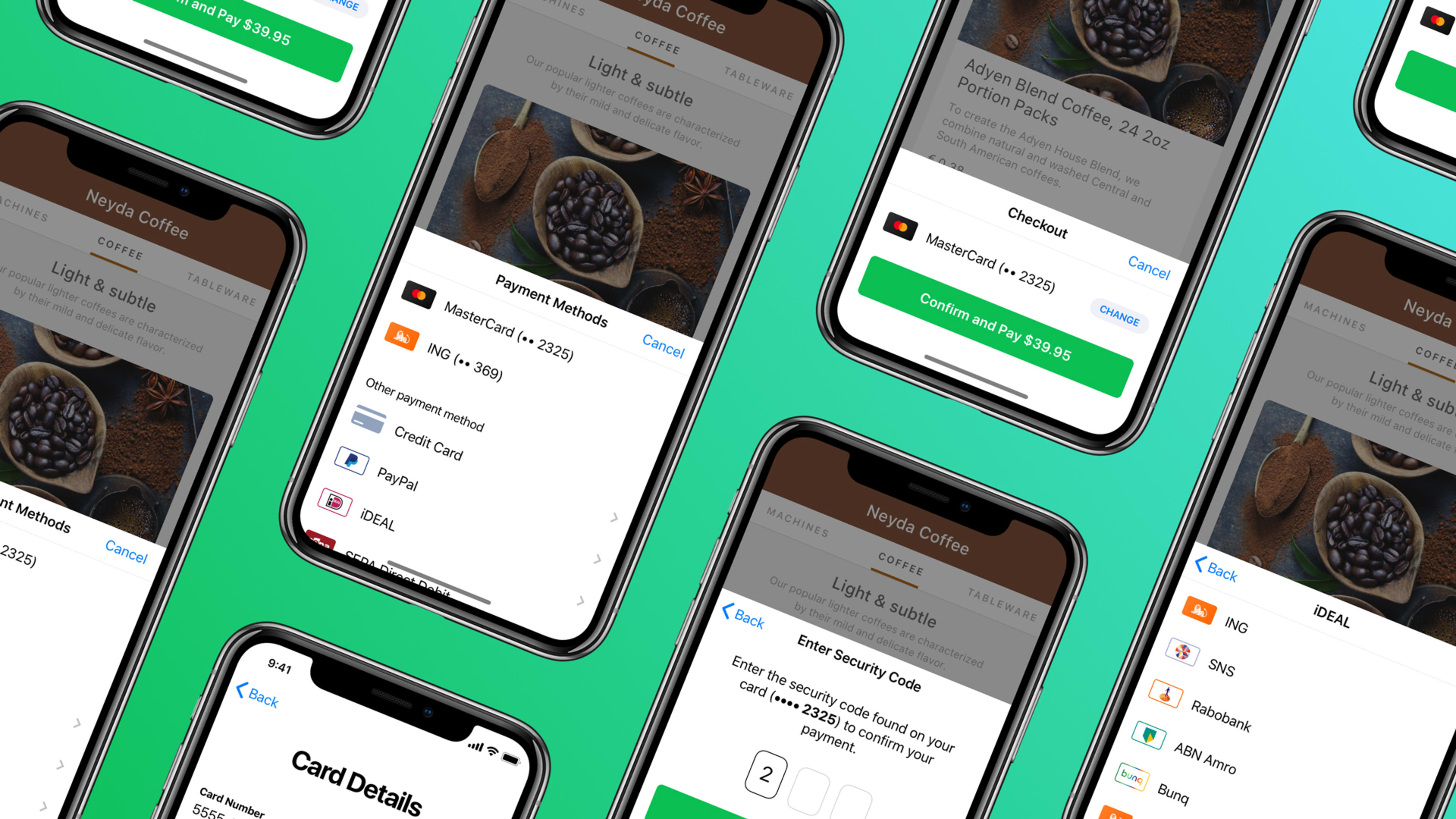

While Stripe has carved out a niche serving small-scale retailers and app developers, Adyen has pursued bigger companies with global businesses. Clients include Airbnb, Facebook, Netflix, Spotify, and Uber—digital-first giants with the need for mobile-friendly solutions and cross-border functionality. When eBay announced its plans to ditch PayPal in January, sending PayPal shares down 8.5%, the online marketplace revealed that it would be transitioning to Adyen as its new processor.

“The unique differentiator of Adyen, they combine the financial services know-how—all the licenses, all the regulatory approvals across the world—with pretty incredible scalable technology,” Jan Hammer, a partner at Index Ventures, told Fast Company last year. “Because it’s all in the cloud, the most profound bit—their cost of processing is almost zero.”

Last year, Adyen posted net revenue €218 million, an increase of 38%. It was also profitable on an EBITDA basis, with earnings before interest, taxes, depreciation, and amortization of €99 million.

London-based Index is Adyen’s largest investor. In addition, the company is backed by Iconiq Capital (a Silicon Valley fund that counts Mark Zuckerberg as an LP), Felicis Ventures, and General Atlantic.

Adyen plans to sell 15% of its shares in the offering.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.