In the philanthropy world, donors who decide that they want to set aside money to receive the tax benefits of giving to charity but wait to distribute that money until later on generally park it in a vehicle called a donor advised fund (DAF), which allows contributions to be invested before being given out. What makes people decide they’re ready to give?

The answer may be the Trump administration. Turns out, many DAF contributors are doling out more right now, and in a way that’s shaking up the leaderboard of who generally receives that money, in part to support causes like Planned Parenthood and the ACLU, which are protecting women’s rights and civil liberties at a time when both appear threatened.

Donor advised funds are popular because people get to watch their social good nest eggs grow while studying up on what causes or groups most deserve the money. That means when they eventually give, they can give more, and theoretically in a way that’s more impactful. DAFs are also versatile, accepting not just cash but also public stock, private company shares, IPO profits, and gains from real estate, private equity, and hedge fund holdings, all of which can be liquidated and managed without the giver having to pay capital gains tax on those assets.

The trade-off is that just growing a theoretical donation in perpetuity doesn’t do much to change the world. To make real change, the donor has to move that money back out to aid groups at some point. Since 1999, Schwab Charitable, a major public charity that manages DAFs, has grown to have $11 billion under management, making it the country’s fourth largest charity. In total, the group has distributed $8.2 billion through roughly 1.5 million grants, according to their recently released 2017 annual report.

Earlier this year, Schwab shared another report noting that the annual amount being distributed had jumped 34% this year. In fact, what is being distributed year-over-year is now triple the amount that was given six years ago–it’s $1.6 billion in 2017 to roughly 64,800 charities. The group’s latest report now shows why: People appear to be giving heavily to progressive cause groups.

Schwab tracks the top five charitable groups that receive funds. In 2016, those five received $15 million. In 2017, it was $25 million. “While we cannot share the dollar amounts granted to individual charities, the amount given to the top five charities increased by 66% from FY2016 to FY2017,” says Kim Laughton, president of Schwab Charitable, in an email to Fast Company. “In addition to Planned Parenthood and the ACLU, outside the top five, the Southern Poverty Law Center and Natural Resources Defense Council were also among the charities that saw big increases.”

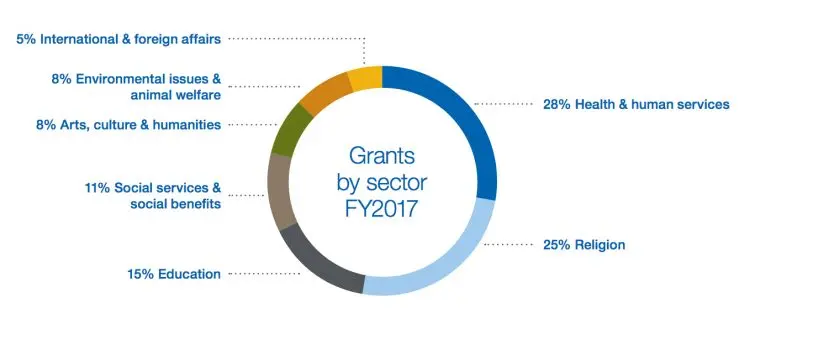

In general, the top priorities for donors have stayed steady during that time: As the chart below shows, givers prioritized health and human service groups first, followed by religion and education.

But within the top five groups, Planned Parenthood jumped two spots, from number four in 2016 to number two in 2017. The ACLU made the short list for the first time in recent years, taking the number five spot, which was previously held by Campus Crusade for Christ. (The top earning charity is still Feeding America, while Doctors Without Borders and the Salvation Army round out the list, which appears below.)

Typically, older Americans have accumulated the most wealth, driving the bulk of the overall giving. Per the report, the “greatest generation” (born before 1946) gave an average of 11 grants worth $8,000 each. Those numbers drop as givers get younger with baby boomers gifting 10 grants at 6,000 apiece, gen-Xers doing an average of 7 at $5,000, and millennials giving 5 at $2,000 apiece.

Still, support for Planned Parenthood rose across all age levels, but it was particularly strong among gen-Xers, who made it their top-contributed charity. Boomers, gen-Xers, and millennials also lent the ACLU strong support; it cracked each age group’s top five for the first time in more than five years.

Short term, the Trump administration has also fueled DAF growth in a different way. This year, Americans poured nearly $3.1 billion into Schwab’s DAFs for later charitable spending. Part of that may be to get ahead of tax reforms being championed by the Trump administration, which may reduce how much charitable giving the wealthy can write off.

“An improving economy, strong market performance, and the potential for tax reform contributed to the increase in charitable giving in fiscal year 2017, which ended in June,” says Laughton, who notes that “any reduction in income or capital gains tax rates could lower the value of charitable deductions in the future so many may have decided to give more last year and this year.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.